Pound-Yen: Bullish Flag Pattern Forming

Image © Adobe Stock

- GBP/JPY could break higher as bullish pattern forms

- Move up to trendline at 144.00 possible

- Yen to be driven by BoJ meeting and risk appetite

The Pound-to-Yen exchange rate is trading at around 139.60 at the time of publication, having falling 0.97% in the week before. Studies of the charts suggest the pair is trading sideways within an uptrend and that the directional bias is still bullish.

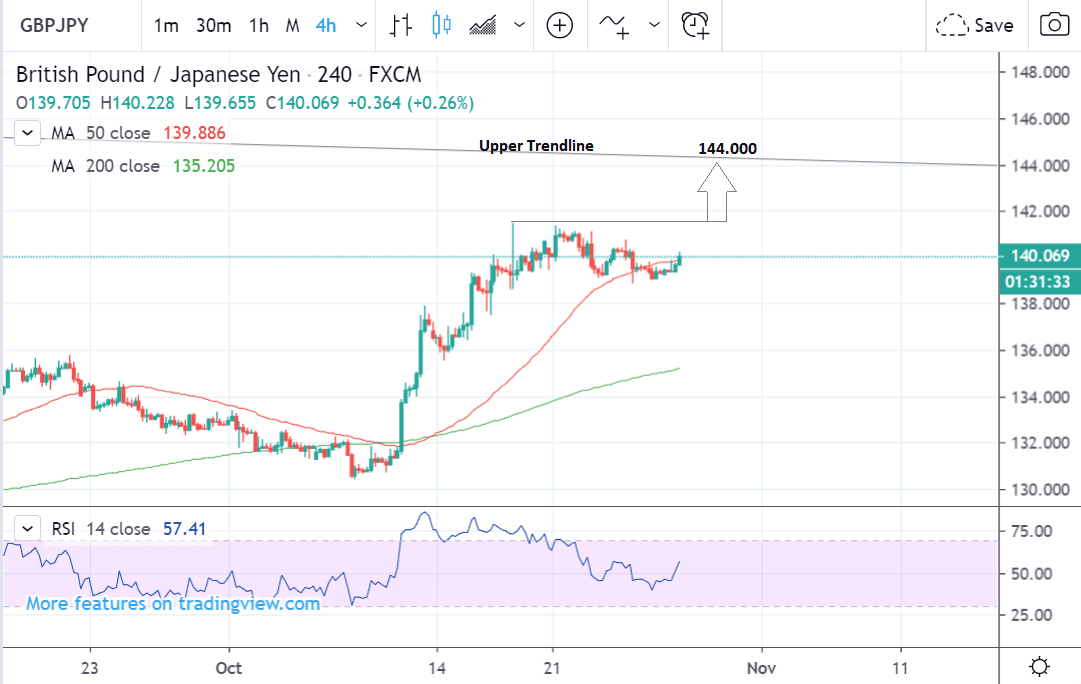

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair trading sideways after peaking at the October 17 highs.

Because the pair is in an established uptrend the balance of probabilities favours a continuation higher to a target at 144.00 and the upper trendline.

A break above the 141.50 highs would probably confirm such a continuation higher to the next target.

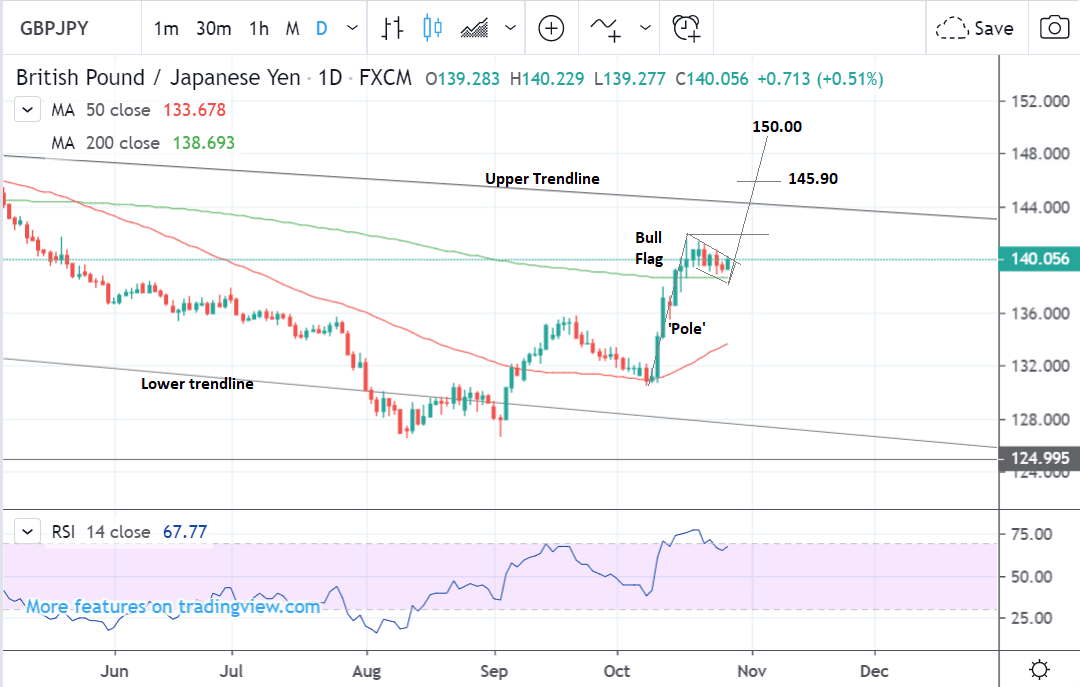

The daily chart is showing the formation of a bullish pattern called a ‘bull flag’.

The pattern is made up of a steep rally, called the pole’ followed by a sideways consolidation, called the ‘flag’.

A break above the high of the pattern at 141.51 would provide the necessary confirmation to expect a continuation up to a target at the 144.00 upper trendline.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

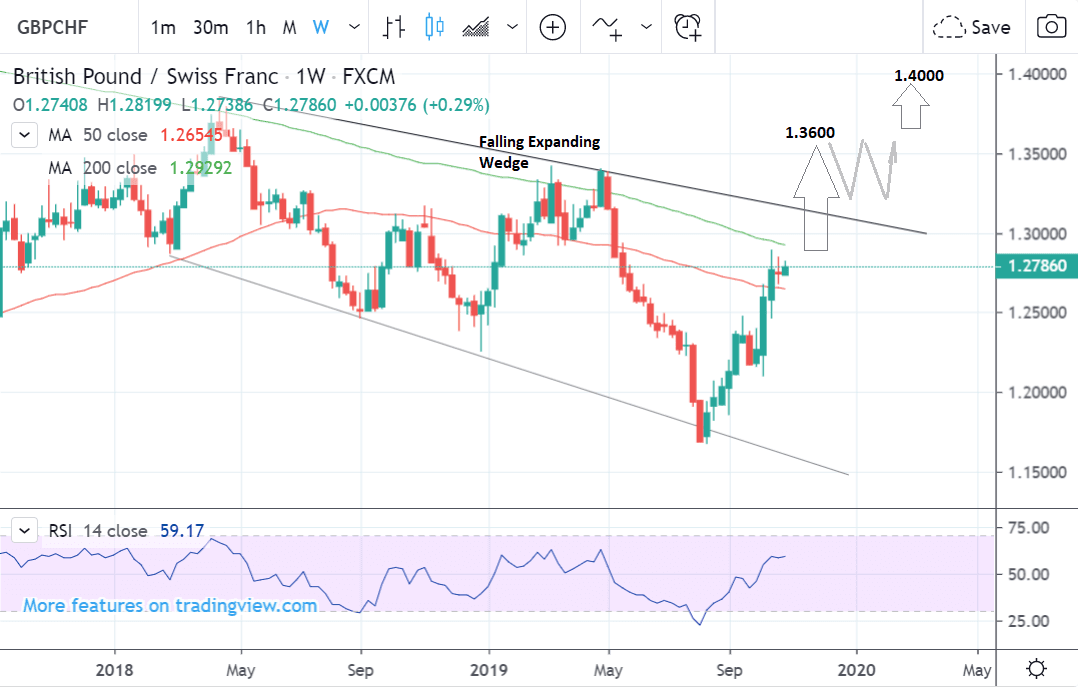

The weekly chart shows the pair rising up within the broader wedge pattern.

A break out of the wedge would be a very bullish sign for the pair and suggest a move up to a target of at least 155.00 initially.

The weekly chart is used to give us an indication of the outlook for the long-term, defined as the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Japanese Yen: What to Watch this Week

The main factors driving the Yen over the short-term are monetary policy factors and global risk sentiment.

There is a risk the Yen could move after the meeting of the Bank of Japan (BoJ) on Wednesday, at 23.00 BST as there is a 50/50 chance of the BoJ will vote to lower interest rates by 0.10%.

Domestic growth has been slowing and inflation is down to 0.0% suggesting a heightened chance the BoJ will intervene with more monetary easing to drive greater growth and demand.

If they cut interest rates it will weaken the Yen by reducing net capital inflows; if they do nothing, it might lead the Yen to strengthen.

"It’s a very close call even for the markets; the markets are assigning a 50% probability for a 10 basis points rate cut, which literally means investors are split," says Marios Hadjikyriacos, an investment analysts at FX broker XM.com. "Now the latest reports suggest the board is leaning slightly towards holding its fire and not doing anything at this meeting, so if that is the case, we are looking for a spike higher in the yen on the decision."

Another driver of the Yen in the short-term is investor risk appetite since the currency trades like a safe-haven which means it gains in value during crises - like gold.

The Yen is currently weaker on the day due to improved investor sentiment after U.S - China trade talks appeared to have made significant progress.

The two sides are now close to completing the text for a Phase 1 deal ready for signing by mid-November, according to commentators.

The Yen has also weakened after the EU ratified a Brexit extension till January 31 with the flexibility to opt out via a ‘flextension’ if the UK manages to get a deal approved before then.

Yet there are up-and-coming risks too - Chinese PMI data on Wednesday at 21.00 will provide further insight into how the global slowdown is impacting on its economy.

Then there is important U.S. data on Friday and the Fed meeting on Wednesday at 19.00.

China’s PMI data will provide an early clue as to the performance of the economy in Q4. Analysts see a chance the data could be potentially brighter if the upbeat tone of September carries over.

"We get an early read of the state of the Chinese economy in Q4 next week, with the release of the manufacturing and services PMIs for October. Although China’s economy slowed further in Q3, the quarter seemed to end on a brighter note with a firming in retail sales and industrial output in September. The October PMI surveys may show some of that momentum carried over into Q4," says Wells Fargo.

The Fed will provide an assessment of the U.S. and global economy at their policy meeting on Wednesday and this could also impact on broader risk markets and the Yen.

If the Fed is more negative, it could strengthen the Yen, and vice versa if it is more positive.

The risks appear balanced with some analysts expecting a more dovish analysis and others a more hawkish assessment.

"The reaction of the Dollar will depend mainly on the signals they send for future rate cuts. On that front, I do not think they will commit to anything - I think they will keep their cards held close to their chest... But, if anything, it might be a slightly more hawkish message than the markets are expecting," says Hadjikyriacos.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement