Pound-Yen Rate Recovery Pauses, but can Still go Higher

Image © Adobe Stock

- GBP/JPY trading sideways in triangle pattern

- Short-term trend appears to have flipped positive

- Yen to be driven by global risk trends

The Pound-to-Yen exchange rate is trading at around 129.37 at the time of writing on Thursday, having edged lower 0.1% so far this week.

Studies of the charts suggest the pair may have reversed the longer-term downtrend in the short-term and could now be on course to go higher.

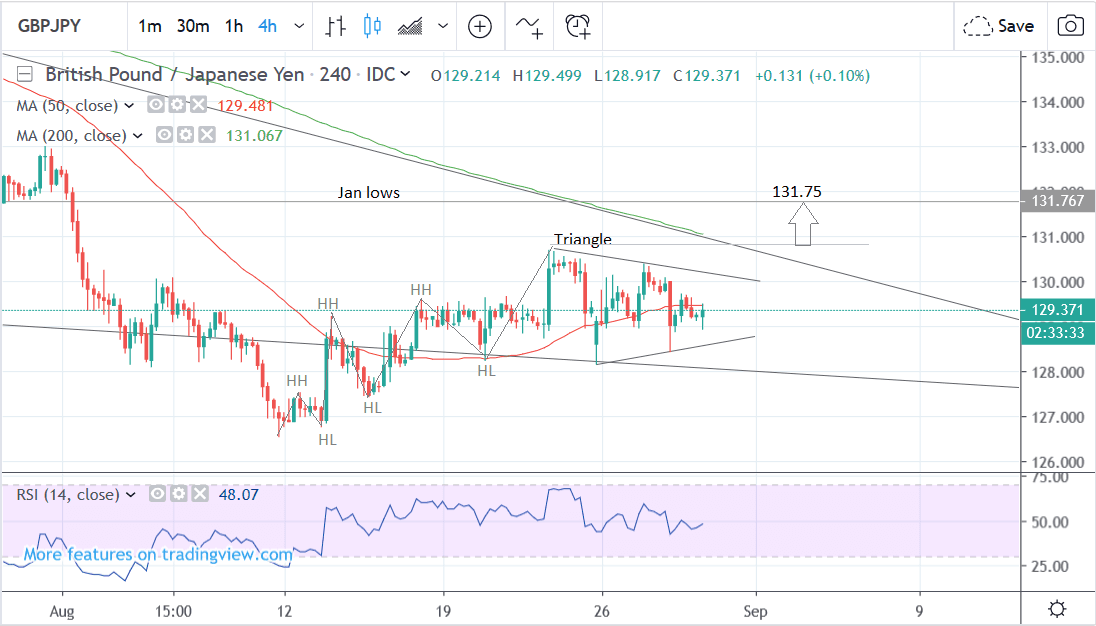

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair has probably reversed its downtrend and started a new uptrend higher.

The pair has completed more than two sets of higher highs (HH) and higher lows (HL) which is a sign the trend has reversed.

GBP/JPY currently also appears to be forming a triangle pattern which is likely to breakout higher. A break above the 130.70 highs would probably confirm a move up to a target at 131.75 and the January lows.

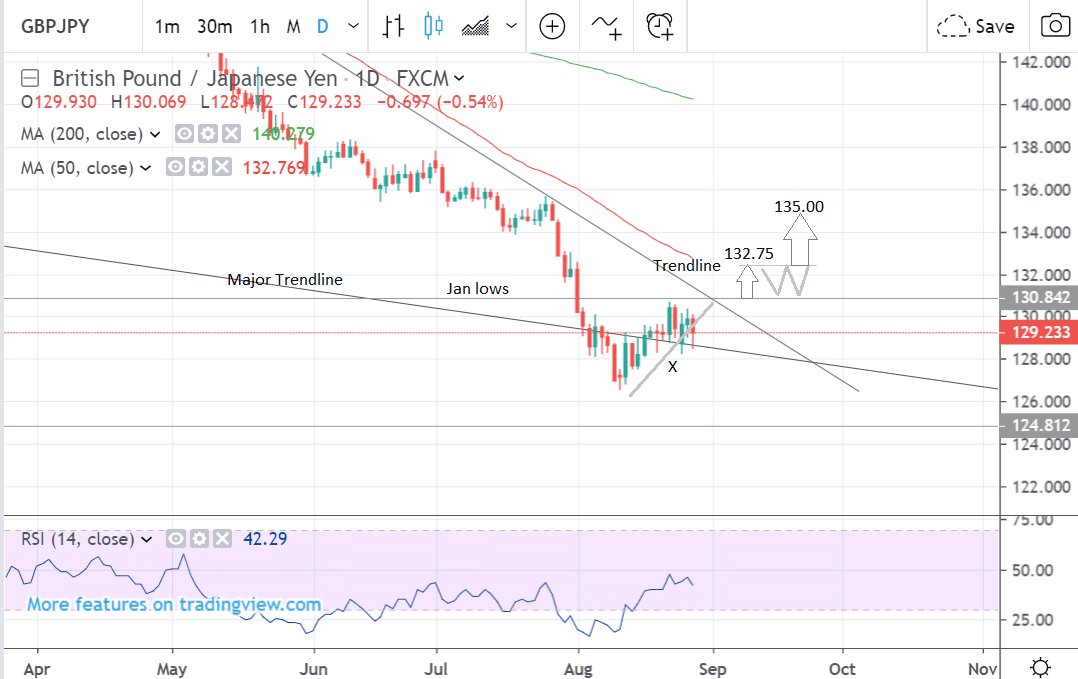

The daily chart shows how the pair has successfully recovered back above a major trendline. If it breaks successfully above 131.50 it will open the way to more upside and an eventual target at 135.00 potentially.

The length of the move up prior to the trendline (labeled ‘X’) can be extrapolated higher, according to technical theory, to generate an eventual upside target at 135.00.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

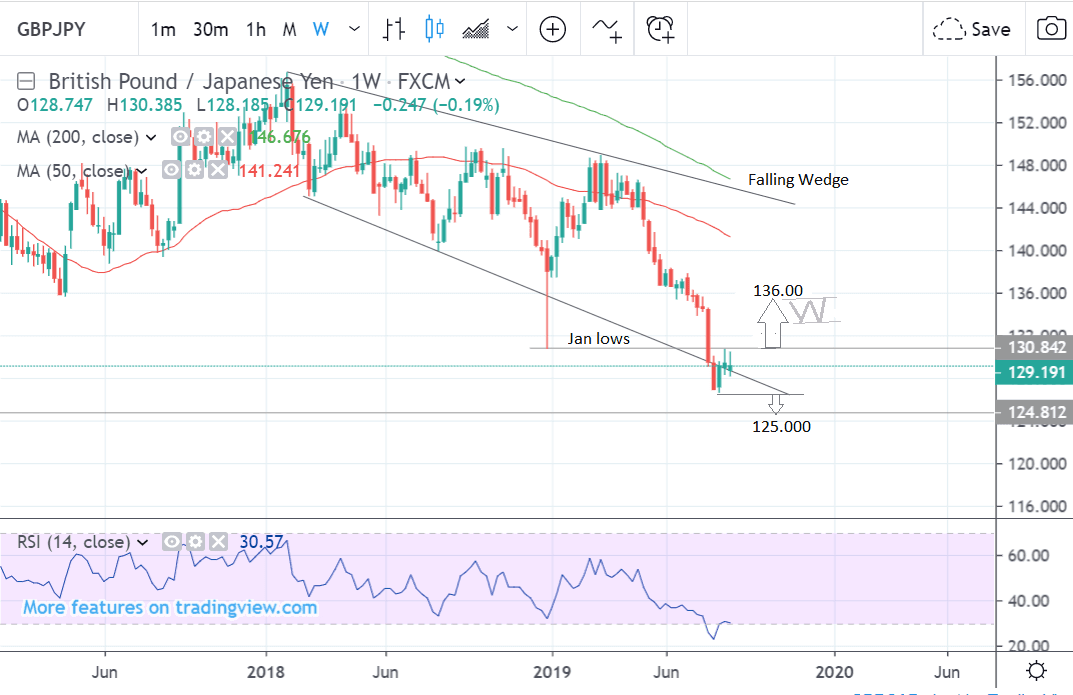

The weekly chart - used to give us an indication of the outlook for the long-term, defined as the next few months - shows how the exchange rate has broken back inside its wedge pattern albeit tenuously.

Assuming the pair has reversed its downtrend and is now in a short-term uptrend, there is a possibility it could rally all the way up to a target at 136.000. Wedge patterns are normally considered bullish and this adds the potential for more upside.

Alternatively, there is still a chance that the entrenched downtrend may continue down to a target at 125.000 in the long-term, with a break below 126.54 providing the green light for such a continuation lower.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Japanese Yen: Key Drivers to Watch

The main driver of the Yen in the short-term is likely to be global risk appetite since the Yen acts like a safe-haven currency, tending to rise when investors grow fearful and fall when they grow confident.

"The yen has been one of the best performing global currencies this year and continues to benefit from building downside risks to global growth from escalating trade tensions," says Fritz Louw, Currency Analyst with MUFG in London. "Global trade tensions took a notable turn for the worse late last week when President Trump reacted badly to retaliatory tariffs from China by announcing that he would raise the tariff rate on USD250 billion of Chinese imports from 25% to 30%, and from 10% to 15% on nearly USD300 billion of imports which will soon be subject to higher tariffs."

News flow on the China-U.S. trade war has gone relatively quiet over recent days, which has seen demand for the Yen fade somewhat.

The next major date will be on Monday, September 1, when both countries are set to impose further tariffs on each other’s goods.

A 15% tariff will be applied to roughly USD112 billion of Chinese imports, and it will be followed up by applying a 15% tariff on USD160 billion of

Chinese imports on the 15th December. The 30% tariff on USD250 billion of Chinese imports will be applied on the 1st October.

There is a chance these tariffs may be delayed at the last minute, but commentators do not appear to be attaching much of a probability to that happening. If it were to happen, it would be positive for risk appetite and negative for the Yen.

Italian politics is another potential global risk event with a probable resolution on the horizon which could impact on the Yen, albeit in a minor way. M5S and the democrat party are in coalition talks after the dissolution of the previous M5S-Lega coalition government following the resignation of prime minister Conte due to a falling out with Lega leader Salvini.

A new coalition will probably be announced relatively soon and this may provide markets with a positive bump (negative for the Yen), although the effects are likely to be marginal outside of European assets.

On the domestic data front, the main releases are Tokyo inflation which always precedes nationwide inflation, industrial production and retail sales, all out on Thursday, just after midnight BST.

Core Tokyo inflation is forecast to fall to 0.8% from 0.9% in August - any deeper decline is likely to be negative for the Yen as it will weigh on monetary policy expectations.

Industrial production is forecast to show a rise of 0.3% in July from -3.3% previously.

Retail sales is forecast to fall by -0.6% from 0.5% previously, in July.

A surprise stronger-than-expected rise in either of these releases would be a positive influence on the exchange rate, though the effects of domestic data are usually very marginal.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement