Morgan Stanley Tip Yen and Euro to Benefit in Global Slowdown

Image © Adobe Stock

- Global slowdown to lead to deflation

- This will support JPY and EUR more than others

- GBP/JPY forecast to decline steeply

The foreign exchange winners out of a trade and debt induced global slowdown are likely to be the Japanese Yen and the Euro, says Wall Street investment bank Morgan Stanley.

Their analysis envisages a process by which a global economic slowdown causes deflation which then impacts on interest rates and finally disproportionately advantages currencies with existing low interest rates, such as the Japanese Yen and the single currency.

They see both USD/JPY and GBP/JPY as likely to fall steeply as a result.

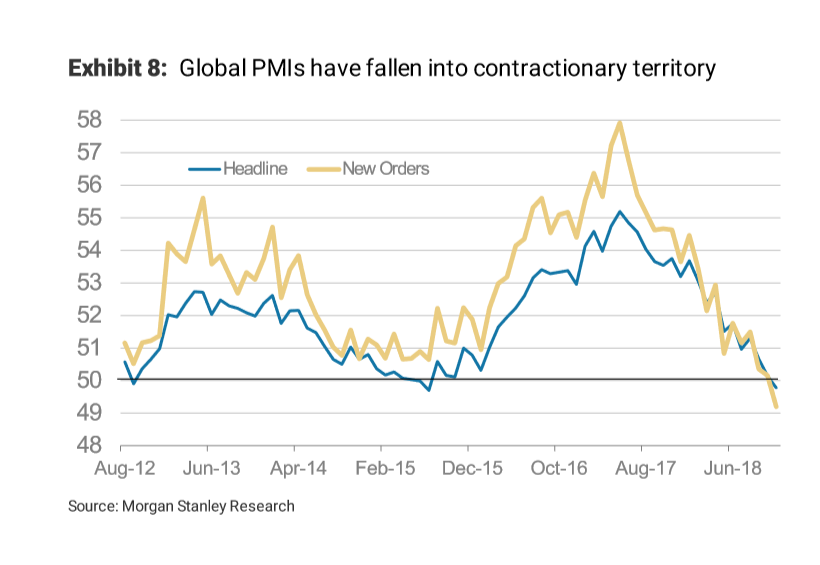

Trade tensions have already led to a slowdown in global manufacturing activity as evidenced by recent lower-than-expected global PMI data.

Further evidence of a slowdown comes from falling Chinese factory gate prices (see below), and this disinflationary spiral is likely to spread to the rest of the G7.

The deflation is being caused by factories finding themselves saddled with rising inventories due to a dysfunctioning export market environment, caused by trade tensions.

“There are two factors pushing core inflation lower,” says Hans Redeker, a strategist at Morgan Stanley. “One is trade tensions, which create an initial demand shock leading to oversupply and hence falling prices. The other factor is falling currency-adjusted Chinese factory prices as shown in Exhibit 11. Lower prices for Chinese factory-produced goods appear to lead G7 core inflation rates by 12 months. Lower Chinese PPI suggests that low G7 inflation will persist.”

Falling inflation will impact countries differently depending on the level of their existing interest rates.

Countries with higher interest rates, such as the U.S. and emerging market economies, will see their interest rates fall in tandem with falling inflation expectations.

This will also cause a simultaneous fall in real yields, which is the margin between interest rate and the inflation rate.

Those countries which already have low interest rates, on the other hand, such as Japan and the Eurozone, will see a different dynamic evolve in response to deflation.

Here interest rates are so low already - circa 0.0% for Europe and -0.10% in Japan - that there is little ‘head room’ to reduce them any further. This is likely to lead to a widening of the real yield margin since interest rates will not be able to fall in line with inflation to the same extent as in countries where interest rates have a higher starting point.

The end result is a greater real yield available in the Eurozone and Japan then in most other countries, and since international investors will be desperately searching for real yield during the slowdown, they will increasingly see Eurozone and Japanese bonds as an attractive proposition. This will increase net inflows to those two jurisdictions, driving up demand for their currencies in the process.

Another factor which is expected to support demand for the Yen and the Euro is repatriation flows as domestic investors pull out of U.S. equities.

U.S. Equity valuations have decoupled from fundamentals and this has resulted in an artificially overvalued U.S. stock market which is ripe for a correction.

Redeker says this is likely to happen when the ISM Manufacturing PMI falls below 50 - we are not there yet but close. Given the official world manufacturing PMI data is now below 50 the ISM will probably follow.

As a result of the drivers explained above, how high could the Yen go? When a similar dynamic was at play in 2016, the Yen rose by 20%, says the investment bank.

But this time around Morgan Stanley see USDJPY at 102 by year-end. And in their bear case at 93 by 2Q20. In their bull case they see it reaching 103 by 2Q20.

If the Yen is set to rise against the Dollar then it is doubly so against the Pound, given Sterling’s Brexit risk handicap.

“GBPJPY, like USDJPY, should trade lower,” says Redeker. “GBP.. should stay under pressure with elevated risk premium as political uncertainty related to Brexit and the ongoing leadership contest in the Conservative party keeps investor appetite for the GBP limited.”

But even forgetting Brexit for a moment, UK data has been underperforming expectations recently as shown by the low levels reached by the economic surprise index, and this too could pressure GBP lower.

This leads Morgan Stanley to see GBP/JPY (currently at 135.50) falling to a target at 128.00. A rise above 138.00 would negate the bearish forecast.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement