Pound-Yen Entering Short-Term Downtrend

Image © Adobe Stock

- GBP/JPY Breaks below key 143.70 level

- Solidifies short-term bearish bias

- Brexit talks to drive GBP; risk trends the Yen

The Pound-to-Yen exchange rate is currently trading in the 143.11, over 2.0% lower this week so far.

The pair declined as a result of a weaker Pound which appears to largely be the result of fading hopes that cross-party Brexit negotiations will yield results, while a stronger Yen has resulted from global growth fears after the U.S. signalled trade talks with China had deteriorated to the extent that a fresh set of tariffs on Chinese goods will be imposed by the U.S. on Friday.

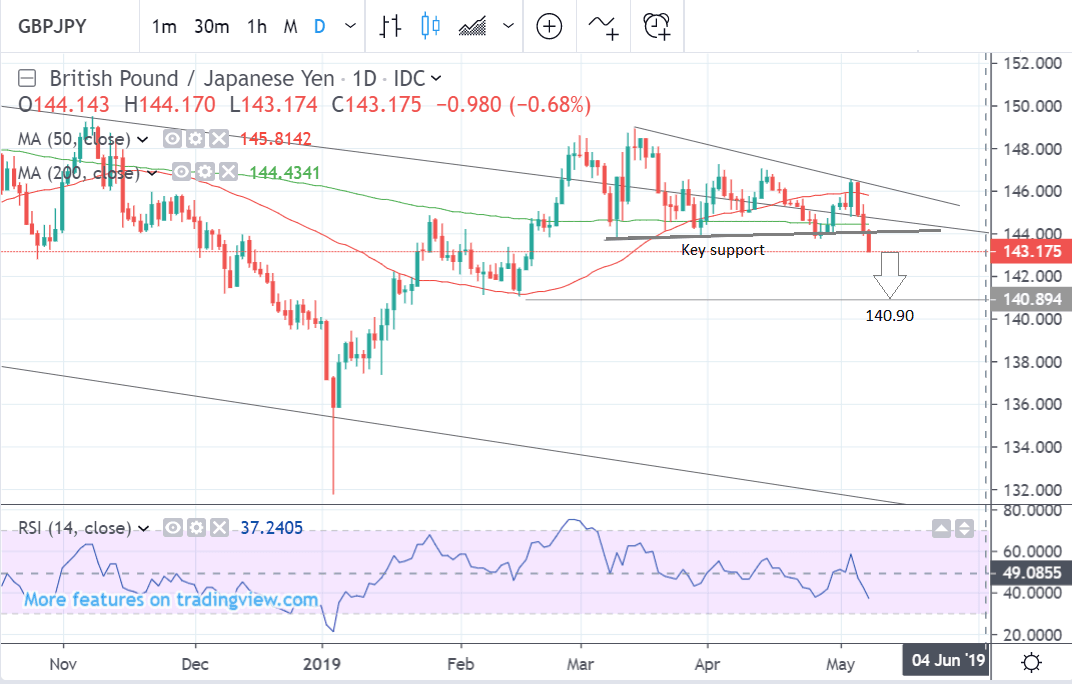

The technical setup on GBP/JPY has now turned bearish after the exchange rate broke convincingly below a key long-term support level in the 143.70s.

There is now an increased risk that the pair will decline to the next target at 140.90. Such a move could unfold over the next 1-3 weeks.

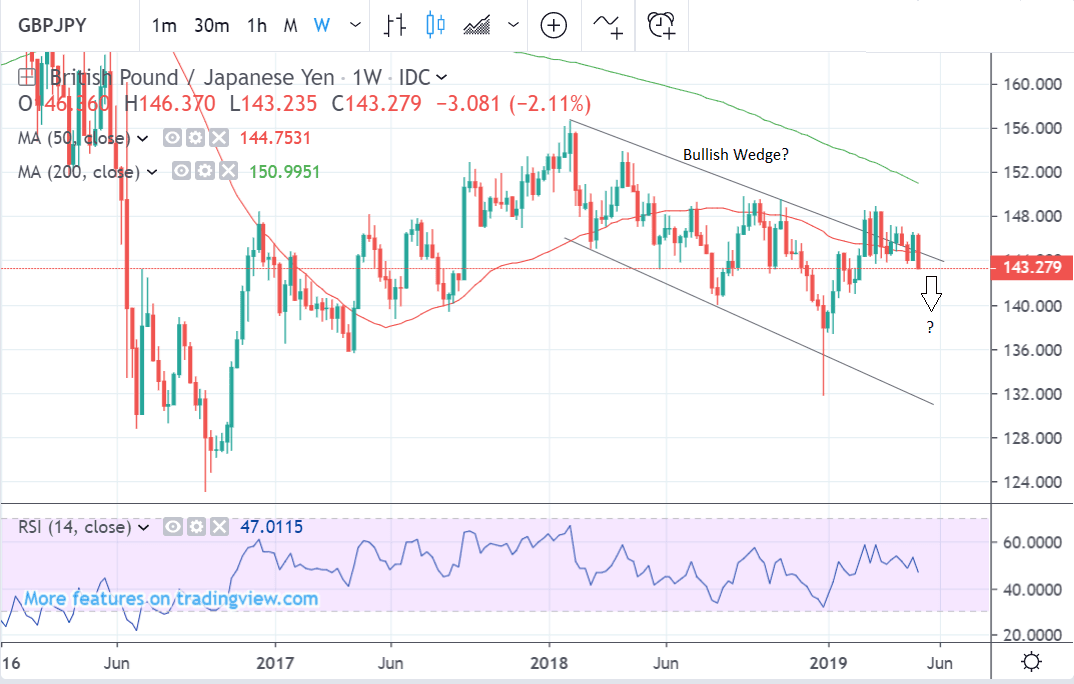

The longer-term weekly chart shows the pair trading at the top of a bullish wedge pattern.

Since February the pair looked poised to breakout higher but after repeated attempts failed. Whilst the current decline could not yet be classed as a definitive failure and there is a chance the pair could recover, it nevertheless, brings into question the previous bullish bias.

The 4hr chart provides evidence for the formation of a short-term bearish trend. The pair has formed more than two sets of lower highs (HH) and lower lows (HL) - one of the signs analysts use to evidence the start of a new downtrend.

The RSI momentum indicator in the bottom panel is a little oversold suggesting the current move lower may run out of steam and result in a pull-back, however, after that it will probably resume its decline.

The Japanese Yen Outlook: Fear-Factor in Charge

The Yen was actually the strongest major currency on Wednesday, rising versus the Pound and the Dollar as a result of investor fears about an escalation in the trade war between the U.S. and China.

According to a Reuters China has backtracked on nearly all aspects of their trade negotiation with the US. In each of the seven chapters of the 150-page draft trade deal, China has deleted its comments regarding law changes addressing US complaints.

This explains why Trump tweeted a threat to allow higher tariffs to kick in Chinese imports, scheduled to begin this Friday. China’s redactions were seen by the US as undermining the “core architecture” of the trade deal.

There is a chance of the deal could be salvaged at the last minute, however, as Chinese Vice Premier Liu is expected to arrive in Washington on Thursday, for 11th-hour talks.

If no compromise is reached, however, a new round of tariffs will take effect at 0001 on Friday. There’s speculation that Liu could agree to scrap the latest proposed text changes and agree to making new laws. But at this point, it’s unsure what level of authority and constraints Liu has got from President Xi Jinping Thus, no one knows what results Liu could achieve.

Recent trade data showed Chinese trade with the U.S. has fallen substantially, with exports down 9.7% in April. Although exports to other countries such as Europe helped offset the losses to the U.S. they couldn't overall and total Chinese exports contracted -2.7% compared to a year ago.

"It is becoming increasingly apparent that these talks will likely end without the desired compromise," says Derek Halpenny, an analyst with MUFG in London.

On May's future, Haplenny is "increasingly sceptical that she will remain in place as PM that long. A Tory leadership election is becoming increasingly likely."

"Sentiment towards the UK currency seems to be shifting again, not only due to the lack of progress in these talks, but also due to repeated calls from key Tory lawmakers for PM May to resign," says Marios Hadjikyriacos, an Investment Analyst with XM.com.

"In the near term, a lot will depend on whether the Tory-Labour talks finally produce anything of substance. If they do, the pound could soar, as that would catch markets by surprise. However, since that is looking increasingly unlikely, uncertainty may continue to reign over British assets, implying that more pain may be in store in the immediate term," says Hadjikyriacos.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement