Pound-Yen Outlook: Bullish Longer-Term, Neutral Short-Term

- GBP/JPY keeps to well worn range

- Directional call dependent on breakout from range

- U.S.-China talks could influence the Yen over coming days

- Japanese inflation data presents key domestic point of interest

The latest Pound-to-Yen exchange rate technical and fundamental outlook suggests the sideways trending market is likely to extend near-term but longer-term Sterling is preferred.

The Pound-to-Yen exchange rate is currently trading at 146.54, a whole Yen higher than it did a week ago.

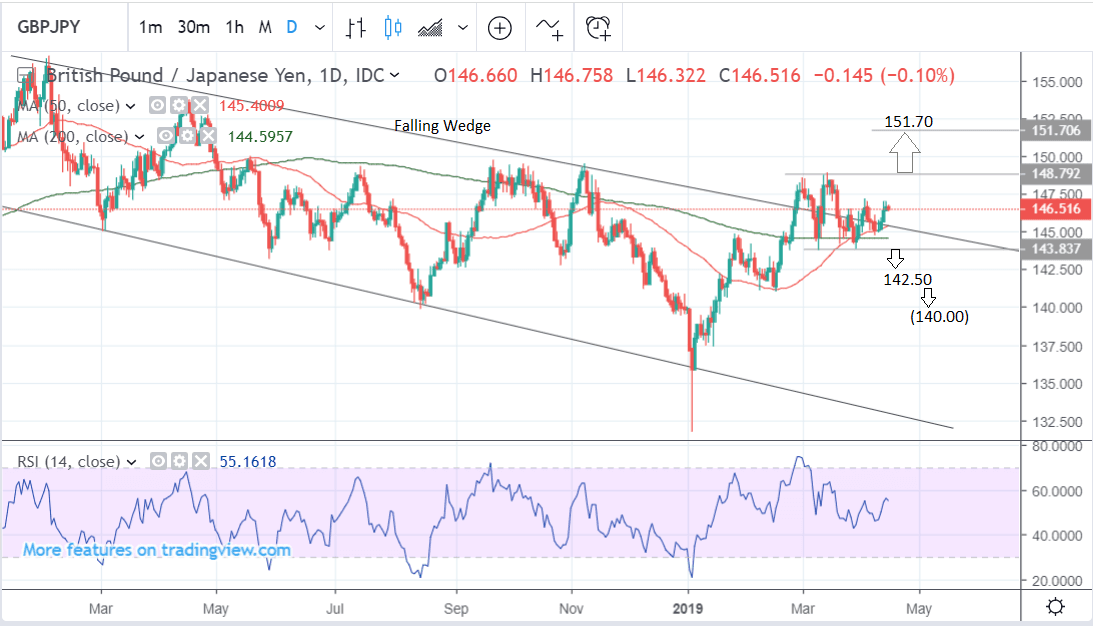

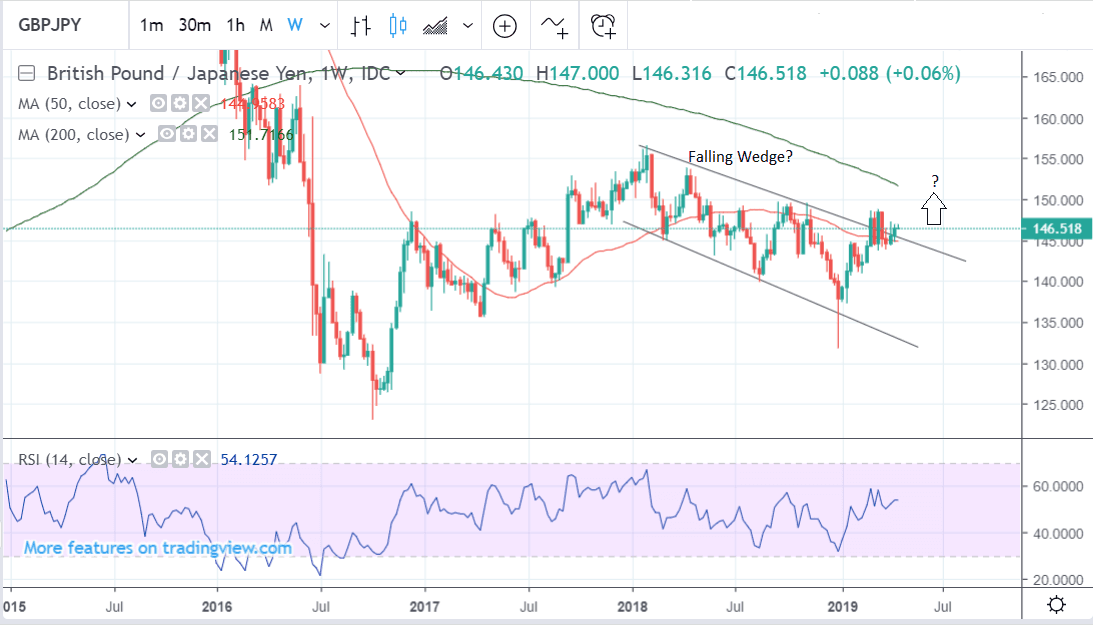

Concerning the outlook, the pair’s chart is looking slightly more bullish as a result of the exchange rate breaking above a key down-sloping trendline.

Overall, we are neutral in the short-term (1-4 weeks) and marginally bullish in the long-term (2-6 months).

This trendline could also be the upper border of a bullish falling wedge pattern. These patterns form when the price pulls back and creates a tranche of steadily widening price action which ends up looking like a wedge-shape. It is usually a precursor to a strong rally higher. Confirmation normally comes from a break above the upper border of the wedge.

Although such a break has already occurred - the first breakout was back in February - the exchange rate could not sustain it and fell back inside the pattern.

Now it has once again broken out higher, yet it remains to be seen whether this breakout can hold, and the risk remains that it will capitulate again.

A strong indication that it has held would come from a break above the former highs set when the pair peaked at 148.87 in February.

If GBP/JPY does convincingly breakout to the upside, in accordance with the wedge hypothesis, we see a strong possibility of a continuation higher to an initial target just below the 200-week moving average (MA) where it will probably meet strong resistance as is usually the case with large MAs.

In the meantime the pair continues meandering in a sideways range or ‘box pattern’ which could continue to enclose the exchange rate indefinitely.

We would need to see a clear break above the highs, as mentioned above, for bullish confirmation. Likewise a break below the range lows at 143.73 would probably trigger a decline to 142.50-00 initially and then 140.00.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

Global Sentiment Could be Key Driver of Yen Performance Going Forward

Short-term momentum appears to have shifted to the downside for the likes of the Japanese Yen, Swiss Franc and U.S. Dollar, which immediately tells us something: markets are taking a decisive cue from global investor risk sentiment.

The Yen and Franc are considered safe-haven currencies that benefit when global markets are being sold off, typically when investors take fright from any development or developments they believe bode poorly for global growth.

The opposite performance by the Yen and Franc is true when markets are optimistic.

"Risk appetite continued to recover last week, but this time G10 currencies performed better at the expense of the USD as confidence that a global recession could be avoided grew," says Timothy Fox, Head of Research & Chief Economist at Emirates NBD.

We therefore look towards any major data releases that might shed some light on the global economy, while also keeping an eye on the progress of U.S.-China trade talks.

The most significant release for the Yen is therefore probably Chinese Q1 GDP data on Wednesday, April 17, at 3.00 BST.

The data is expected to show a slightly slower 1.4% pace to Chinese growth in Q1, after growth of 1.5% in Q4.

There is a risk it could surprise to the upside, however, as recent better-than-expected Chinese trade figures, could mean the GDP is better-than-expected and this could, in turn, weigh on the Yen.

“Given policymakers’ focus on global growth, without doubt, the official release of China’s Q1 GDP growth will be watched with interest,” says Henry Occleston, an analyst at Lloyds Bank. “It is forecast to be marginally weaker than prior, though with positive sounds from the IMF, and the stronger than expected trade data we saw this week, it could surprise on the upside.”

The main domestic data releases for the Yen, on the horizon are inflation data on Friday, balance of trade and industrial production data on Wednesday, and Nikkei Manufacturing on Thursday.

Inflation data for March is forecast to show a 0.5% rise (year-on-year) compared to a year ago, from a more subdued 0.2% in the previous month.

Core inflation is expected to continue to rise at the same 0.7% pace year-on-year as it did in February.

Inflation is key because it informs central bank policy on interest rates and this directly impacts on the local currency. The higher inflation rises, the greater pressure there is on the BOj to adjust monetary policy - either by tightening stimulus or eventually raising interest rates - which strengthens the Yen. Japanese inflation has remained moribund for years despite continued efforts to drive it up by the Bank of Japan (BOJ).

In a recent speech Haruhiko Kuroda, governor of the Bank of Japan said he would “patiently continue” the central bank’s “powerful” monetary easing as it was taking longer than previously thought to accelerate inflation to its 2 percent target.

“Prices remain weak despite a tight labor market, but the momentum toward 2 percent inflation is intact,” Kuroda told lawmakers in parliament.

The governor was probably responding to recent calls from prime-minister Abe and finance minister Aso suggesting the inflation target was too high and it should be lowered to a more realistic level. Kuroda is widely known to not share their opinion.

Kuroda further advised regional banks to try to reduce costs and extend tie-ups in order to increase profitability. The BOJ has been concerned its massive monetary stimulus may have exacerbated the decline in profits at regional banks, thus undermining ‘financial intermediation’. This was the rationale behind their yield curve control policy, to keep long-term rates higher.

Kuroda also told CNBC that there is still some scope for further stimulus if required.

“I think there (is) still some room for further monetary easing if needed,” he said, but adding that it isn’t necessary at this stage.

The BOJ chief also said that the Japanese economy has “slowed down”, partly because Japan’s exports to China have become “somewhat” weak.

Kuroda emphasised the risks stemming from an escalation in trade wars, saying, “some sort of protectionism” around global trade was the “most serious risk involved in the global economy.”

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement