Pound-Yen Rate Poised to Break Out of Top of 'Bull Wedge'

Image © Adobe Stock

- GBP/JPY bullish due to multiple indicators

- Bullish wedge, monthly pivot swing, ABCD pattern..

- Pound to take cue from Brexit; Yen from trade talks

The Pound-to-Yen exchange rate is trading at 145.70 at the time of writing, after rising almost one and a half percent in the week prior. The gains come on the back of broad-based strength in the Pound as markets judge the chance of a 'no deal' Brexit occurring is shrinking. Of note, UK PM Theresa Mays said on Tuesday for the first time that Brexit could be delayed, giving MPs a vote on "a short, limited extension to Article 50" if both her deal, and leaving the EU without a deal, are rejected.

Speaking in the House of Commons on Tuesday, February 26 May says parliamentarians will first be asked to vote on a revised Brexit deal following the latest round of negotiations with the EU.

The Pound has rallied on the back of the news, achieving a three-month high against the Dollar and a two-year high against the Euro.

If May's deal fails on its second vote in parliament, parliamentarians will then be asked to vote on a whether or not the UK will leave the EU without a deal. If this is rejected a vote on extending Article 50 takes place.

The Yen has meanwhile weakened against all the majors over the last two weeks on increased optimism the U.S. and China will negotiate a sensible trade deal and the U.S. will not introduce higher tariffs on March 1 (Friday), as had been feared. The Yen is a safe-haven currency which means it tends to trade in a topsy-turvy manner, falling as risks ease and rising in times of crisis.

Technical Studies Suggest 'Forceful' Move Higher Likely

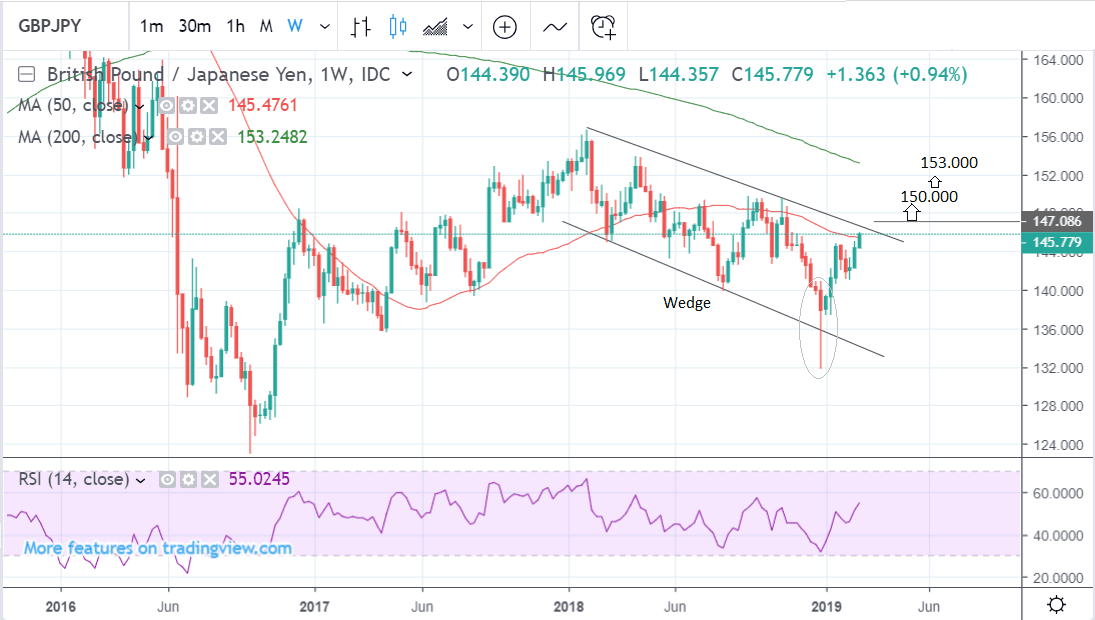

From a technical perspective, the outlook favours more upside; the pair continues to rise as it has done ever since the 132.000 December lows. These looked like exhaustion lows, indicating the potential for a major reversal higher, which is what has happened.

GBP/JPY is rising within what is probably a long bullish wedge pattern, this means if it breaks out above the top of the wedge it is destined to continue its rally to the upside, with much force.

The 50-week moving average (MA), at 145.47, remains an obstacle to further upside progression. A break above it on a closing basis, however, would provide confirmation it had been cleared.

One positive sign is that the pair has now successfully broken above the 200-day moving average (MA).

The RSI momentum indicator is also strong which supports a bullish outlook. It is at the same level as when the exchange rate was above 150.00 in the second half of 2018. This suggests ‘pent up’ bullish potential.

If GBP/JPY can break above 147.000 it will probably provide confirmation for a breakout from the wedge and result in a move up to an initial target at 150.000 followed by 153.000.

The first target is a major psychological level where bullish traders will start to take profit in high volumes, the second is based on the height of the wedge as a guide and the location of the 200-week MA nearby.

The monthly chart shows how the pair formed a long Japanese hammer candlestick pattern in the month of January and this is a strong indicator a bullish reversal is on the cards.

The successful break above the December highs at 145.55 on the monthly chart moreover is a bullish signal indicating a bias to expecting more upside.

It means the exchange rate has performed a ‘monthly pivot swing’ higher around the December 132.000 lows, which is a very bullish medium-term signal for the pair.

The possible unfinished ABCD pattern which looks like it is forming on the daily chart is another sign the pair biased to going higher.

ABCDs are three wave zig-zags in which waves A-B and C-D tend to be of a similar length. This enables forecasting of a final target at the end of C-D. In the case of GBP/JPY this indicates a probable conclusion of the rally at about 155.000.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

The Japanese Yen: What to Watch

Trade negotiations between China and the U.S. are likely to be the main fundamental driver of the Yen in the short-term. If the two superpowers agree a deal to avert the March 1 tariff hike on Chinese imports, markets will probably rally on avoidance of a crisis but the Yen will fall, because of its safe-haven status. A deal is more likely than not.

Domestic data is unlikely to move the Yen very much - unemployment data out on Thursday at 23.30 GMT, is expected to stay at 2.4%, which is extremely low, but this won't help the Ye, as it has been low for years with little positive effect.

Wage data rather than raw employment is more important as it impacts on inflation and interest rates, which are major drivers for the Yen. After a brief surge in 2018 wages and inflation have fallen back down to their perennially low levels, and are unlikely to cause the Bank of Japan (BOJ) to lift interest rates anytime in the future. Interest rates are currently negative. As such the Yen is likely to remain under pressure.

Worthy of mention, however, is the consumer confidence gauge out on Friday, March 1, as it is an important leading indicator for the economy, and it is forecast to show a slight decline to 41.6 from 41.9 in February when it is released at 5.00.

Industrial production and retail sales in January are out on Wednesday at 23.50, with a decline of -2.5% forecast for the former and slow down to 1.1% for the latter - on a monthly basis.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement