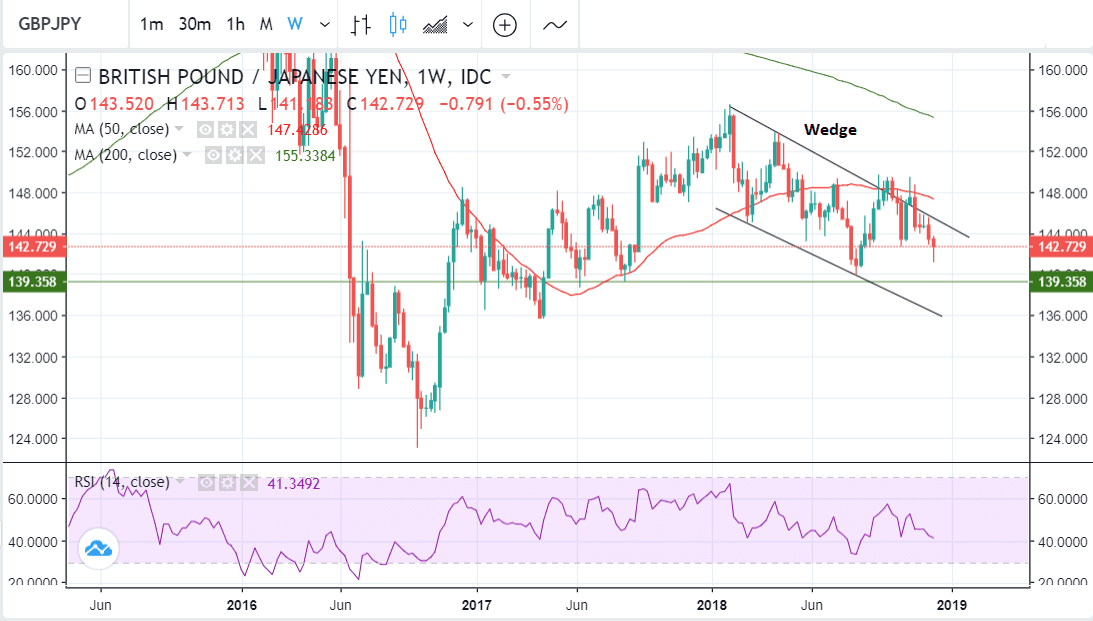

Pound-Yen Rate Could Fall to 140.000 Short-Term if Lows Broken, Longer-Term Bullish Potential Remains Intact

- GBP/JPY poised to decline further after 144 to 142 fall

- Longer-term charts less bearish

- Slow Japan growth weighs on Yen; Brexit pressures Pound

GBP/JPY is trading at 142.70 at the time of writing after declining almost half a percent since the beginning of the week.

Growing fears of a ‘no-deal’ Brexit contributed to the decline after Theresa May decided to delay the common’s vote on her withdrawal deal in a bid to squeeze further concessions out of the EU. The pair is in a short-term downtrend which is marginally biased to extend.

Longer-term the technical picture is more complex and there remain signs the pair could break higher. It has formed what could possibly be defined as a bullish ‘wedge’ pattern since peaking in January, and this indicates a strong propensity to more upside.

Despite multiple attempts to break out of the top of the wedge, however, bulls have so far failed. Yet this does not mean they could not be successful in the future.

As things stand, however, we remain marginally bearish short-term on the condition that the pair can break below the 141.18 lows.

Such a break would unlock the next downside target at 140.000, which, apart from being a major psychological number, is also the level of the historic lows made in 2017.

Historic lows are often levels of strong support and resistance which act as hard ‘floors’ or ‘ceilings’ to the exchange rate, thus we see a possibility the pair could base at 140.000 before deciding in which direction to go next.

From a fundamental perspective the key events in the week ahead are the Tankan survey on Thursday (23.50 GMT), and December Manufacturing PMI (00.30) and Industrial production on Friday (04.30).

The Tankan survey of mostly large companies is broadly forecast to show a pull-back in Q4 which will not improve dwindling hopes of a recovery. Industrial Production, however, is forecast to swing from decline to expansion in October.

Data is unlikely to support the currency in the week ahead unless it is very good. Recent Q3 GDP growth data was exceptionally poor after showing a -0.6% decline following a 0.7% rise in Q2. It was the worst contraction since 2014 and will extinguish any hopes of a recovery leading to a change in the Bank of Japan’s ultra- easy monetary policy, the main domestic factor weighing on the Yen.

“Japan’s economy is facing its second drop since the beginning of the year,” says Vincent Mivelaz with Swissquote. “Largest contributors to the drop are: the trade war between Washington and Beijing; Typhoon Trami that disrupted production and distribution channels; and a 6.7 earthquake that hit the Northern Island Hokkaido. Given an outlook of a 2.50% decline, Japan’s GDP is worrisome, as Japanese domestic demand dropped 2.20%.”

A fall in investment, or ‘capital expenditure’ as it is known, was a contributing factor.

“In particular, the capital expenditure component of GDP fell 2.8%, much weaker than the estimate of 1.6%. This capex slump could dampen growth and inflation and has weighed on business confidence,” says a note on the matter from Kenny Fisher, an analyst at Marketpulse.