Pound-Yen Rate Liable to Further Losses as Bear Flag Unfurls

Image © Adobe Stock

- GBP/JPY poised to break lower after bearish pattern

- Flag ‘signal’ suggests downside break to target in 142s

- Pound driven by Brexit news; Yen by risk trends

The Pound-to-Yen exchange rate is trading at 144.80 at the time of writing, marginally down on the day, but little changed from the previous week’s close.

Although it is meandering sideways it remains vulnerable to more downside, especially in the short-term.

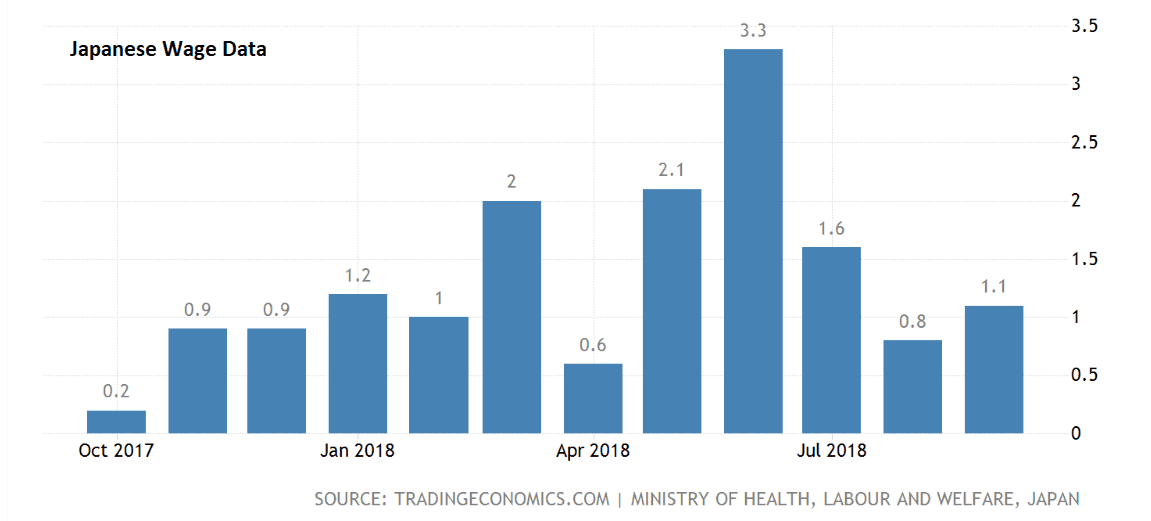

The Yen has lost some of the temporary strength it gained a few months ago from a marked improvement in wage data and hints from the Bank of Japan (BOJ) that it might be considering an end to monetary stimulus. These improvements proved ephemeral, however, and the old status quo now seems more established than ever.

A cursory glance at the daily chart of GBP/JPY (below) reveals a sideways range with no obvious clues as to future direction. At the most one could posit a gentle downwards trajectory, but nothing conclusive.

Scope in a little, however, and you will see how a bearish flag pattern is probably forming which could be about to break lower, and this provides harder evidence of bearish potential.

Bear flags are composed of a ‘pole’ section and a ‘flag square’. A break below the pole lows, in this case at 144.009, would confirm a continuation down. The next target at 142.60, calculated by extrapolating the pole lower.

The weekly chart suggests the pair has formed a descending wedge-pattern after rallying up to a peak at the 156.61 highs in January. This wedge pattern - if that is what it really is - is normally considered a bullish formation, yet in this case it has failed to break out higher, despite several attempts.

On the latest attempt it fell back inside the wedge again, further substantiating the bearish tenor of the chart.

The main driver of the Yen is investor risk appetite, which when high leads to outflows, weakening the Japanese currency, and when low leads to ‘safe-haven’ inflows, strengthening the currency.

As such, the recent decline in the US stock market, accompanied as it was with a fall in investor risk appetite has broadly supportive of the Yen.

Stocks have since recovered after comments from the chairman of the US Federal Reserve (Fed) Jerome Powell, who said interest rates might not rise much more - a change from what was previously expected.

One of the reasons for the sell-off in stocks had been fears about rising interest rates limiting growth, so his comments suggesting borrowing costs might be close to peaking, provided some ballast to sentiment. This was not, however, positive for the topsy-turvy Yen.

Today (Thursday) marks the start of the G20 summit in Buenos Aires and this too may have an impact on risk appetite and the Yen. Investors are keenly awaiting the outcome of private talks between President’s Trump and Xi concerning trade relations. If talks are constructive the Yen could weaken; if not it could see a spurt higher.

The latest commentary from the BOJ has reinforced the current policy agenda. The most recent BOJ official to comment was Takako Masai, who offered an optimistic view on price prospects, saying the economy has not lost momentum to push inflation toward the BOJ's 2.0% target.

However this would only be the case by keeping the monetary easing ‘taps’ on.

"As such, the best approach would be to sustain the current ultra-loose monetary policy ... so the positive momentum is not disrupted," she added.

Recent retail sales data was surprisingly good, but nevertheless, failed to move the Yen much. October retail sales beat estimates of 2.7% by coming out at 3.5% from a year ago.

The next major release is Tokyo inflation data, out at 23.30 GMT (today), Thursday, November 29. It is forecast to slow to 1.1% in November from 1.5% previously. Core is forecast to stay at 1.0% compared to a year ago.

Unemployment and industrial production are also out at the same time and expected to hold at 2.3% in October. Industrial production is forecast to rise 1.2% month-on-month in the same month.

The Pound, meanwhile, has weakened on the dawning realisation that Theresa May’s Brexit deal probably will not get Parliamentary approval.

Although Parliament is only gets a ‘meaningful vote’ which is not legally binding, it has the potential to humiliate May into a stand down, if she were to lose by a large majority.

The prime minister is 60 votes short of a majority, according to estimates from Sky News, whilst she could face a crushing 200 vote defeat, according to Tom Newton Dunn, the political editor of the Sun.

We believe the scale of the defeat of the brexit deal's first passing through parliament will be key for Sterling: a slight defeat hints that a second passing would be successful. A defeat on the scale suggested by Newton Dunn would almost certainly sent Sterling tumbling into year end.

The government also published its own forecasts on Wednesday, which showed how different types of Brexit deal would impact the economy. These also showed a ‘no-deal’ would have the worst impact but that all of the possible deal options on the table would result in a decline in growth compared to staying in the EU.

Advertisement

Bank-beating GBP/JPY exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here