Knowledgebase: Understanding Market Trends and Their Impact on Forex Trading

- Written by: Sam Coventry

-

Image © Adobe Images

In the vast landscape of forex trading, understanding market trends is akin to wielding a compass in uncharted waters.

These trends, akin to the ebbs and flows of the tide, play a pivotal role in shaping the direction of currency values.

In this educational article, we'll unravel the significance of market trends and their profound impact on forex trading.

Keeping it simple, we'll explore how being aware of these trends can guide traders towards making informed decisions.

Defining Market Trends in Forex Trading

Before delving into the impact, let's demystify what market trends are in the context of forex trading.

Market trends essentially represent the general direction in which the market is moving.

These trends can be categorised into three main types: uptrends, downtrends, and sideways trends.

An uptrend indicates a general upward movement in currency values, a downtrend signifies a downward movement, while a sideways trend suggests a relatively stable market with fluctuating values.

The Influence of Market Trends on Forex Trading Strategies

Understanding market trends is crucial for forex traders as it directly influences their trading strategies.

For instance, during an uptrend, traders might consider adopting a 'buy' strategy, anticipating that the value of a currency will continue to rise.

Conversely, in a downtrend, a 'sell' strategy may be more appropriate, as the currency is expected to decrease in value.

Sideways trends, on the other hand, might prompt traders to adopt a range-bound strategy, focusing on buying low and selling high within a specific price range.

Examples of Market Trends:

Uptrend Example:

Let's say the value of the British Pound (GBP) against the US Dollar (USD) has been steadily increasing over a defined period. Traders observing this consistent upward movement may interpret it as an uptrend.

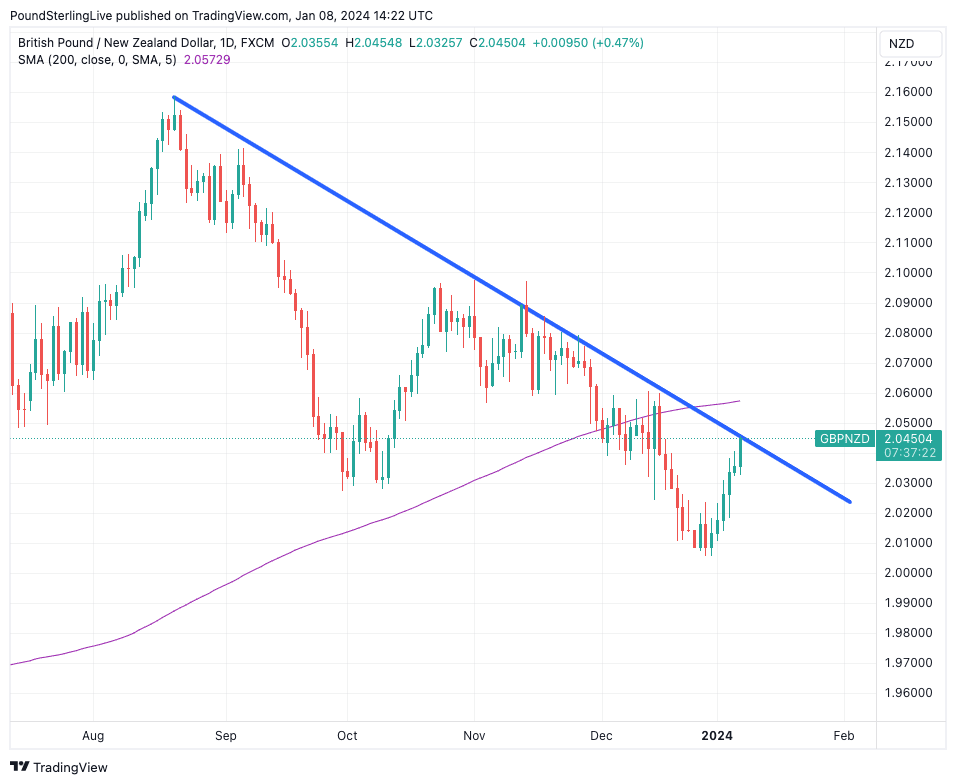

Downtrend Example:

Conversely, if the Pound (GBP) consistently loses value against the New Zealand Dollar (NZD) over a specific timeframe, traders might identify a downtrend, indicating a potential decline in the GBP/NZD currency pair:

Sideways Trend Example:

In a scenario where the Australian Dollar (AUD) shows minor fluctuations against the Swiss Franc (CHF) without a clear upward or downward pattern, traders might recognize a sideways trend in the AUD/CHF pair.

Key Considerations and Tips for Identifying Market Trends:

Moving Averages:

Use moving averages to smooth out short-term fluctuations, helping identify the overarching trend direction.

Support and Resistance Levels:

Analyse support and resistance levels to gauge potential trend reversals or continuations.

Volume Analysis:

Consider volume analysis to confirm the strength of a trend. Higher trading volumes often accompany significant trend movements.

News and Economic Indicators:

Stay updated on economic news and indicators as they can influence market trends. For example, positive economic data may contribute to an uptrend, while negative news might lead to a downtrend.

Adapting to Changing Market Conditions

One of the key takeaways for forex traders is the dynamic nature of market trends.

Trends can change due to various factors, such as economic indicators, geopolitical events, or market sentiment.

Staying informed about these changes is crucial, and this is where the role of the best forex brokers in the UK becomes significant.

Choosing the Best Forex Brokers in the UK: A Necessity for Informed Trading

Selecting the right forex broker is fundamental for traders aiming to navigate the intricate world of market trends. The best forex brokers in the UK act as facilitators, providing a platform for executing trades and offering valuable insights.

In the context of changing market conditions, a reliable broker becomes a strategic partner, offering timely updates, analysis, and tools that aid traders in adapting to evolving trends.

When considering the best forex brokers in the UK, factors such as regulatory compliance, trading fees, available currency pairs, and customer support come into play.

Platforms like ABC Forex, XYZ Traders, and LMN Currency Hub are examples of brokers that prioritize user-friendly interfaces, competitive fees, and a diverse range of currency options, making them favorable choices for traders navigating market trends.

Risk Management in the Face of Market Trends

Market trends, while informative, also introduce an element of risk. Even the best forex brokers cannot eliminate market volatility. Therefore, risk management becomes an integral part of a trader's toolkit.

This involves setting stop-loss orders, diversifying portfolios, and staying disciplined with trading strategies.