Inverted Hammer Pattern Signals Possible Shifts in Market Narrative

- Written by: Sam Coventry

-

Image © Adobe Images

The expansive world of financial markets is akin to a grand tapestry, with each thread representing a different facet of the global economic machinery.

As this tapestry unravels over time, various patterns, intricacies, and insights emerge for those who take a closer look.

These patterns, subtle to the untrained eye but profound for the seasoned observer, become critical signposts.

Among these, the inverted bearish hammer candlestick stands as both an enigma and a guide, signalling possible shifts in the market narrative.

As we prepare to journey into the realm of this fascinating pattern, let's first set the stage with a broader understanding of the language it employs: the rich lexicon of candlestick patterns.

A Deeper Dive into Candlestick Patterns

The annals of trading history reverberate with tales of Japan's 17th-century rice merchants, who pioneered the use of candlestick patterns. It was their visionary approach to encapsulate the tumultuous tides of supply and demand into a visual narrative.

When we gaze upon a candlestick chart, we are, in essence, witnessing the age-old drama of fear, greed, anticipation, and regret. Each candlestick portrays a battle - a battle between bulls and bears, optimism and pessimism.

The thick-bodied centre of the candle narrates the opening scene and the closing act of a specific period, while the wicks or shadows, thin and stretching, depict the ambitions and the ground realities, the peaks of hope and the troughs of disappointment.

Grouped together, these candles often form patterns, and therein lies the power to foretell potential future moves.

The Inverted Hammer: An Emblem of Hope?

Amid the array of patterns, the inverted hammer stands tall, not just because of its elongated upper shadow but due to the promise it often carries.

- Description: Nestled at the base of a downtrend, this singular pattern boasts a compact body, which can either herald a bullish or bearish sentiment.

But its defining feature remains the long upper shadow, commonly extending at least twice the length of its body. Interestingly, its lower shadow is mostly a mere whisper, if not entirely absent.

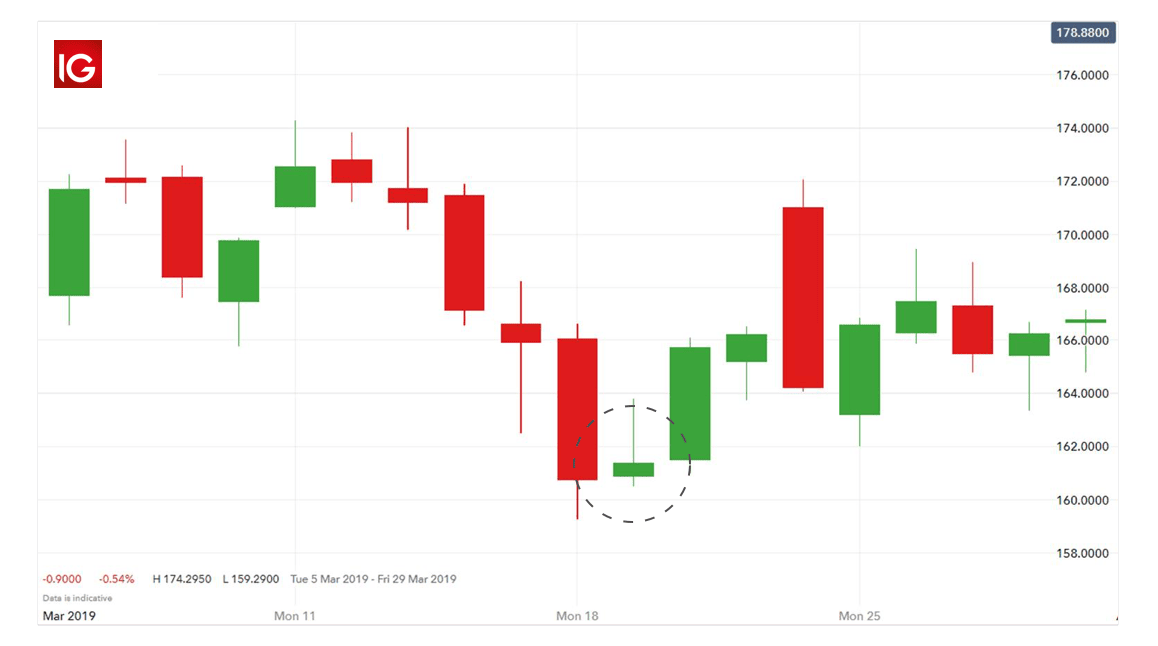

Above: Example of an inverted hammer, image courtesy of IG.

- Interpretation and Significance: The appearance of an inverted hammer, especially at the tail end of a bearish phase, is akin to the first light of dawn after a long night.

It suggests that though sellers initially dominated, pushing prices skyward, the buyers rallied, signalling a possible shift in the market winds. - Practical Application: Yet, one must tread with caution. The inverted hammer, while promising, needs validation. This usually comes in the form of a subsequent bullish candle, heralding a potential reversal.

And as any market maestro would advise, anchoring one's strategy with a stop loss just beneath the inverted hammer can be the protective shield against unforeseen volatilities.

Forex Swap Free Accounts: An Introduction

Now, let's shift gears and talk about a unique offering in the Forex world: the Swap Free Account.

- Definition and Purpose: The Forex Swap Free Account is not just a standard trading account. At its core, it represents an alignment of financial practices with ethical and religious beliefs.

In this type of account, traders neither pay nor earn swap or rollover interest on overnight positions, which is a direct nod to Islamic finance principles that prohibit the earning or paying of interest, termed as "Riba." - Who's It For?: While these accounts were initially designed to cater to Muslim traders adhering to Sharia law, their appeal has transcended religious boundaries.

Today, Swap Free Accounts attract a diverse group of traders. Some opt for these accounts to align with their religious beliefs, while others are drawn by strategic reasons or the desire to avoid the complexities and costs associated with swap fees.

- Advantages and Disadvantages: Trading without swap considerations comes with its own set of pros and cons. The clear advantage lies in the realm of ethical and religious compliance, ensuring traders do not compromise their beliefs.

Moreover, the absence of swap fees offers a clearer view of trade costs, streamlining the trading process.

However, it's essential to note that brokers might adjust for this 'swap-free' feature by introducing alternative fee structures, such as higher account fees or slightly wider spreads.

As with all trading tools and account types, a thorough understanding and assessment are crucial for success.

Unveiling the Inverted Hammer's Role in Forex Swap Free Accounts

In the Forex arena, known for its rapid pirouettes and swings, the inverted hammer can be akin to a guiding star, especially for those venturing with Swap Free Accounts.

Such accounts, with their unique no-interest feature, shine a spotlight even more brightly on the importance of patterns and price actions.

Patterns become not just tools, but the very compass by which traders navigate. The inverted hammer, with its foretelling nature, can be especially crucial for those trading in Forex Swap Free Accounts.

Stripped of the complexities of interest considerations, traders are offered a purer, undiluted view of the market. Here, the inverted hammer's insinuations of a bullish tide can be the very lighthouse guiding traders through murky waters.

To illustrate: Picture a trader, adeptly using a Swap Free Account, who discerns an inverted hammer amidst a downward spiral in the USD/CAD pairing. With astuteness, they anticipate a bullish upswing.

The ensuing trading days not only confirm this prediction but underscore the profound synergy between pattern recognition and the distinct attributes of a Swap Free Account.