U.S. Dollar Remains on Front Foot after Federal Reserve Upgrades Economic Forecasts and Flags More Rate Hikes to Come: Analysts Give their Views

- Written by: James Skinner

-

© Xiong Mao, Adobe Stock

- USD trades on front foot following new Federal Reserve projections.

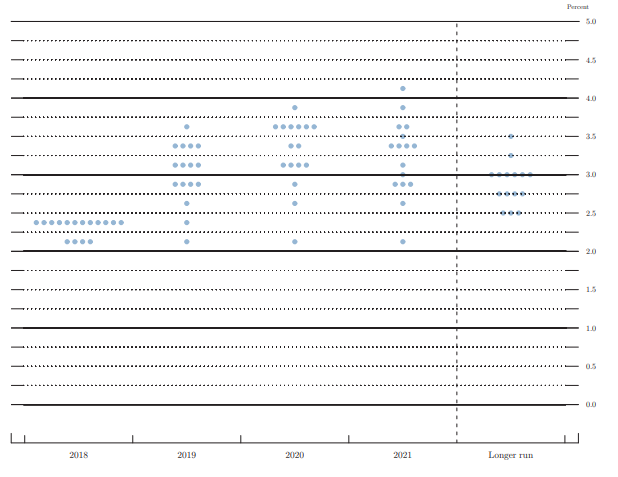

- Dot plot forecasts show long term U.S. interest rate moving higher.

- Fed revises growth projections higher, inflation to remain elevated.

The U.S. Dollar advanced against rivals Thursday after the Federal Reserve (Fed) dropped some key language from its latest monetary policy statement before upgrading forecasts for the economy and how high its interest rate will sit on average over the long-term.

Wednesday's forecast and statement changes came after policymakers raised the Federal Funds rate to between 2% and 2.25%, from between 1.75% and 2%, marking their eigth interest rate rise since the end of 2015.

The rate rise was well telegraphed and already priced by the market in advance so traders and analysts were focused largely on changes to the Federal Reserve's outlook for the economy and interest rates in the future.

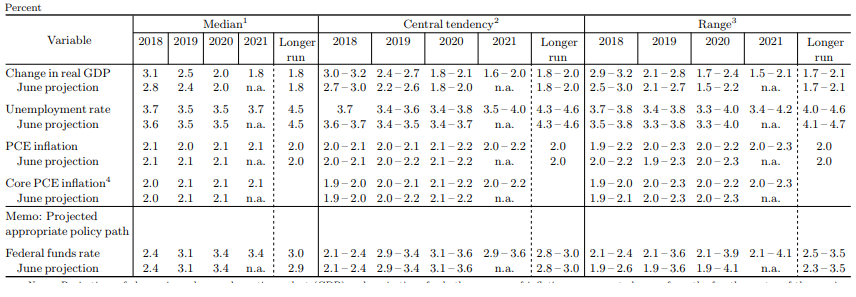

Fed officials dropped the well-worn line that monetary policy remains "accomodative" from their statement, although they now see the U.S. economy growing at a faster pace of 3.1% and 2.5% respectively this year and next, when back in June they had predicted growth of 3% and 2.4% for the period.

Above: Federal Reserve economic projections.

The so-called dot plot's median projections for the Federal Funds rate still envisage U.S. borrowing costs peaking at 3.4% in 2020 although the estimate of the "longer run" interest rate rose a fraction from 2.9% to 3%.

Policymakers have nudged their median projection for rates at the end of 2020 higher repeatedly of late, taking it from 2.9% back in September 2017 to 3.4% by June 2018.

Expectations of faster growth and higher interest rates prevail despite the latest forecasts also suggesting that PCE inflation, the Fed's preffered measure of domestic price pressures, will dip temporarily from 2.1% to 2% in 2019.

Inflation still remains at or above the 2% target throughout the forecast period but the dot-plot projections now show the Federal Reserve expects to stop raising its interest rate in 2020, as had been anticipated by the market.

(Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run.)

The U.S. Dollar index was quoted 0.32% higher at 94.58 during early trading Thursday, up from 94.36 Wednesday afternoon.

The Pound-to-Dollar rate was 0.44% lower at 1.3112 and the Euro-to-Dollar rate was down 0.50% at 1.1687.

The U.S. Dollar has outperformed in 2018 because the superior U.S. economic performance has enabled the Federal Reserve to go on raising its interest rate at a time when many other central banks across the globe are sat on their hands due to underperformance or sub-par inflation.

Changes in interest rates, or hints of them being in the cards, are only made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

Wednesday's decision and accompanying projections came as the U.S. Dollar index trades on a 2.2% gain for the 2018 year after having reversed what was once a 4% first-quarter loss. The six months to the end of September have seen almost all currencies cede ground to a resurgent greenback.

Analyst opinions about exactly what the Fed's statement means for the greenback from here, however, do vary. Below is a compilation of views and predictions.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Michael Pearce, economist, Capital Economics

"The upbeat tone of the accompanying statement and the upward revisions to the Fed’s forecasts for economic growth support our view that the Fed will continue raising interest rates once a quarter until mid-2019."

"Our view is that the Fed will press ahead with gradual rate hikes for now, but that officials are still underestimating just how quickly the economy is likely to lose momentum next year, as the fiscal boost fades and monetary tightening bites."

"As economic growth slows below its potential rate around the middle of next year, we expect the Fed to call time on rate hikes and ultimately begin cutting rates by early 2020."

Bipan Rai, macro strategist, CIBC Capital Markets

"The real story is in the removal of the reference to policy being ‘accommodative’. A sizeable chunk of the market had anticipated this outcome based on recent Fed-speak. Fed Chair Powell pushed back against the notion that this signals a change in the rate-path."

"Still, the change in language underlines that the Fed is further along its policy path than other central banks and that the USD should trend lower as policy settings become more growth restrictive."

"We are approaching a period where markets will start placing a greater emphasis on the US’ funding needs and the increased costs attached to them. In market terms, this means that it’s entirely possible (and likely) that US rates will diverge with the USD over the medium-term. That’s what you get when growth in global liquidity is slowing (and even declining) and you’re running expansionary policy."

"We still favour a weaker USD into the medium-term. We like the AUD, SEK, NOK on reversion and expect that the NZD will join in on the fun, but would prefer to wait for the RBNZ later today. For now, we’re long AUD and SEK versus the CAD (which faces the same strategic headwinds as the USD) but we’ll happily leg switch to the USD as a short once the cyclical convergence story is underway (the US economy begins to slow)."

Adam Cole, chief FX strategist, RBC Capital Markets

"Despite some initial volatility around the removal of the reference to “accommodative” (significance played down by Powell in the press conference), net FX moves post-FOMC have been negligible (DXY +0.1%)."

"The implicit message that rates are getting closer to neutral should be offset by an upward revision in the neutral rate itself (+12.5bp on the median, but only +2bp on the mean). We think this will be a theme going forward, leaving the Fed chasing a moving target and the risks are still to the upside of market pricing."

Lee Hardman, currency analyst, MUFG

"The main message from the Fed was one of policy continuity. The updated projections continue to signal that Fed believes it will be necessary to lift rates into mildly restrictive territory in the coming years to dampen upside risks to the inflation outlook."

"The Fed has become more confident in the economic outlook but not sufficiently to make more material changes to their plans for policy at the current juncture. The distribution of the dots revealed that the Fed is moving towards adding an additional rate hike into their plans, which also highlights the Fed’s increasing confidence in the outlook."

Ulrich Leuchtmann, head of FX strategy, Commerzbank

"The Fed can continue its gradual (compared with inflationary times in the past) rate hike cycle as planned and does not have to suddenly speed up – as there is no inflation to fight – nor slow down – as the real economy continues to develop well. As a result an FOMC decision of this nature is a non-event that one could almost ignore if reverence for the US central bank did not demand that we mention it."

"There was a certain amount of toing and froing on the FX market yesterday as clearly some market participants (who had not yet got used to the “best of all worlds”) had expected a more hawkish statement. But in the end neither the FOMC decision itself (as expected +25bp) nor Powell’s press conference had a major and sustainable effect on the USD exchange rates. That is what happens half way through a Fed rate cycle, which is finally generally accepted as such."

"However there is one thing that slightly ruins this peaceful scenario: US President Donald Trump’s whingeing. As he told the world he is once again “not happy” about yesterday’s rate hike. “I am a low interest-rate person”. We know him for comments of this nature, but unlike his colleague in Turkey, who caused the collapse of the lira with similar comments over the past months, Trump’s words remained without effect for the dollar."

Viraj Patel, FX strategist, ING Group

"As ING’s Chief International Economist James Knightley notes on the Sep FOMC meeting: “The Fed voted unanimously for another 25 basis point rate rise and while policy is no longer described as ‘accommodative’, the gradual increases in the Fed funds rate look set to continue for at least another couple of quarters”. "

"With the Fed failing to show any additional hawkish aggression to sustainably lift the dollar higher, the focus for investors now turns to US politics – not least after what can only be described as a truly extraordinary press conference by President Trump following the UN summit yesterday."

"For global markets, there were two particular issues beyond the President’s aversion to the FOMC raising interest rates: (1) accusations of China meddling in the US midterm elections – which briefly saw USD/CNH trading higher; and (2) the President’s negative tone over NAFTA and US-Canada trade talks – which has seen the CAD fall by around 0.60% overnight."

"The prospects of a ‘Zombie NAFTA’ may keep CAD under some pressure for now – while a formal break-up risks seeing USD/CAD at 1.35-1.36."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here