US Dollar Rally is Now Over say Morgan Stanley; Losses to Renew this Summer

- Written by: James Skinner

-

- US Dollar rally is now over says Morgan Stanley, losses to renew.

- Global growth recovery, trade and "twin deficit" fears to hit USD.

- US Dollar index now forecast to lose 5% - 6.5% before year-end.

© Robert Cicchetti, Adobe Stock

The US Dollar rally that has been the dominant theme in currency markets during recent months is now over, according to strategists at Morgan Stanley, and the greenback is set to resume its earlier decline against rivals in the developed and emerging worlds.

A recovery in global economic growth and market concerns over White House trade policy are both likely to help push the Dollar lower during the months ahead, Morgan Stanley say in a recent analyst briefing to clients.

And the greenback's lacklustre performance in the wake of June's Federal Reserve meeting, which saw rate setters add a much vaunted dot to the so called "dot plot", confirms the outlook for the US Dollar has turned for the worse.

"Recent weeks have seen US equities and the USD rally simultaneously as investors moved funds into the US. We expect these flows to reverse from here, suggesting a lower USD as US markets become less supported. We remain bearish USD largely across the board," says Hans Redeker, head of FX strategy at Morgan Stanley.

Morgan Stanley's view is noteworthy because the bank's strategists were among the first to call an April turn in market sentiment toward the US Dollar, which duly saw the greenback convert a 4% 2018 loss into a 3% gain.

They argued back in March that the first-quarter slowdown in the global economy, which came as the US economy motored along at a healthy clip after being buoyed by President Donald Trump's tax cuts, would be supportive of the Dollar. A "protectionist" bent in White House trade policy was also flagged as something likely to dent investors' appetites for riskand boost the US currency.

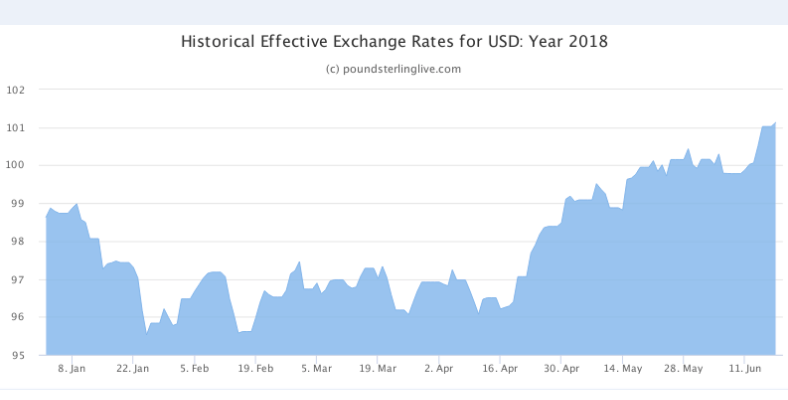

However, the Dollar index has risen close to 7% since the middle of April and with the global economy now showing signs of picking back up toward the end of the second quarter, the Morgan Stanley team is calling time on the US Dollar's renaissance.

Above: Pound Sterling Live graph showing US Dollar index.

"The USD behavior post-Fed increased our conviction that the upward USD correction which began in February is complete. USD bullish positioning and market sentiment may soon be challenged by the US sharpening its protectionist rhetoric, which is likely to dampen risk appetite," Redeker adds.

The Dollar did not receive a meaningful boost last week when the Federal Reserve raised its interest rate for the second time in 2018. Neither did it respond much to Federal Open Market Committee members having added another dot to the so called dot plot that shows policymaker expectations of when the Fed will likely raise rates.

Instead, the greenback edged lower overnight on the Wednesday and into the Thursday session due to fears over White House trade policy. The Trump administration's increasingly aggressive trade agenda has left financial markets, which have shifted from having bets heavily stacked against the US currency to having all of their chips behind it, exposed.

Seperately, Morgan Stanley reckon EUR/USD below 1.16 represents good value.

"Trade War" in Focus

President Donald Trump instructed US trade representatives on Monday to begin preparing a 10% tariff on imports of more than $200 billion in Chinese goods, which has already drawn a threat of retaliation from China's Ministry of Commerce and may have far-reaching implications for US inflation, economic growth, interest rates and the Dollar.

It follows Friday's decision by the White House to push ahead with $50 billion of tariffs on Chinese technology goods, in the name of combating China's alleged unfair trade practices, despite President Trump having said in May that China has agreed to substantially increase its imports of US agricultural goods in order to reduce the bilateral trade deficit.

Fears are that the tit-for-tat tariff fight will dent economic growth in the US and China, which could have spillover effects for economies elsewhere in the world. The Trump administration is also holding the North American Free Trade Agreement countries over a barrel and has threatened the European Union with tariffs on automotive imports.

"Rising US fiscal deficits will require higher capital inflows, meaning the US will need to offer compensation via higher yields or a cheaper exchange rate. Given high US leverage, particularly in the corporate sector, higher yields will be more difficult to manage, suggesting a weaker USD is more likely," Redeker notes, flagging another ailment of the US Dollar.

Twin Deficit Fears Return

Another factor likely to drive the Dollar lower in the second half of 2018 is the so called "twin deficit" being run up by the White House in the wake of January's tax cuts.

President Trump's tax reforms will add more than $1 trillion to the budget deficit in the next ten years and fuel increased US demand for borrowing from overseas, which many expect will drive a deterioration in the current account deficit at the wrong point in the current economic cycle.

These concerns have dented the Dollar before, leading to a 4% depreciation in the US Dollar index between January 2018 when the tax cuts were implemented to the end of March. Redeker and others say these concerns will now reassert themselves over the Dollar.

"Late-cycle fiscal easing is good for the dollar in the near term insofar as it forces the Fed to tighten more or faster than it would otherwise. But easing this late will destabilise the cycle and bring the next downturn closer at the same time as boosting both budget and current account deficits in the years ahead," chimes Kit Juckes, chief FX strategist at Societe Generale.

Juckes and the Societe Generale FX team forecast the US Dollar index will fall back to 90.3 before the end of 2018, from 95.09 Tuesday, implying a decline of around 5%. Redeker and the Morgan Stanley FX team forecast the US Dollar index will fall even further, back to 89 before the end of 2018, which implies a fall of around 6.3% before year end.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here