Pound-to-Dollar Rate Forecast For the Week Ahead: Possibility of a Small Rally Higher

- GBP/USD enters the week on short-term bullish footing

- The main release for the Dollar will be March inflation data

- The Pound will take its cue from Industrial and Manufacturing data

© RCP, Adobe Stock

One Pound buys 1.4107 US Dollars at the time of writing having earlier in the session set this month's new high at 1.4118, having been as low as 1.3966 a mere four days earlier. The turnaround is quite impressive with the Pound ending Friday, April 6 on a high amidst seasonal flows which have proven to be supportive of Sterling.

Indeed, the Pound tends to rally against the US Dollar in April, and analysts see little reason to believe April 2018 will be any different.

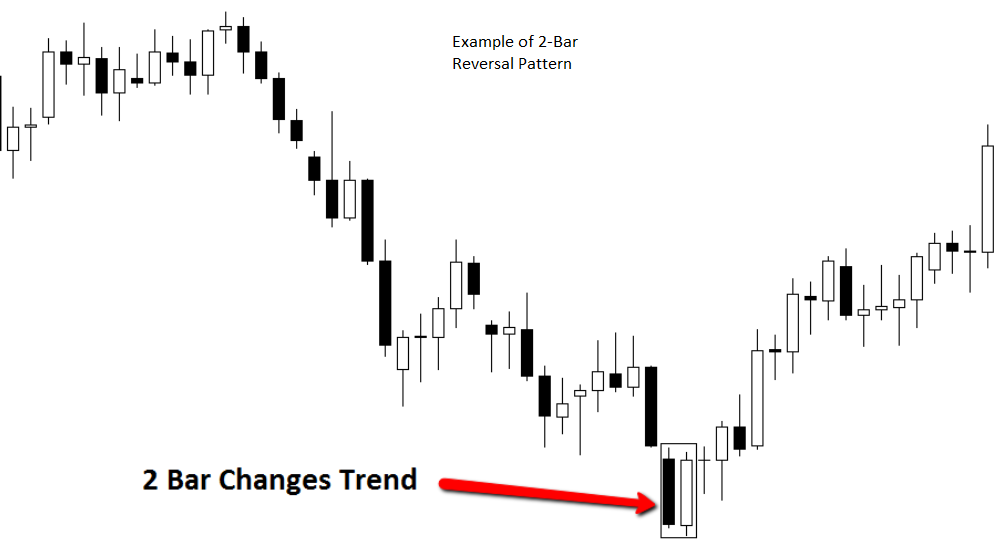

Our technical studies note Sterling remains elevated against the US Dollar as we enter the new trading week, with a spot price still above the 1.40 psycological 'high water mark' level. Friday's up-day for GBP/USD ended up forming, what could be a bullish reversal pattern on the daily chart in the form of the two-bar reversal (see below).

This suggests the move down - the correction really - from the March 26 highs, may now have terminated and the pair could be about to start a fresh new short-term cycle higher.

For an example of a two-bar reversal see the chart below from Dailyforex.com, which shows how a two-bar punctuates a long-term down-trend and heralds the onset of a new more bullish phase.

The main problem for bulls is the substantial and robust resistance in the from of the 200-week MA overhead, 1.4225.

The 200-week provides a natural ceiling level on the chart, as can be seen from the chart below which shows how it has been capping activity thus so far. All in all, it will be a difficult level for the exchange rate to break through, so any moves higher due to the two-bar will likely be limited.

Trending prices often stall, pull-back or even sometimes reverse at the level of large moving averages like the 200-week, because it is used by large speculators, fund managers and retail traders alike as a decision-making tool, and is therefore subject to an increased level of volatility.

Nevertheless, given the formation of the bullish reversal pattern on the daily chart as well as the fact that the 50-day moving average appears to be offering underpinning support to the exchange rate (see chart below), there is a possibility of a small rally higher to 1.4220 in the week ahead, however, this forecast is conditional on the exchange rate being able to break above the highs of the two-bar at 1.4105.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Dollar

The big day for US data which is likely to impact most on the US Dollar this week is Wednesday, April 11, when, first inflation data at 13.30 GMT, and then the minutes of the US Federal Reserve at 19.00, are released.

Inflation is forecast to rise 0.0% in March compared to the level it was at in February, and Core Inflation, which leaves out volatile food and fuel inputs, by 0.2%.

Compared to the previous year, or year-on-year (yoy) as it is known, the inflation rate is expected to show a rise of 2.4% and 2.2% respectively.

These increases are in line with current market expectations of the Fed raising interest rates by a further 0.25% to 2.0% in the summer.

Concerning the Fed, the release of the minutes on Wednesday are expected by strategists with Barclays to be supportive of the Dollar; "Wednesday's FOMC minutes may read hawkish, in line with revisions to the dot plot, especially against Chairman Powell's dismissal of those changes in the press conference," say Barclays in a weekly strategy note.

The US Dollar fell across the board after the US Federal Reserve raised interest rates in March but signalled they were in no rush to hasten the pace at which they raise interest rates in the future. However, the much-watched ‘dot plot’ graph of FOMC participants’ interest rate expectations - contained in the latest set of economic forecasts - shows that the majority think this policy will require two further interest rate rises in 2018.

Barclays reckon a hawkish Fed should set up further gains in the Dollar, but moreso against the Euro than the Pound. However, this is still one factor to be wary of for GBP/USD.

We do not expect any upside surprises given the status quo stance adopted by the Fed's Chairman Jerome Powell in his speech on Friday which suggested a 'steady as she goes' attitude. The Fed is on the frontline when it comes to the economy so if there were any risks to the data showing an extreme overshoot higher or lower Powell would have been expected to know about before the rest of us and to have dropped hints as such on Friday. The fact he didn't speaks volumes.

Most of the analysis out there is about the escalating trade war and whether it will get any worse in the coming week. The ball is now in China's court so there is the possibility of further retaliation given the US's move to increase the scope of tariffs to include 100bn more goods from China, on Thursday, on top of the existing 50bn.

Scandinavian lender Nordea Bank notes how the S&P 500 is at a make or break level now, in the form of the 200-day moving average, a key line in the sand for everyone from big Wall Street fund managers to the guy next door who likes to trade his pension portfolio part-time.

A further escalation in the trade tit-for-tat could be just the catalyst required to send stocks down another notch and lead to a break and close below the 200-day, and if that happens there's likely to be much blood spilled and deep follow-through declines.

Of course, how this will impact on the Dollar is not exactly clear - the usual relationship is that what is bad for stocks is good for the Dollar because when all is said and done the US Dollar is still a safe-haven currency but it's not by any means a straight line correlation.

The week ended with a small swing higher in stocks after senior White House advisor Larry Kudlow sought to take the heat out of the trade war debate by saying he didn't expect most of the tariffs to materialise in reality, but Nordea Bank's Andreas Steno Larsen cautions against taking advisor's comment's too seriously as Trump is very much 'captain of his ship' when it comes to trade policy.

"We advise against taking too much comfort in softer trade tones from Trump’s economic advisers, including the newly appointed Larry Kudlow (as the market did earlier this week). Ultimately, Trump seems to be personally in charge of these trade efforts," says Larsen.

Expectations that Trump may shy away from a trade war because it will have a negative impact on the S&P 500 which he appears to have "internalised" in the words of the Nordea analyst, should also be taken lightly - Trump probably has the stomach for a trade war.

"Recent communication from the White House indicates that Trump is increasingly willing to see through a stock market correction, as the trade measures are a “longer-term thing”," says Larsen.

As far as the chances of an escalation go, if it's going to happen, it may well happen next week with a salvo from China.

"China may or may not issue their own threat of enhanced tariffs next week, which would add pressure on the dollar but serious trouble comes when these words turn into action," says Kathy Lien, Managing Director of BK Asset Managment in a note on Friday.

Another potentially significant release for the Dollar in the week ahead is the release of the March Fed meeting minutes on Wednesday, however, in light of Chairman Powell's speech in which he endorsed a steady trajectory we doubt the minutes will deviate much from him, so there, is perhaps only a very outside chance of a surprise.

Data and Events to Watch for the Pound

The consensus now appears that recent poor business survey data was as a result of the weather - the 'Beast from the East' - rather than a real economic slowdown.

This means the Pound is probably on course for more gains as the Bank of England (BOE) are still likely to raise interest rates in May as most expect.

Higher interest rates are the fuel which drives currency trends as international capital-flows now dictate currency values, and they tend to move to places where interest rates are higher, all other things being equal, as that's where they will earn the most return.

Yet notwithstanding the weather, some doubt has now crept into whether the BOE will still pull the trigger in May.

In the coming week, there will be a heavy focus on wage inflation since if that rises the BOE is more likely to want to cool the economy with higher interest rates. In this respect, the IHS Markit REC recruitment industry survey, out at 23.00 GMT on Tuesday, April 9, may be instructive, as it includes the latest pay information from recruiters, according to Chirs Williamson, Chief Economist at IHS Markit.

"With the Bank of England having laid the ground for a May rate hike, the focus will, therefore, fall heavily on pay trends. In that respect, the REC recruitment industry survey will give an update on new starter and temp/contract staff pay rates, both of which tend to move in advance of pay growth in the wider economy," he says.

Another major release in the week ahead is Industrial and Manufacturing Production data for March at 9.30 on Tuesday, and the Trade Balance at the same time, which is forecast to narrow to -11.9bn in February from -12.3bn in the previous month - a narrower trade balance is sometimes positive for currencies, although the correlation of late seems to be waning.

Another major release is the Halifax house price index at 8.30 on Monday morning, with analysts carefully watching the result given the sector's lacklustre figures of late, and the especially poor Construction PMI result for March, which collapsed into contraction territory.

House prices ought not to be affected by the bad weather as much as construction 'activity' so this may be an important release for restoring some confidence in the sector.

If Halifax house prices show a deeper than expected fall, however, it may hit Sterling as it will almost certainly reduce the probability of the BOE hiking rates in May.

Current forecasts are for only a 0.1% rise in March versus the 0.4% increase in February, or 2.1% compared to a year ago vs 1.8% in February.

Finally, a heads up for Retails Sales in March comes in the form of the CBI Retail Sales monitor, out at 12.01 on Tuesday.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.