Pound-to-Dollar Exchange Rate Just Turned Short-Term Positive

Technical studies of the Pound-to-Dollar exchange rate confirm recent moves have turned the outlook a little more positive in the short-term.

GBP/USD has risen 0.40% over the course of the last five days - a small gain, but a gain nevertheless.

At an exchange rate of 1.3252, the market is well within recent ranges that have been in place since October so those watching the conversion will not be seeing anything unfamiliar at current levels.

However, a look under the bonnet, shows some interesting developments.

"GBP/USD has eroded the short term downtrend," says Karen Jones, a technical analyst with Commerzbank in London. "Should we also clear the 55 day moving average at 1.3239, the risk will increase of a move to 1.3338/43."

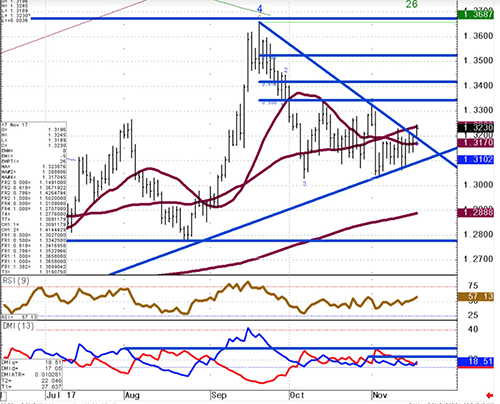

Above: The GBP/USD exchange rate has just broken above the short-term downtrend, denoted by the downward-sloping diagonal blue line. This advocates for further gains.

So some bullish developments for the exchange rate have developed and Jones is favouring gains from here. It is note the recent October high and the 50% retracement at 1.3338/43 continue to act as a short term ceiling for the market which gives an identifiable upside target to watch.

The analyst says while the market has turned somewhat positive it is worth keeping an eye on support - that level that the exchange rate must stay above if it is to maintain a positive bias.

Jones says attention remains on the 1.3049 2016-2017 uptrend; noted as the rising blue line in the above chart.

"The 1.3049 level represents the break-down point to 1.2830/1.2774, the 38.2% retracement and August low, and the 1.2575 50% retracement," says Jones, eyeing out where the exchange rate could fall if the uptrend line is broken.

"Upside risk," says Winson Phoon, an analyst with Maybank in Singapore, referending the near-term prospects for GBP/USD. "GBP firmed amid better than expected retail sales data. Pair was last seen at 1.3230 levels. Daily momentum and stochastics indicators are not indicating a mild bullish bias. A move higher towards resistance at 1.3270 (50DMA, 38.2% fibo retracement of Sep high to low), 1.33 levels should not be ruled out."

However, technical strategists at UBS believe Sterling's advance higher against the Dollar should be relatively contained, and any advances will be sold into by traders expecting a return lower.

"Cable traded higher on the back of USD weakness, taking it through the resistance area at 1.3210-20 levels. With further Brexit uncertainty around the corner I would be inclined to sell a further extension of this rally, preferably towards 1.3270-80 and keep a stop above 1.3320," says a note from the technical strategy desk at UBS, dated November 17.

So if you put the above views together, we can expect some upside, but these gains are widely expected to be limited in scope.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

"Upside Risks" Building for the Pound

Sterling has had a good week against the US Dollar having risen 0.45% over the past five days at the time of writing, taking the 2017 advance to 7.44%.

The Pound is a political currency at present; therefore the direction of travel of Brexit talks will matter greatly.

The question markets want answered is whether the UK and EU can agree to move talks onto trade and the future relationship in early 2018 - the tone set a December conference on Brexit held by European leaders will be key in answering this question.

In particular, progress on the question of the amount of money owed by the UK to the EU after Brexit must be made to move talks forward.

"We see increased upside risks for the pound due to clear signs of progress being made toward a financial settlement that could result in transition and trade talks beginning in January. We will get a better sense of any progress that has been made when PM May meets with European Council President Donald Tusk at the EU summit in Sweden later today," says Derek Halpenny at MUFG.

According to Manfred Weber - the head of Europe’s centre-right MEPs in the European Parliament and a close ally of German Chancellor Angela Merkel - UK Prime Minister Theresa May is close to offering a deal on payments that would unlock Brexit negotiations.

Weber said he had received “positive messages” during a meeting in Downing Street mid-week.

Weber told reporters he had witnessed a substantial shift in the British approach which might now allow EU leaders to move on to the next stage of negotiations.

Following a meeting held with Theresa May, David Davis and Amber Rudd, Weber notes:

“I am one of the more sceptical partners from the European parliament side on Brexit negotiations and ongoing progress but I have to say that after my meetings today my main message is that I am more optimistic that there is progress; that there is the will to see progress.

“The message is that the will is there.

“That is the most important thing, because the perspective from a European point of view toward London was that in the last month or two there was not. After my meeting I have more certainty about the general direction and that is positive.”

For a currency that is so closely tied to political gyrations, this development is supportive.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.