5% Rise in US Dollar Forecast as Taylor Model Shows Federal Reserve Way Offside

- Written by: James Skinner

-

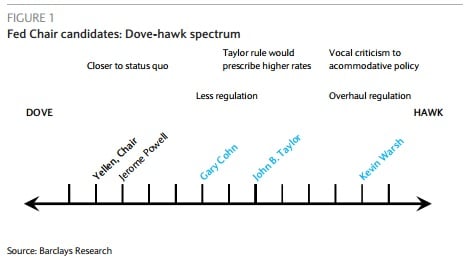

The Taylors Rule places the Fed considerably behind the curve on interest rates, which has led strategists to speculate the USD could rise substantially if the Stanford economist who gave his name to the rule gets the Fed's top job.

The US Dollar could rise as much as five per cent if Stanford University economist John Taylor becomes President Donald Trump’s nomination for Federal Reserve Chair when Janet Yellen’s term expires in February 2018, according to one strategist.

This is because precipitous falls in the US unemployment rate over recent months have left “Taylor Rule” economic models showing the Federal Reserve considerably behind the curve when it comes to interest rates.

Taylor’s prescriptive approach to setting monetary policy has led him to criticise the Fed for keeping the federal funds rate too low; "simple versions of his “rule” suggest that the rate should have been pushed back above the zero bound as early as 2011 or 2012," says John Higgins at Capital Economics.

This implies the Fed's basic interest rate settings should be substantially higher if the model were to be followed which in turn implies the Dollar - which largely tracks move in interest rates - should in turn be higher.

Furthermore, Higgins reckons Taylor has also disapproved of quantitative easing - a significant source of long-term Dollar weakness - and would probably prefer the Fed’s balance sheet reduction to be substantial.

“He is viewed as one of the most hawkish potential picks which could encourage a significantly stronger US Dollar,” says Lee Hardman, a currency analyst with MUFG in London. “We would not be surprised to see the US dollar strengthen initially by around 3% to 5% if John Taylor is confirmed as the next Fed Chair.”

Source: Hoover Institution

Such a move would be enough to push the Pound-to-Dollar rate back to 1.2500, just below its mid-point for the year to date.

Hardman’s proclamation comes as the Dollar continues to rise broadly in London after reports suggested John Taylor met with President Trump at the White House and that the meeting, or interview, was a success.

The Taylor Rule

Stanford economist, and Fed chair candidate, John Taylor is the man behind the “Taylor Rule” interest rate forecasting theory. This links interest rates with inflation and employment, mandating that when an economy reaches or exceeds full employment, interest rates must rise.

Taylor introduced the concept in a 1993 paper that prescribes a value for the federal funds rate - the short-term interest rate targeted by the Fed - based on the values of inflation and economic slack such as the output gap or unemployment gap.

Since 1993, alternative versions of Taylor's original equation have been used and called "simple (monetary) policy rules", "modified Taylor rules," or just "Taylor rules."

The rule describes how, for each one-percent increase in inflation, the central bank tends to raise the nominal interest rate by more than one percentage point.

“A potential shift in strategy towards a more rules based approach for setting policy would be seen as less supportive for financial markets and increase the likelihood of the Fed raising rates materially more in the coming years than is currently priced in,” says Hardman.

Policymakers already take employment and unemployment into account when setting interest rates and have been holding out for full employment, as well as wage growth, before really hammering on the breaks.

“Anyone armed with a Bloomberg terminal can type in TAYL GO and see where a Taylor rule estimate of appropriate rates is,” says Kit Juckes, a cross-asset strategist at Societe Generale.

What is significant for markets in the context of Taylor is that policymakers are currently afforded considerable discretion when determining where to set interest rates. But Taylor advocates a strict rules based approach, where rates are determined by outputs from economic models.

“On the basis of a 2% neutral real rate, and a 4% NAIRU, the Fed is a long way behind the curve, which may be reason enough to think that a Taylor Fed would be more hawkish,” says Juckes.

Estimates of exactly what the full employment rate is for the US can vary and almost all have trended lower over the years. However, US unemployment reached a sixteen year low of just 4.2% in September, taking it below its earlier level at the beginning and end of the previous Fed hiking cycle.

“Playing with the input to the rules doesn’t alter the two important facts – that Professor Taylor thinks a rules-based approach to monetary policy would have helped avoid the worst of the GFC, and that he is ‘hawkish’ by inclination,” says Juckes.

Kevin Warsh, a lawyer and economist who was previously a frontrunner for the Chair position, saw his odds of success fall in the wake of Taylor’s meeting with Trump.

Kevin Warsh. Source: Hoover Institution

The debate over Federal Reserve leadership comes ahead of February 2018, which marks the expiration of the incumbent Janet Yellen’s first four year term.

“Powell is now in first place (~35%) and it’s a three-way tie in second place between Warsh, Yellen and Taylor,” says Elsa Lignos, global head of foreign exchange strategy at RBC Capital Markets.

Withstanding the Tuesday discussion of Taylor, some have suggested the market’s intense focus on Trump’s nomination for Fed Chair is misplaced given that US rate decisions are determined by a committee of 16 voters.

This is while the open Vice Chair position and a number of other vacant seats on the FOMC can also be used to balance out the policy effect of a hawkish appointment to the chair position.

“The new Vice Chair could be a balancing force, and markets seem oblivious to the fact that Vice Chair Fischer will depart soon,” says Juan Prada, a strategist at Barclays. “We see the gyrations of the market on the likely hawkishness of the new Chair as exaggerated, as we will not have a complete picture without knowing the complete composition of the board, and the Vice Chair’s stance in particular."

That being said, it is far from certain that Yellen, who is a dove with a steady but cautious hand, will not be renominated by Donald Trump to continue her stewardship of the Federal Reserve.

Such a move would offer President Trump all of the trappings of the kind of “low rates” policymaker he is said to be looking for, while being a lower risk option for his administration politically.

A re nomination of Yellen would avoid politicisation of the Fed, which has implications for central bank independence, while ensuring continuity in the hands of a competent policy maker.

It would also mean the Fed remains under the stewardship of a Democrat nominee and so, should the central bank’s hands be found all over any future calamity, it might be difficult to lay responsibility entirely at the feet of Trump’s Republican administration.

For a more detailed overview of the different candidates in the race, as well as respective implications for monetary policy, see our report titled; Change at the Fed: What Each of the Candidates Could Mean for the US Dollar's Outlook.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.