Pound-to-Dollar Rate Predicted to Remain Above 1.30 on Market Positioning

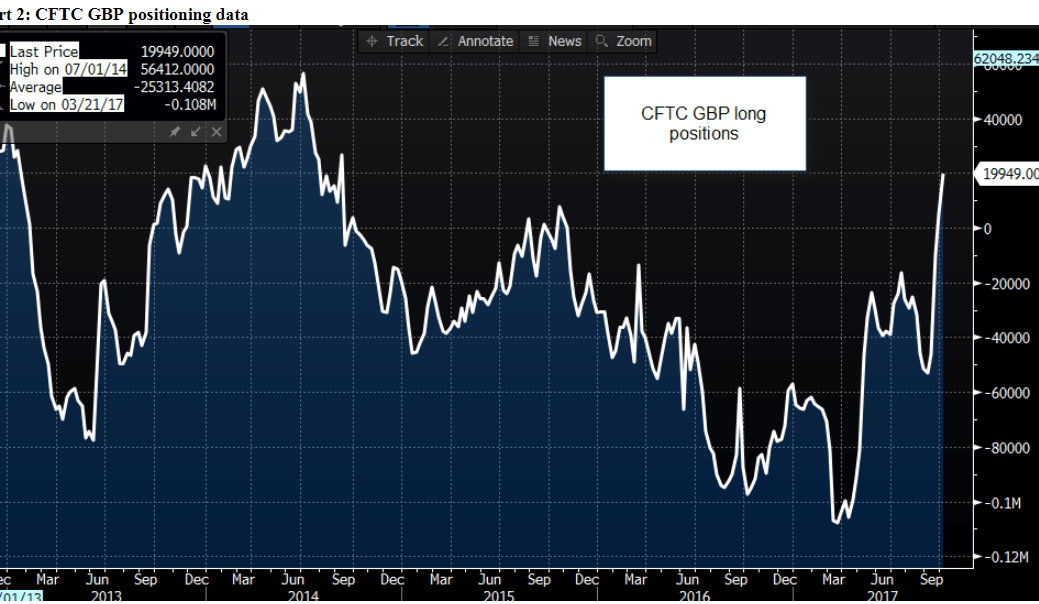

Data on the positions taken by currency traders gives a clue as to why the worst might have passed for the Pound.

Strong demand for Sterling on the currency futures market could prevent the Pound from suffering another significant bout of weakness suggests Kathleen Brooks, a market analyst with retail trading providers City Index.

Brooks contrasts the currency’s recent bout of weakness with data from the Commodity Futures Trading Commission (CFTC) which shows buying interest in futures, spearheaded hedge funds, turned a net positive last week for the first time since the EU referendum:

“Last week the Pound was the weakest performer in the G10. Interestingly, the market is still building up long positions in GBP, with long speculative positions at their highest level for 3 years,” says Brooks.

This tells us market participants are gearing up for a stronger Pound in coming months.

“While positioning data can be a contrarian indicator, considering how far GBP has dropped since the June 2016 EU referendum this data suggests that there could be a floor in GBP, which could limit another sub 1.30 decline like we saw last year,” adds the analyst.

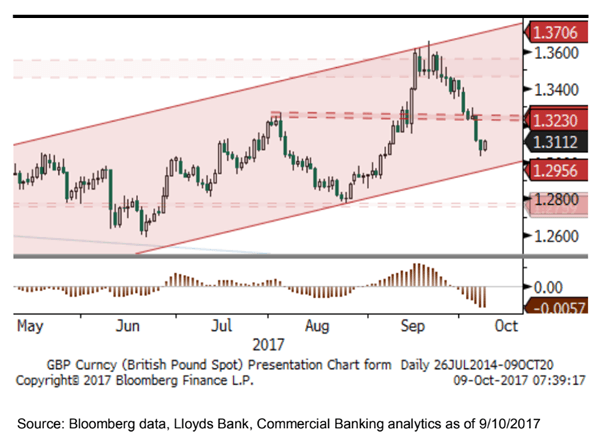

Brooks notes the sharp rebound from the 1.30 level to today’s 1.31 which shows there is a decent amount of buying interest around that level.

“This suggests that GBP/USD could be range bound between 1.30 and 1.36 for the foreseeable future,” says Brooks.

1.3110 is a key confirmatory level for Brooks, however, as it is the 61.8% Fibonacci retracement from the August-September rally, and needs to hold for the bullish case to remain.

The shift in favour of Sterling in CFTC data is reflected in other sources of data. Credit Agricole’s latest positioning data shows net buying of GBP has intensified of late and pushed their positioning index for the currency into positive territory for the first time since the Brexit-induced selloff.

Credit Agricole’s, Head of G10 FX Strategy, Valentin Marinov, says the move into positive territory on the futures market was suggestive of a market which was ignoring resurgent political risks “and instead prefer to focus on the shifting BoE policy outlook.”

The Bank of England in September shifted stance on their views concerning UK interest rates suggesting an interest rate rise might soon be necessary; a shift that caught markets by surprise.

Markets had expected the first rate rise from the Bank to come in 2019 but now believe a November rate rise likely. This has allowed the Pound-to-Dollar exchange rate to recover from sub-1.30 in early September to 1.36 in subsequent weeks.

While the Pound has faded somewhat, positioning data is telling us that damage might be limited.

Weekly data from the world’s largest foreign exchange dealer - Citi - shows that while speculators have recently cooled towards Sterling, those who need the Pound for commercial reasons are driving demand.

“Real Money investors continued to buy GBP last week, possibly on potential BoE hawkishness and better UK economic data surprises, bringing their four-week flow to levels only seen once since 2013!” notes Sukrita Chatterji at CitiFX in London.

‘Real money’ refers to that segment of the market buying Pounds for delivery, such as cross-border trade and reflects an increase in fundamental demand for the currency.

Citi’s data meanwhile shows leveraged investors - i.e. speculators - on the other hand, “remained wary of Sterling and flipped to net sellers late last week as GBP weakness resumed on speculation over Prime Minister May’s future after the Conservative Party Conference.”

This segment of the market is understandably more sentiment driven and can be considered to be ‘hot money’.

What does this tell us about the Pound's prospects going forward?

“This divergence brings the spread between Leveraged and Real Money four-week GBP flow to its largest since mid-2016, noting there is plenty of room for GBP upside if leveraged investors switch to buying as speculation over BoE hawkishness intensifies,” says Chatterji.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.