No Game-Changer for the US Dollar: Reactions to the Federal Reserve's September Update

- Written by: James Skinner

A December rate hike is a go, but Wednesday's cuts to FOMC projections for longer-term rates might weigh on the Dollar beyond the short term.

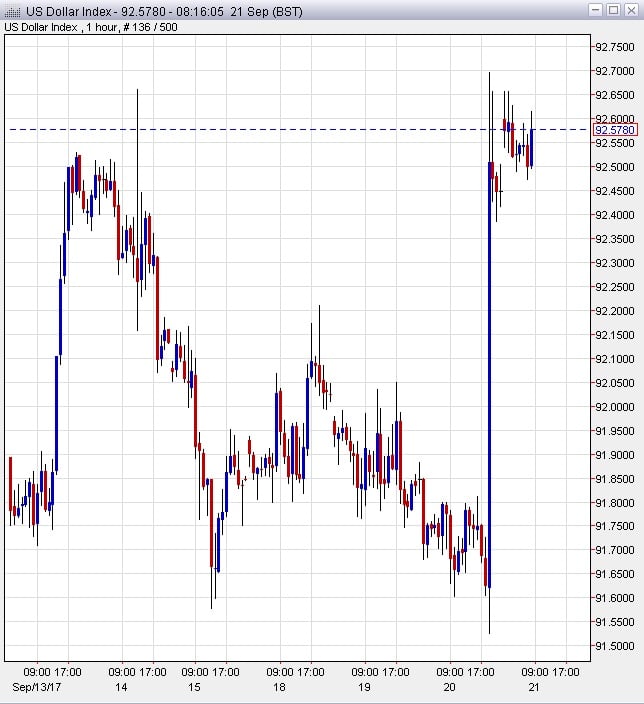

The US Dollar strengthened broadly overnight after the Federal Reserve set a course toward a December rate hike in its latest round of projections, but downgraded forecasts for inflation and longer term interest rates could weigh on the greenback further out.

As expected, the FOMC kept the Fed Funds rate unchanged at 1%-1.25% and paved the way to begin unwinding its balance sheet in October.

But it was policy maker projections of another interest rate hike in 2017 that really got markets moving as traders had begun to kick the idea of another rate hike down the road and into next year.

“We had suspected that the recent softness of core inflation would persuade officials to hold off on the next rate hike until next year,” says Andrew Hunter, a US economist at Capital Economics. “But, given these latest projections and the broadly unchanged language on inflation in today’s policy statement, officials are clearly still in a reasonably hawkish mood.”

The Dollar moved broadly higher on the event but the gains are hardly convincing. We would view the reaction representing more a sigh of relief rather than a bullish repricing of the Dollar.

US Dollar Index at hourly intervals. Source: Netdania.

"We could not find anything decisively hawkish (relative to expectations) that could justify the Dollar rally. In all likelihood some market participants may have been expecting a more cautious stance that did not materialize and responded by bidding the greenback higher as the probability of a rate hike in December has now risen," says Chiara Silvestre, Economist, at UniCredit Bank in Milan.

Rates Could Rise Faster in the Short Term

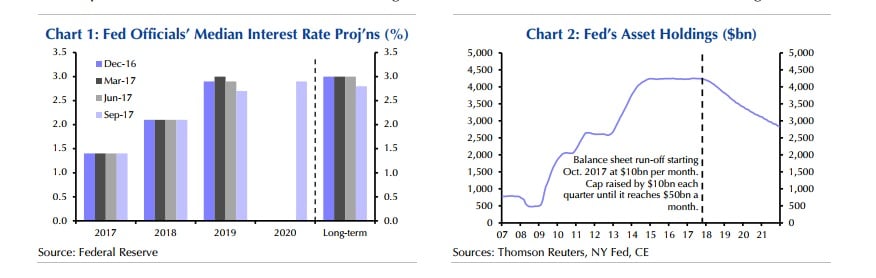

The FOMC continues to price in another three rate hikes in 2018, where markets had thought it might moderate the pace a bit, suggesting the US central bank has been undeterred by lacklustre inflation and muted wage growth - which Janet Yellen described as transitory at Wednesday’s press conference.

“Its expectation for a further 75bps in 2018 is one-quarter point above our view, but both we and Fed are more hawkish than markets had been going into this announcement,” says Avery Shenfeld, chief economist at CIBC Capital Markets.

In addition, Capital Economics’ Hunter forecasts a New Year pickup in core inflation, which is consumer price inflation minus energy and food cost inflation, as well as a further fall in the unemployment rate.

“Along with the possibility of a fiscal stimulus, we expect this to persuade the Fed to hike rates four times over 2018 as a whole, with rates ending next year at 2.25%-2.5%, – a slightly faster pace of tightening than officials currently project, “ says Hunter.

Source: Capital Economics Report.

But Rates Won't Rise As High In The Longer Term

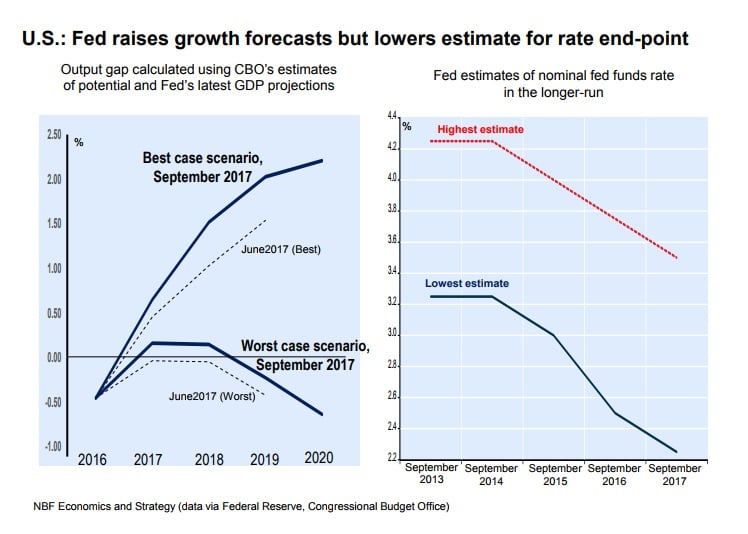

But, looking beyond this year and next, Federal Reserve officials have made some tweaks to their guidance on interest rates that might eventually begin to matter for the greenback.

They’ve cut their estimate of the longer term neutral interest rate, where monetary policy is neither expansionary nor contractionary, from 3% to just below 2.8%.

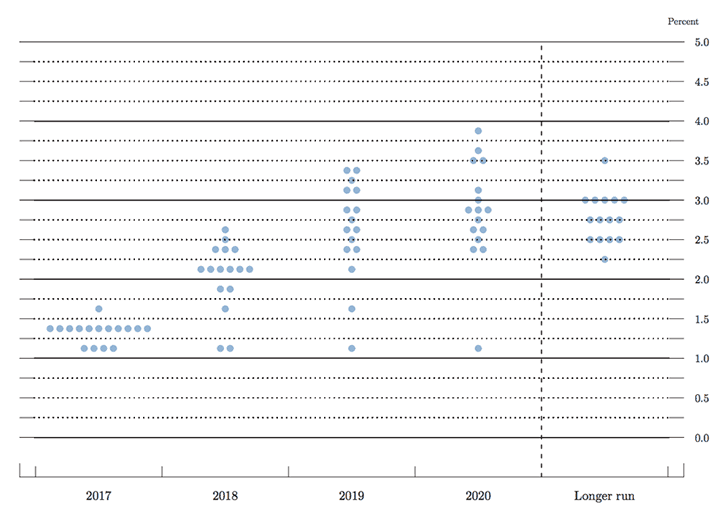

Above: The dot-plot graph. Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specifed calendar year or over the longer run. One participant did not submit longer-run projections for the federal funds rate.

FOMC voters kicked their estimate of the final hike they are predicting in the current cycle out into 2020, from 2019 at the last meeting.

This means policymakers expect rates to be lower over the longer term than they did just a few short months ago.

“The median forecast sticks to the view that there is one more hike this year, and three more next year, but the target for 2019 and beyond is slightly flatter, with a "long run" target of 2.75% (vs the prior 3%),” says Shenfeld.

Source: CIBC Capital Markets report.

Historic Balance Sheet Unwind Begins In October

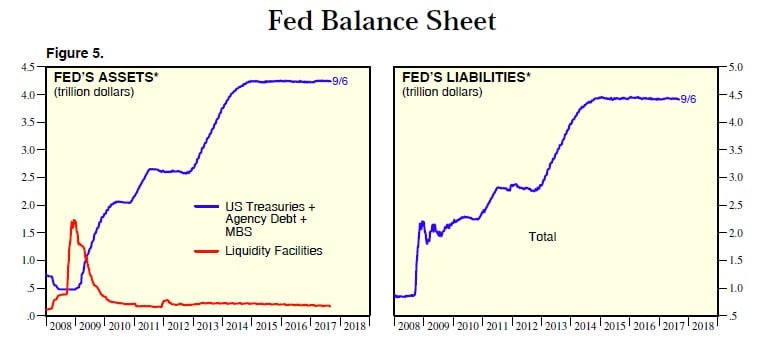

Separately, the Fed will begin to phase out the reinvestment of its government bond holdings from October, beginning by cutting $10 billion per month off of the amount it reinvests from matured bond holdings.

“Finally, the news that the Fed will begin winding down its $4.3tn crisis-era balance sheet next month, by phasing out the reinvestment of principal from maturing securities, was something of a historic moment,” says Hunter. “In truth, however, the move has been so well telegraphed and, at just $10bn per month initially, the pace of run-down will be so gradual that it is unlikely to have a major impact on the economy or financial markets.”

The FOMC’s decision marks the beginning of a great unwinding of the Federal Reserve balance sheet, which swelled from around $800 billion before the financial crisis of 2008, to nearly $5 trillion today - thanks largely to quantitative easing.

During the next twelve months the Fed will further reduce the amount of money it reinvests from bond maturities, till its monthly reinvestment has been cut by around $50 billion.

“Over the long run, we expect the balance sheet will reach a trough much larger than that prior to the crisis mainly because of currency demands, thereby limiting the amount of pressure on Treasury yields,” says Shenfeld at CIBC.

Federal Reserve Balance sheet. Source: Yardeni Research.

GBP/USD Takes a Knock, but this is no Game-Changer for the Dollar

The Pound-to-Dollar rate took a knock off the back of the FOMC announcement, falling by more than 100 points to trade back down below 1.3460, and was quoted at 1.3494 during early trading in London Thursday.

The move reflects the initial pro-USD knee-jerk reaction seen across the FX market.

Manuel Oliveri at Credit Agricole says he doubts that this is a game-changer event for the US Dollar, "since markets are unlikely to fully price the December hike for now and will not fully converge with the 2018 dot-plot not least because there is considerable uncertainty about Fed leadership next year."

Credit Agricole maintain the view that the USD would need to see either major fiscal stimulus or a broad acceleration in inflation to post a sustained rally.

The Euro-to-Dollar rate also took a pummelling, dropping 100 points, to trade back down below the 1.1900 handle for the first time since September’s ECB meeting.

UniCredit's Silvestre says the Fed's latest update, "does not change our fundamental stance. We still think EUR-USD corrections will remain contained and the area around 1.1850 should prove to be a strong support zone. We see no reason to change our constructive stance as nothing has changed in terms of relative fundamentals."