The US Federal Reserve Dominates Outlook for US Dollar - What to Watch For

The bar has been set very high for US Dollar gains in response to the Federal Reserve meeting on Wednesday, which forms the key event for the USD this week.

"In the absence of any convincing hawkish signal - such as a reference to another rate hike being 'appropriate soon' - we think the USD is likely to follow the historical pattern of moving lower in the aftermath of the FOMC meeting," says Viraj Patel, an analyst with ING Bank N.V. based in London.

A sequence of unexpected natural disasters, inconsequential inflation and deep-rooted personnel changes at the Fed itself are the main factors favouring a more cautious assessment.

Hurricane's Harvey and Irma have left a slew of destruction in the wake, all of which will impact on economic growth and will favour a cheaper borrowing climate to rebuild, encouraging the Fed to stand still on rates.

Then there are geopolitical jitters emanating from North Korea and the recent departure of deputy governor Fischer means the Fed could be in peril of having its 'head lopped off' when Janet Yellen's term also comes to an end in January 2018.

If Yellen leaves - and analysts think on balance she probably will - her replacement and what sort of policy strategy the new governor will follow, are further cause for increased uncertainty.

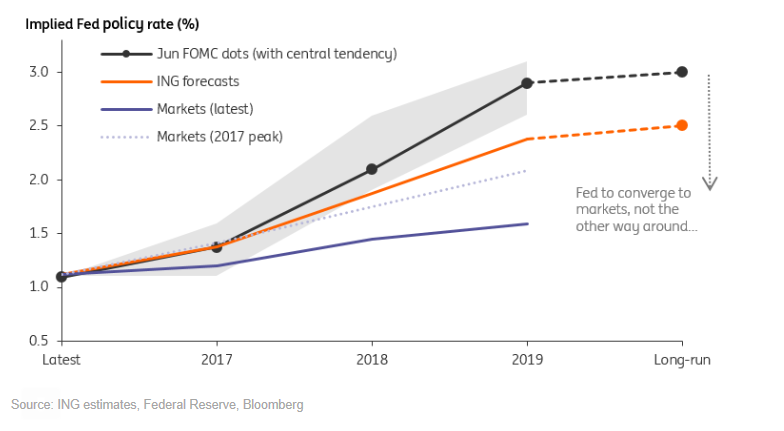

In such circumstances ING sees odds favouring a more cautious assessment and a slowing-down of the previous tightening cycle.

Patel even sees the ingrained expectations of one further interest rate rise in 2017 as in doubt.

This view is shared by markets which do not expect the Fed to raise short term rates this week, and increasingly it is seen as not hiking again this year.

However, policymakers have maintained expectations for a third hike to happen before the year is out.

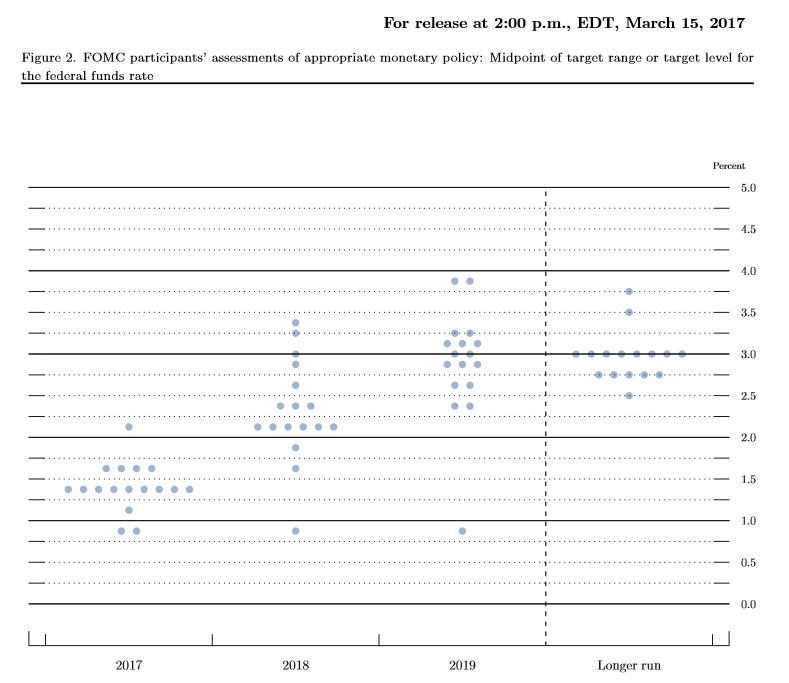

Referring to the Fed's projection of member's expectations of future interest rates, illustrated in a dot plot diagram on the Fed's website, where dots represent each of the 16 voting and non-voting Fed member's projections of future interest rates, he suggests the main clusters of dots - or median expectation - may drop.

Such an outcome would on the margin be seen as negative for the Dollar.

"While the median 2017 dot is still set to tentatively pencil in a December rate hike, we expect to see more members calling for a pause for the remainder of the year," says Patel.

There are also likely to be revisions to expectations in 2018 and beyond:

"More telling of a dovish shift would be if the 2018 dot also moves lower. Here we require five or more members to downgrade their views over future policy hikes – a scenario that cannot be ruled out given the softer US inflation dynamics," he added.

Clearly, if the 'dots' do move lower, it will negatively impact on the Dollar, which is highly correlated to Fed Fund rate expectations.

Balance Sheet Run-off

In June the Fed announced it was considering reducing the number of assets - amounting to circa 3.7 trillion - that it owns on its balance sheet.

These assets were bought up during and after the financial crisis in an effort to provide financial institutions with emergency liquidity but given recent improvements in the economy and fear of financial imbalances the Fed thinks it is time to let them go.

Currently, when assets mature the Fed is paid the principle from the maturing bond which it then uses to reinvest in new bonds, topping up its holdings, however, this is likely to be discontinued, so that the balance sheet can be reduced.

However, the process amounts to defacto tightening, and the Fed may decide to delay running-off its balance sheet just as it is will probably delay the pursuit of higher rates, according to Patel:

"While we do not expect US yields or the USD to move much on what would be a well-telegraphed balance sheet announcement this week, there is a non-trivial risk of the Fed delaying this process.

"One of the pre-conditions Chair Yellen had stipulated back in March was the need for solid underlying momentum in the US economy, and recent weather-related disruptions may give officials a reason to hold fire," he said.

The Appropriate Response to Looser Conditions

The Fed is not just split between 'doves' who want to keep conditions 'easy' and hawks who think they are too easy and interest rates need to be higher - there is also a difference in opinion on what constitutes the appropriate 'medicine' for the economy at its current juncture.

The classical view is that conditions are too easy, which has led to something of a bubble in risk assets prices, by which it is meant the stock market, and this is dangerous.

The medicine is higher rates, however, there is a view that this is not the right medicine.

"Though one member noted that easier financial conditions might warrant tighter monetary policy (the conventional wisdom), another floated the more avant-garde view that elevated risky asset prices were a response to markets adjusting to structurally lower neutral interest rates - a factor which the Fed cannot control," said Patel.

The 'neutral' rate is the appropriate rate for the level of inflation, which has moved structurally lower over time.

"This implies that in the absence of inflation, there may be little need for additional Fed rate hikes to tighten financial conditions," says Patel.

ING agree with this view and note how, "broader US financial conditions are now clearly becoming less responsive to adjustments in the short-term policy rate," ie the easier monetary conditions from low rates are not generating as much inflation as would normally be expected.

And adds, "This may well be the same conclusion that Yellen articulates in the press briefing this week, which on its own shouldn't prompt any major re-pricing of Fed policy expectations."