Buy GBP/USD say ING: Pound Sterling Oversold and a Softer Brexit Beckons

Analysts at ING Bank N.V. react to recent moves in foreign exchange markets in response to the UK General Election by Pound Sterling has been punished too severely.

The Conservative Party have lost their working majority in the lower house of the UK parliament which has opened the door to significant political uncertainty and the Pound has responded by falling.

However, with an eye on the next steps the currency might take is analyst Viraj Patel at ING, who says now could be the time to prepare for a recovery.

Patel tells clients that, “history may show that one of the lasting effects of the 2017 General Election hung parliament result was a paradigm-shifting change in the UK’s Brexit stance.”

Latest news reports suggest Theresa May will seek to govern a minority government with the support of Northern Ireland's DUP.

For Patel, the Pound Sterling’s outlook rests with the nature of the Brexit deal that will emerge over the next two years and recent shifts suggest the party's previous plans with regards to Brexit will have to be reconsidered.

“It may be way too early to conclude this with any certainty right now, but the loss of Conservative seats – and rise in Labour foothold – suggests that the dial within the UK parliament may tilt towards a ‘softer’ core Brexit view, with some ‘hard’ Brexit pushback,” says Patel.

ING believe “this subtle change makes long GBP positions look attractive as a lot of bad news seems to be priced into a heavily undervalued GBP.”

Analysts at the bank’s London branch believe that too much bad news is priced into GBP, with the currency now reflecting both (1) a short-term domestic political uncertainty premium and (2) medium-term ‘hard’ Brexit risk premium.

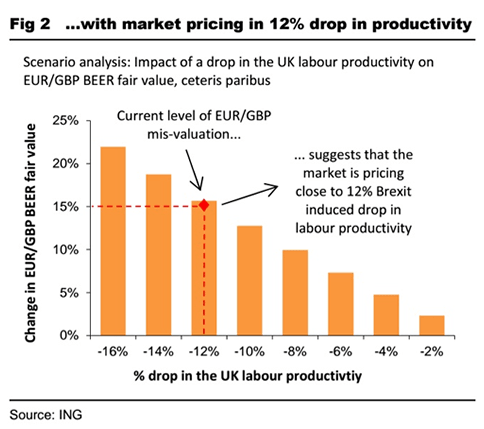

“GBP is undervalued by a significant 15% vs EUR. This is a meaningful undervaluation in both absolute and relative terms and will in our view serve as a cushion against any further pronounced GBP weakness,” says Patel.

Further analysis suggests the current EUR/GBP exchange rate overvaluation is equivalent to a 12% drop in UK labour productivity.

“This looks extreme and should limit GBP downside from here,” says Patel.

An Alternative to Hard Brexit

The UK election outcome raises a potential for an alternative to the hard Brexit which was what PM May was seemingly pushing for; particularly now that May has announced the Conservatives would be working with Northern Ireland's DUP.

We might assume that for Northern Ireland, close links with the Republic are key. This could well form a crux of negotiations.

"The loss of the Conservative seats has exposed vulnerability to the strategy PM May was pursuing and leaves her very vulnerable within her party. She now needs to accept a broader range of views within the party to secure a leadership," says Patel.

"In terms of hard Brexit, which GBP crosses seems to be pricing in, it would be difficult to push it through the UK Parliament given the very fragile (potential) Conservative-DUP collation. Hence, we see more room for re-pricing," adds the analyst.

Also note what is seen as aseemingly conciliatory tone struck by the EU leaders.

Chief negotiator Barnier made comments that negotiations will start only when UK is ready; this could also be seen as decreasing the odds of the worse-case for the UK and GBP.

How to bet on a Recovery in the Pound

ING say they prefer to go long GBP, not against the EUR, but against USD.

This is because they see EUR/USD strengthening going forward which should aid EUR/GBP higher.

Analysts target 1.35 in 6 months on the basis of (a) Hard Brexit being partly priced out of GBP (b) EUR/USD reaching 1.15 due to expectations of ECB QE tapering.