UK GBP/USD Rate this Week: UK Data Ahead, Trump Tax Policies in Focus

Pound Sterling struggles at the start of the new week with the currency opening lower right across the board.

The GBP/USD exchange rate is quoted at 1.2418 as it emerges the prospect of yet another destabilising referendum looms large on the horizon.

"The GBP slides this morning against all major currencies after the Times reports that UK Prime Minister Theresa May is preparing for Scotland to potentially call an independence referendum in March to coincide with triggering of Article 50. The referendum may be allowed but only after the UK leaves the EU," says Johnny Bo Jakobsen at Nordea Markets.

This is clearly an evolving story, but any Scottish referendum on the horizon is not going to play well for the Pound which will simply be racked by added uncertainty.

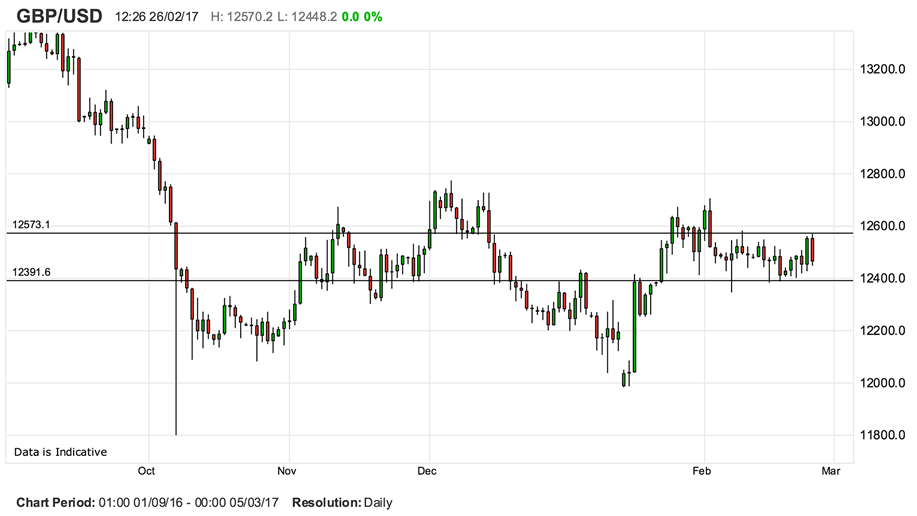

The Pound is still stuck right in the middle of the recent range it has traded against the US Dollar since the beginning of February.

The upper end of the range is around about the 1.2570 area and the lower limit at around 1.24.

To say that the exchange rate will continue to occupy this area as we enter the new month is the obvious conclusion we draw at this stage.

But, price action on February 23 and 24 was notable in that it suggests the market is itching to break out of this compressed range and it is such a breakout - to the top or bottom - that is an exciting prospect for the week ahead as it would immediately deliver multi-month lows or highs for the exchange rate.

Could GBP/USD pop this week?

We have some data due out of the UK this week that could encourage moves in the exchange rate as markets will be looking for confirmation on whether the softening in data seen so far in 2017 is becoming more entrenched.

It goes without saying that confirmation of such a trend will weigh havily on Sterling.

Various PMIs will help markets to gauge the tone of the manufacturing, construction and services sectors.

Manufacturing PMI is released on Wednesday 1 March at 09:30 AM GMT and markets are forecasting a reading of 55.5.

Construction PMI on Thursday is forecast at 52.4.

Services PMI on Friday is forecast at 54.2.

The services sector data is particularly important as it will give a good indication as to whether the trend of softer data seen in 2017 is extending.

If so then Sterling could struggle.

BUT the big trigger to a notable move in GBP/USD lies with the US side of the equation.

US Dollar Eyes Trump Tax Policies

Market attention is squarely focussed on Donald Trump’s address to Congress on Tuesday when it is expected he will deliver big news on taxes.

The ’reflation trade’ has been dominating financial markets with a significant impact on equities, bonds and FX as markets price in higher Government spending in the US which should drive higher levels of inflation.

This has been particularly beneficial for the US Dollar which has embarked on a notable rally since Trump’s November election win.

Any disappointments could hurt the USD notably, so we look for the announcement of big tax cuts.

However, it is the more controversial Border Adjustment Tax that markets will be interested in. This is a plan that sees Trump look to tax imports and subsidise exports, a cornerstone of his America First agenda.

Financial markets have been quite sanguine to any potential negative effects of Trump’s protectionist trade agenda thus far.

According to Bipan Rai at CIBC Bank, in the options markets the risk is firmly skewed towards volatilities popping higher and the USD rallying.

If Trump does introduce a Border Adjustment Tax analyst Andreas Rees at UniCredit Economics in Frankfurt reckons the US Dollar, “will probably get stronger indeed.”

“However, a permanently higher Greenback is unlikely. A border tax is pushing up import prices and creating stronger inflationary pressure. Financial markets could initially be pricing in swifter and stronger rate hikes by the Federal Reserve which would lift the Greenback,” says Rees.

After the US Dollar initially getting stronger, a policy move into protectionist territory might hurt the Greenback in the longer term argues Rees, as it undermines confidence in US policymakers and hurts domestic growth and employment.

Indeed, in her recent testimony before Congress, US Fed Chair Yellen also raised some question marks behind a permanently stronger US Dollar:

“The problem is there’s great uncertainty about how in reality markets would really respond to these changes. A strong set of assumptions is needed to believe that markets would fully offset those changes. It’s very difficult to know just what would happen.”

If the markets get the sense that this week’s policy announcements will see the Fed step back from raising interest rates then we could well see a notable drop in the US Dollar and GBP/USD could finally break into higher levels.