Time to Bet on a Pound / Dollar Advance as Real Wages are Rising Faster in the UK than in the US

In a contrast to the general view that the US Dollar is going to continue rising and that the Pound is ultimately doomed, Nordea Market’s Aurelijia Augulyte retains her bullish stance on the Pound to Dollar exchange rate (GBP/USD).

The analyst thinks GBP/USD will continue to rise because, “real wage growth is still better in the UK than in the US.”

This is due to inflation rising more rapidly in the US than in the UK and wages not keeping up.

This view stands out as there is a general assumption in the UK press that increasing inflation is a uniquely British phenomenon largely owing to the fall in the value of Sterling following the Brexit vote.

And, it is quite sexy for newsrooms to spin a Brexit-inflation story. After all, the fall in the Pound has been one of the only palpable financial impact of Brexit to date.

Of course it would be wrong to pretend the fall in the Pound has not put upward pressure on prices in the UK as well as deny the effects are likely to last for months yet.

But, it would also be incorrect to isolate UK inflation from a global trend of rising prices - and this is important when comparing currencies.

In fact, if we look at the data it makes perfect sense.

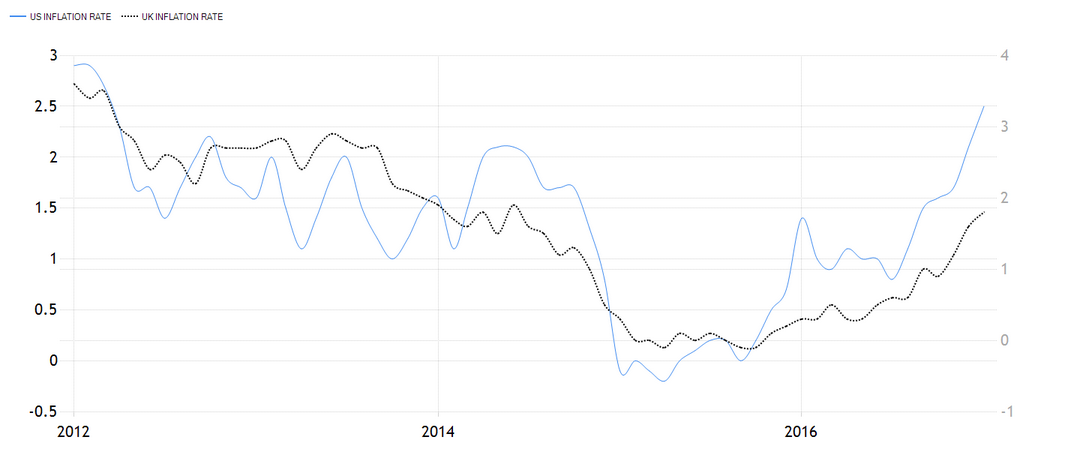

Below is gross inflation in the UK and US – witness how both are rising but US inflation is running away.

Now look at wages in the two countries.

Here we see that in the US wages are not rising as fast as in the UK, despite the supposedly lacklustre reading in UK earnings released last week.

This argues that the average consumer in the US is going to experience a greater shortfall in real income taking into the account the effects of inflation.

This is likely to lead to the average American tightening their belts which will lead to a slowdown in consumer spending, the major driving force of the US economy.

The same has been predicted in the UK but to a lesser extent.

Chart View

Augulyte also points to indications on the charts which she claims supports her bullish GBP/USD view.

This is that the pair is finding support at the 50-day MA, which it is struggling to break below.

Long-term averages, such as the 50-day can act as dynamic areas of support and resistance providing a barrier to trending markets, and on GBP/USD it is keeping the exchange rate from falling below the 1.2420 level.

US Surprise Index at Five-Year Highs

The Data Surprise Index measures the number of economic data releases that surprise to the upside against those which disappoint (in relation to consensus forecasts).

Augulyte notes how the Surprise Index is at 5-year highs in the US and whilst she says this is a strong reason to expect the Dollar to remain ‘in the driving seat’ it is also a sign the index could be peaking and data might start to turn lower from here and begin to disappoint.

“Where should the negative surprises come from? While manufacturing/firms is/are performing, consumers are challenged globally by higher inflation. We have seen that in the UK data last week. We haven’t seen that in the US data yet – but, looking at the real wage growth, a slowdown is imminent,” said Augulyte.