Pound to Dollar Week Ahead: Still Pointed Lower

- Written by: Gary Howes

Image: Photo by Anthony Quintano. Licensing: CC 2.0. Sourced: Flickr.

Pound Sterling looks set to remain on the defensive against the Dollar, and we could see sub-1.30 levels for GBP/USD again in the coming five days.

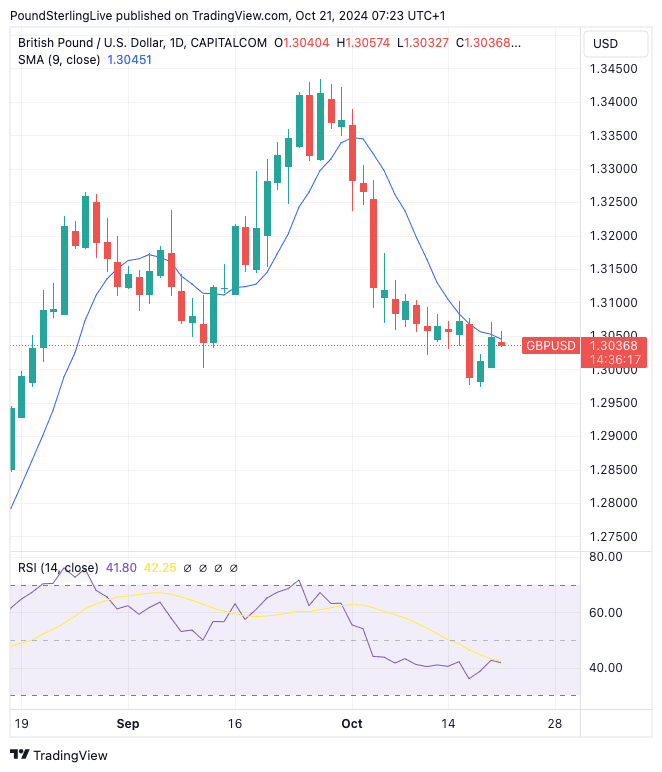

Our Week Ahead Forecast model says the downside is preferred in the near term, with last week's (Thursday/Friday) rebound running out of steam at the nine-day simple moving average.

This indicator is pointed lower, and if we look at the daily chart, we can see gains have been sold when meeting the line:

Should the exchange rate break above the nine-day MA, then the prospect of a more concrete stabilisation above 1.3050 should become a prospect to consider.

Momentum is nevertheless soft, with the RSI indicator at 40 and pointing lower, underscoring a near-term preference for weakness.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

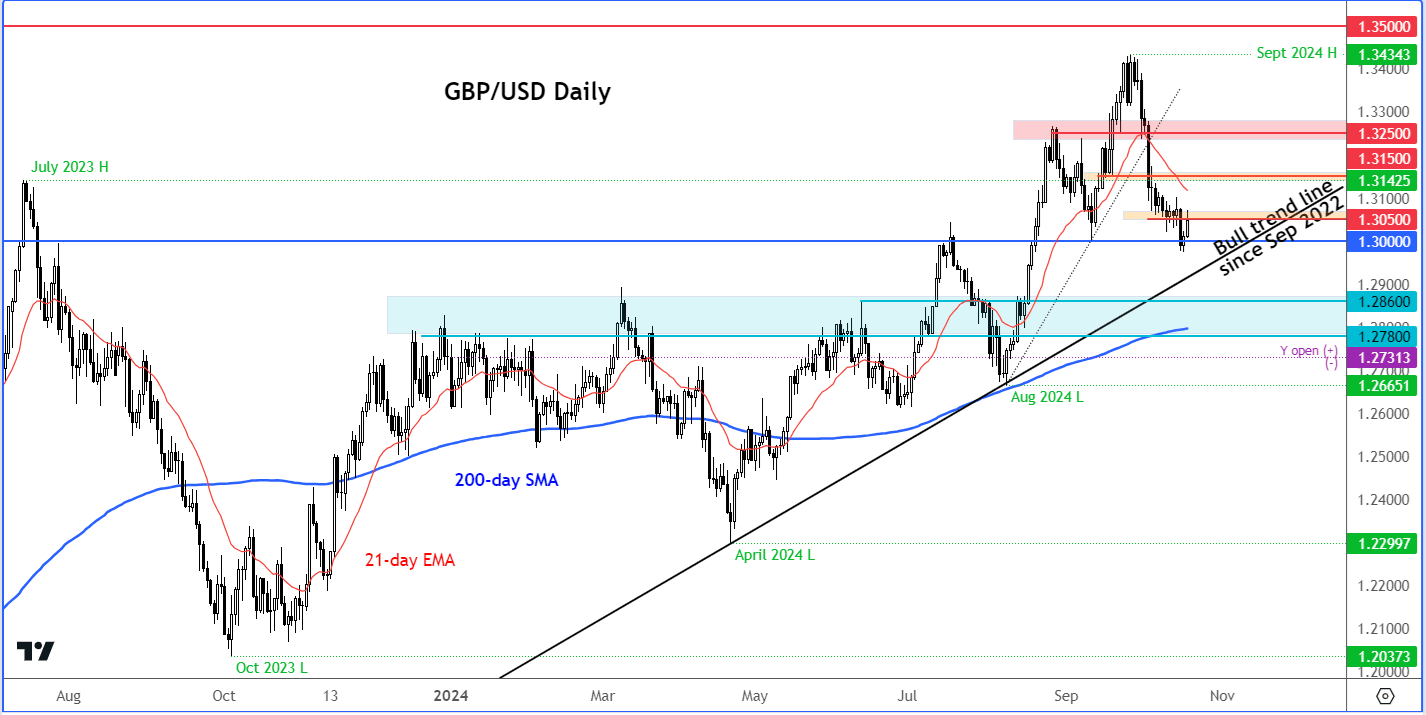

Fawad Razaqzada, an analyst at City Index, says GBP/USD has arrived at an interesting area near 1.3050 to 1.3080, where it had previously encountered selling pressure.

"Can it resume lower from here? The next target below the 1.30 handle is around 1.2870, which marks the breakout point from mid-August. Below that, 1.2800 becomes the next significant level, where the 200-day moving average also comes into play," he says.

Razaqzada says the GBP/USD's broader trend remains bearish, and the U.S. dollar is likely to remain supported ahead of the upcoming US presidential election.

"With Donald Trump gaining ground in the polls, markets are beginning to factor in a possible win, which could keep the greenback supported," he explains.

Image courtesy of City Index.

There are no tier-one data releases due from either the UK or the U.S. this week, leaving the market to focus on next week's bumper event risk.

The U.S. election (November 4) and non-farm employment data from the U.S. (October 31) will keep markets on edge. And, a nervous market is one that tends to favour the USD by default.

In the UK, we will receive PMI survey data for October, which could disappoint as it will cover a period of growing concern ahead of next week's UK budget.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

A softer reading (consensus expects the services PMI to read at 52.2) would potentially deal a setback to Pound Sterling ahead of the weekend.

But it is speeches from Bank of England Governor Andrew Bailey and fellow Monetary Policy Committee (MPC) members that are potentially of greater market interest.

The risk is that Bailey (he speaks on Tuesday) sees signs in the recent data that would allow for a quickening in the pace that the Bank cuts interest rates.

"Market participants would be looking for any indications that there is now growing support at the MPC for more aggressive easing ahead. The GBP could remain vulnerable in the very near term as a result even though we recognise that some negatives are in the price of the currency and it no longer looks as overbought or overvalued as before," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

Last week's inflation figures roundly undershot expectations, which could allow the MPC to cut in November and then again in December.

A November cut is fully priced by the market and wouldn't offer the Pound any troubles, but December is only priced at about 50/50 odds.

If expectations for December rise towards 100% then the Pound can come under pressure.