Pound to Dollar Rate Week Ahead Forecast: The Next Leg Higher

- Written by: Gary Howes

Image © Federal Reserve

The Pound to Dollar exchange rate could test the 2024 high at 1.3250 if the Federal Reserve cuts interest rates by 50 basis points this week.

This is a significant week for global financial markets as the Federal Reserve will finally commence its interest rate cutting cycle, which is anticipated to boost the global economic growth impulse and weigh on the USD more broadly.

The Pound received a boost against the Dollar last week on apparent leaks from the Federal Reserve that gave a strong hint that it would commence with a decisive 50 basis point interest rate cut instead of a vanilla 25bp move.

The leaks came via a number of financial news outlets, the most prominent coming from a journalist at the Wall Street Journal who is known to have close links with policymakers.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"One might think Fed officials wouldn’t push leaks suggesting 50bps if they felt market pricing of 25bps (which the market had converged with post CPI), matched the FOMC’s assumptions," says Sam Hill, Head of Market Insights at Lloyds Bank.

He explains that the Fed might have preferred a modicum of space in pricing to reflect variances in the debate. "But to actively encourage the market to add back bets for more (via comments from ex-staffers and the WSJ’s Nick Timiraos), only to then deliver less, could call into question the credibility of the “quiet period” communications process."

The improved odds for a 50bp cut triggered a weaker U.S. Dollar and this snapped the Pound-Dollar exchange rate's September decline.

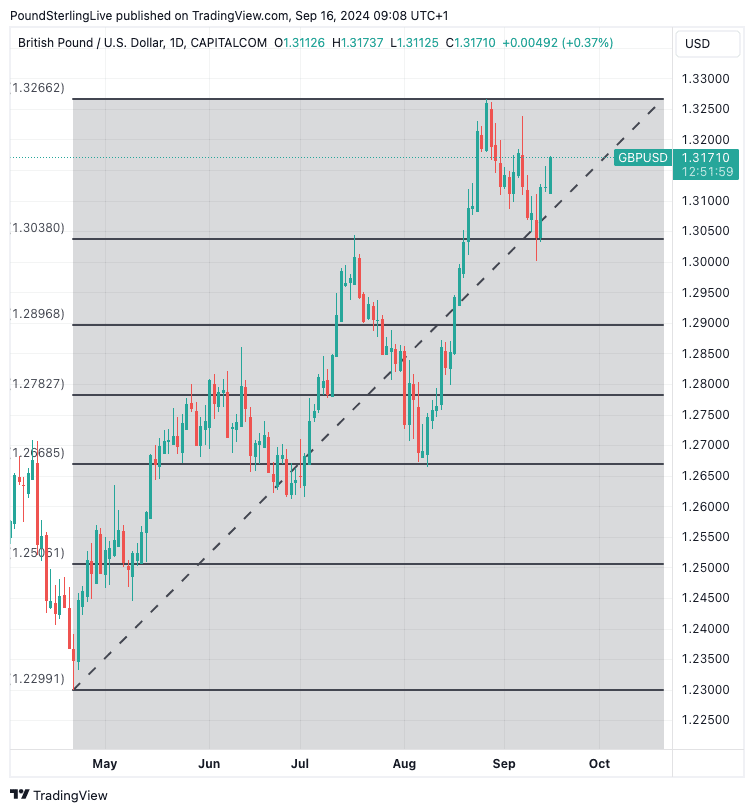

From a technical perspective, the pullback was needed as the exchange rate rose at breakneck speed in August, leaving it overbought from a technical basis.

It is interesting to note that the pullback kissed the 23.6% Fibonacci retracement level of the current medium-term uptrend, which gives us a strong technical support level to consider for the coming days in the event that the Fed rumours prove to be unfounded and they opt to go with a smaller 25bp cut.

The pullback from 1.3250 to 1.30 (last week's low) unwinds previous overbought conditions, flushes some GBP 'longs' from the setup, and poises the exchange rate for fresh gains in the coming days.

As always, our Week Ahead Forecast model is based on conservativism, but we think the 1.3250 high is back on the cards in a one- to two-week timeframe, based on an assumption the Fed cuts by 50bp.

However, fresh multi-year highs are now a distinct possibility as the broader U.S. Dollar decline evolves in sympathy with the commencement of the Fed's rate cutting cycle.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

It's a busy week in the UK, too, with Wednesday's inflation report and Thursday's Bank of England decision offering some domestic flavour.

Core CPI inflation is expected by the consensus to have risen from 0.0% to 0.4% month-on-month, taking the annual rate from 3.3% to 3.5%. Headline CPI is forecast to have jumped from -0.4% m/m to 0.3%, while the annual rate is expected to have remained at 2.2.%.

Any undershoot in the data would weigh on the Pound. But, survey data continues to show a resilient economy and there are no signs of massive disinflation taking hold. The Bank of England and institutional economists think inflation will inch up over the remainder of 2024, and this week's data should confirm this.

The Bank of England will acknowledge these inflation dynamics on Thursday by keeping interest rates unchanged at 5.0% and communicating that it will continue to watch the data when deciding on future interest rate cuts.

Because there is no Monetary Policy Report or press conference this week, markets will instead keep a close eye on the minutes from the meeting and the vote composition of the Monetary Policy Committee.

"The focus could be on the voting pattern among committee members. We are bracing for either an 8-1 or 7-2 vote, with ultra-dove Swati Dhingra to potentially be joined by Dave Ramsden in opting for an immediate rate reduction," says Matthew Ryan, Head of Market Strategy at Ebury.

"A closer vote, whereby we see more of a balance between the hawks and the doves, could trigger a sell-off in sterling, as markets ramp up bets in favour of cuts at a pace more frequent than one per quarter," explains Ryan.

The base case assumption amongst economists is that the vote will land at either 8-1 or 7-2, which, if correct, would underpin our bullish stance on GBP/USD.