GBP/USD Rate Hits 1.30

- Written by: Sam Coventry

Image © Adobe Images

Pound Sterling reached a key level against the U.S. Dollar amidst improved global investor sentiment.

The Pound to Dollar exchange rate quoted a new daily high of 1.3012 on Tuesday amidst an ongoing global stock market recovery centred on rising expectations of U.S. Federal Reserve rate cuts that pushed the broader USD to seven-month lows.

"The dollar remains on the back foot as calm has been restored quickly in financial markets," says Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Pound-Dollar is particularly sensitive to global investor sentiment, tending to fall when markets are in a 'risk off' mode and rise when investors' animal spirits are running high.

According to Goltermann, last week's U.S. economic data offered renewed support for the "soft landing" scenario, whereby the economy avoids a major and protracted slowdown, aided by falling inflation and lower central bank interest rates.

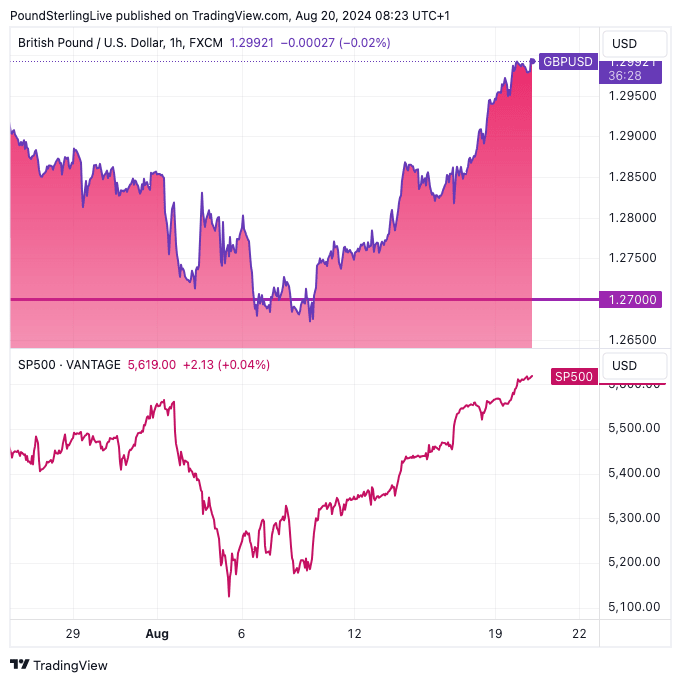

Above: GBP/USD at one-hour intervals (top) and the S&P 500 stock index.

"Sterling continues to benefit from the US dollar’s bearish outlook, particularly given its robust performance this year. GBP is currently up approximately 2.0% year-to-date against the Greenback, making it the biggest winner among the G10 currencies," says Ruta Prieskienyte, Lead FX Strategist at Convera.

The near-term calendar risk for the Pound-Dollar is the Kansas City Federal Reserve's annual Jackson Hole conference, where Chair Powell will deliver the keynote speech on Friday.

"Our sense is that while he may take a dim view of recent speculation of a 50bp rate cut in September, the overall message is likely to reassure market participants looking for confirmation that policy rate cuts are now imminent. As such, the greenback may well remain under pressure in the near term, although given the extent to which Fed easing is already discounted, we doubt there is that much further dollar weakness in store," says Goltermann.

If this assessment is correct, the Pound's rally against the Dollar could soon run into resistance near the 2024 highs close to 1.3042.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The more benign market backdrop will be a key determinant in future Pound Sterling performance, ensuring any pullbacks are likely to be shallow.

"If the newfound calm holds, the carry trade may yet make a reappearance," says Goltermann.

Crucially, for the Pound, the return of carry would be supportive, given analysts think this is a key driver behind 2024's outperformance. Carry is where investors borrow in a low interest rate currency to invest in higher interest rate bearing assets, such as UK bonds. This creates flows that support Sterling.

Karl Schamotta, Chief Market Strategist at Corpay, says U.S. bond yields are softer and the dollar is retreating as traders bet Powell will acknowledge an ongoing shift in the balance of risks facing the U.S. economy, suggesting that restrictive policy settings are no longer appropriate, and opening the door to an imminent easing decision.

"The euro, pound, and Chinese yuan are all inching higher," says Schamotta.

However, he doesn't think Jackson Hole will be the catalyst to the next leg higher in the rally.

"Chair Powell is unlikely to put the central bank on a more aggressive easing trajectory without sustained evidence of a rollover in growth and employment, and investors may find themselves disappointed with the substance of his remarks," he explains.