GBP/USD Rate Week Ahead Forecast: "Problem For France is a Problem for GBP"

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate faces three key tests in the coming week: French political risk, UK inflation (Wednesday) and the Bank of England decision (Thursday).

European risk sentiment deteriorated last week amidst a spike in French bond yields that was due to rising political uncertainties and fears for the outlook of the country's growing debt burden.

This helped the Pound rise to fresh 22-month highs against the Euro, but losses were registered against the safe-haven U.S. Dollar. "A problem for Europe is a problem for GBP," says Kristina Clifton, an analyst at Commonwealth Bank.

Markets are relatively calm on Monday, suggesting that much of the bad news regarding France is 'in the price', and the Euro could correct some of its recent losses over the coming days. This can help Pound-Dollar recover some of last week's losses.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

That said, Pound Sterling has fallen for two consecutive weeks against the Dollar and the short-term technical setup is looking a little dour.

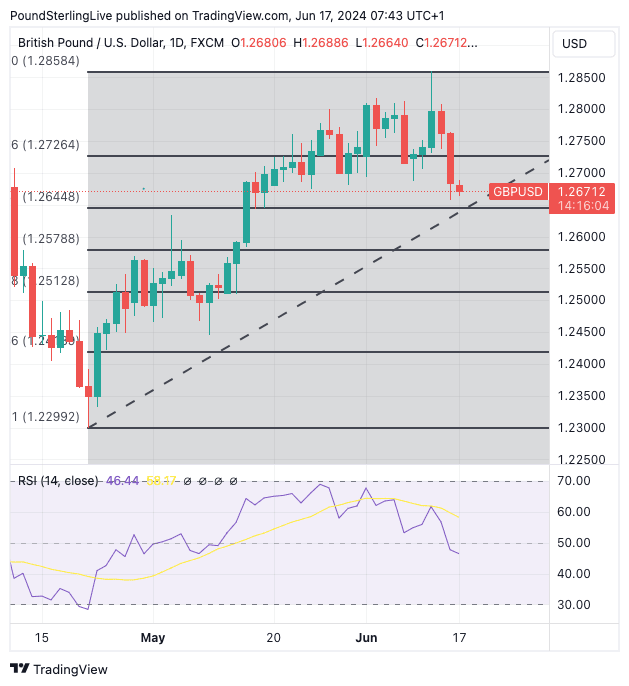

The Relative Strength Index (RSI) (in the lower panel in the chart) is at 46 and pointing lower, confirming short-term momentum is to the downside. We also note GBP/USD sliced through the 21-day moving average on Friday, confirming the near-term trend could be lower.

We think Pound-Dollar can fall to the 38.2% Fibonacci retracement of the April to June rally at 1.2644, this is also approximately where the 100-day moving average is coming in, which can fortify support:

Above: GBP/USD at daily intervals. Track GBP/USD with your own alerts, find out more here.

For now, weakness can be shallow and limited to the coming days, particularly if the global equity market bull run can be reestablished and if French-inspired risk is contained.

Ultimately, we look for a retest of the 1.2850 high in the coming weeks as the global backdrop remains constructive amidst expectations for a potential Federal Reserve interest rate cut in the Autumn.

Should this week's inflation data beat expectations and the Bank of England express caution about raising interest rates, Pound-Dollar can recover to 1.2750 ahead of the weekend.

"My prediction for next week’s CPI inflation figures. Headline 2.3% (unchanged). Services inflation 6% (+0.1). Goods inflation -1% (-0.2). Core inflation 3.8% (-0.1%). Not enough change to prompt a rate cut from MPC," says Andrew Sentance, an economist and former member of the Bank of England's MPC.

In May, Sentance correctly predicted that April's inflation reading would overshoot expectations, and if he is again correct, these upside surprises will likely boost the pound.

The key figure to watch on Wednesday is the services inflation print, as this is running well ahead of levels consistent with a durable fall in UK headline inflation to 2.0%.

The Bank of England and other economists expect a steady pickup in inflation over the remainder of the year owing to elevated services inflation levels. Another above-consensus reading would raise questions about just how fast the Bank of England can cut interest rates.

There are sizeable downside risks for the Pound this week if inflation comes in softer and the Bank of England is inclined to signal an August rate cut. This is because the market currently sees less than a 50% chance of an August cut, meaning there is scope for repricing in a GBP-negative direction.

Pound-Dollar will likely fall below 1.2644 if this occurs.

"The pound may lose some of its recent momentum if UK services inflation comes in cooler than expected next Wednesday, as it would raise the probability of a BoE cut in August and bring rates differentials back to the fore," says George Vessey, Lead FX Strategist at Convera.