GBP/USD Week Ahead Forecast: Scope for a Rebound

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate is forecast to recover recent losses in the coming week, with focus falling on UK PMI data and U.S. PCE inflation numbers.

Pound Sterling has fallen 2.30% against the Dollar in just eight trading days, which is a relatively rapid movement that leaves GBP/USD approaching oversold conditions. We anticipate these oversold conditions will unwind in the short term.

The lower panel in the below daily chart shows the RSI index is approaching oversold conditions at near 30, and we would look for some mean reversion in this indicator, taking the Pound-Dollar exchange rate higher.

Above: GBP/USD at daily intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

"Firm support for the GBP around 1.2410 this week and gains through the 1.2472 point should be paving the way for a bit more technical strength in the pound in the short run (towards 1.2540/50). But Cable is struggling to push higher, even with the support of a correction in short-term RSI signals from oversold levels," says Shaun Osborne, Chief FX Strategist at Scotiabank.

For now, rebounds are likely to be relatively short-lived, so the call is strictly one that covers a matter of days. The prospect of further declines in the exchange rate remain elevated, with it residing below its 200-day moving average. Only once Pound-Dollar breaks back above the 200-day MA, currently at 1.2572, would we call an uptrend. We are a long way off such a development as it will take a run of soft U.S. data to flip FX market fortunes.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Pound can rebound against the Dollar in the coming week if U.S. economic growth figures, due for release Thursday, undershoot the consensus expectation for an annualised Q1 growth rate of 2.3%.

A hot reading will only exacerbate the Dollar rally, but given the scale of recent gains, we reckon the bigger FX market movement would follow a disappointing figure.

Image: UniCredit.

The GDP print will likely offer a short-lived impact on FX markets. Instead, the highlight of the Dollar's week is Friday's PCE inflation print.

Economists are fond of pointing out that this is the Federal Reserve's preferred inflation, although evidence from 2024 suggests the Fed is firmly fixating on the hot increases seen in the headline CPI inflation rate.

Nevertheless, PCE numbers could have a market impact on any deviation from the 0.3% month-on-month growth the market expects. Again, we would expect the bigger FX market reaction to follow an undershoot in the figures as this would offer markets the cover to book profit on recent USD strength.

Image: UniCredit.

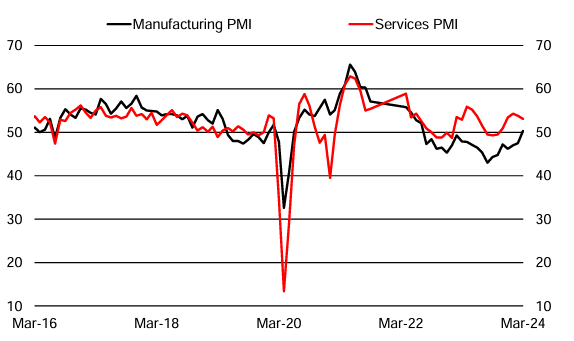

The Pound could prove volatile on Tuesday with the release of the PMI survey for April, the most timely of the major economic data releases that will give a steer as to how the economy started the first quarter.

The number to watch is the services PMI, where consensus looks for a reading of 53. Anything below this could see the recent sombre tone in Pound Sterling extend.

"The flash services PMI likely eased to 52.5 in April. The pick-up in 1Q24, which was presumably related to the improvement in real incomes, is likely to prove short-lived as the labour market is now clearly weakening," says an economic preview note from UniCredit.