GBP/USD Week Ahead Forecast: Trending to 1.30?

- Written by: Gary Howes

- GBP/USD breaks fresh ground

- Technical outlook now constructive

- U.S. inflation, UK wages in focus this week

- Stock market gains also provide a tailwind

Image © Adobe Images

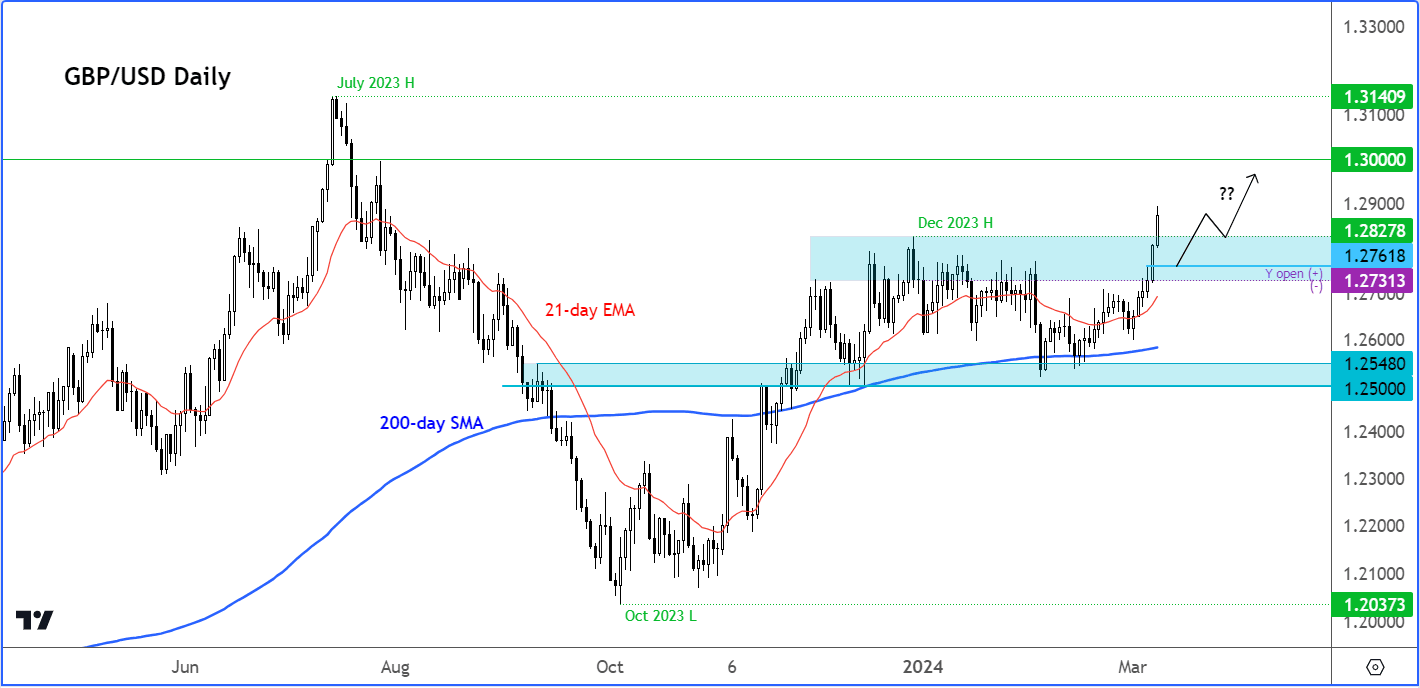

Pound Sterling could hit fresh multi-month highs against the Dollar this week, underpinned by positive technicals. However, any undershoot in UK wage data - or overshoot U.S. inflation data - could prompt a sharp pullback.

Last Friday saw the Pound to Dollar exchange rate extend a run of gains for a sixth day to hit a fresh 2024 high near 1.2850, reaching its best level since July 2023.

Gains are largely a function of the broader pullback in the U.S. Dollar that follow a series of softer-than-forecast U.S. economic releases, culminating in Friday's soft wage figures that shored up bets the Federal Reserve would be in a position to cut interest rates in June.

The sizeable 0.45% daily gain for GBP/USD underscores an increasingly positive technical setup and "the path of least resistance is clearly to the upside," says Fawad Razaqzada, an analyst at City Index.

Above image courtesy of City Index. Track GBP and USD with your own custom rate alerts. Set Up Here

"We will be looking for dip-buyers to step in on any short-term pullbacks to former resistance levels. These levels include 1.2828, the December high, followed by 1.2800 round handle and 1.2760, a previous resistance level," says Razaqzada.

On the upside, the City Index analyst says there are no immediate reference points until the July high of 1.3140.

"Ahead of this level lies the psychologically important 1.30 handle, which is my main upside objective," he adds.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The British Pound is 2024's best-performing G10 currency amidst improved sentiment towards the UK economy, which is widely expected to have exited an H2 2023 recession in light of a widespread improvement in UK economic survey data.

"Dare I say it, the pound’s rally is also a sign of confidence in the UK, after a fairly dismal few years," says Kathleen Brooks, an analyst at XTB.

Above: Last week Bank of America recommended buying GBP/USD. Read more here.

Markets also see the Bank of England potentially cutting interest rates after the Federal Reserve and European Central Bank, which underpins UK bond yields relative to elsewhere, driving demand for Pound Sterling.

The risk is that this narrative is questioned by incoming data encouraging the market to raise bets for a June rate cut, prompting an unwind of recent outperformance. Even a slight miss could offer a decent unwind from recent gains.

With this in mind, all eyes will fall on Tuesday's UK wage data, where any undershoot would prompt a potentially notable pullback in Pound-Dollar and other Pound exchange rates.

Above: UK wage is expected to slow further. Image: UniCredit.

The market looks for a 5.7% increase for January (when bonuses are included) and a 6.2% increase when bonuses are excluded.

Keep an eye on Wednesday's release of monthly GDP figures. For January, a figure of 0.2% month-on-month is expected.

Any above-consensus print in either the GDP or wage figures could help the Pound on its journey higher.

"The quality of the data will likely inform the MPC decision as its members debate the appropriateness of the current policy stance. With that in mind, evidence that the UK economy rebounded at the start of 2024 while the UK labour market remained tight could be seen as delaying any decision to lower rates from here and thus could help boost the rate appeal of the GBP," says Valentin Marinov, head of FX research at Crédit Agricole.

Above: UK GDP is expected to have risen in January. Image: UniCredit.

The key events for the Dollar in the coming week will be the release of February inflation figures on Tuesday and retail sales on Thursday.

The market looks for a CPI inflation reading of 0.4% month-on-month and 3.1% year-on-year. The core CPI figure could be more important, with 0.3% m/m and 3.7% y/y anticipated.

Given the solid sell-off in the U.S. Dollar of recent days, the bigger surprise would come on an above-consensus print, as this would spoil the narrative that all signs now point to a June rate cut.

As such, expect the bigger USD reaction to be to the upside on any beat (Pound-Dollar downside). Any undershoot would allow the recent trend of depreciation to extend.

Above: U.S. inflation's descent has slowed of late. Image: UniCredit.

"Investors would be particularly attentive to any upside surprises from the inflation data that could prop up the USD ahead of the FOMC meeting on 20 March. Indeed, we could see the US rates markets reassessing their Fed outlook in response to a stronger inflation print yet again, boosting the USD's rate appeal," says Marinov.

Thursday's retail sales are anticipated to read at 0.5% m/m in February, and again, we would imagine the bigger USD response would be to the upside on any above-consensus read.

Above: U.S. retail sales are tipped to rebound. Image: UniCredit.

The Dollar enters a new week amidst renewed confidence that the Fed will cut rates in June. Indeed, a 25 basis point cut is now fully priced for June after last week's job report showed easing wage pressures.

"We're waiting to become more confident that inflation is moving sustainably to 2 per cent," Fed Chair Jerome Powell told lawmakers last week. "When we do get that confidence, and we’re not far from it, it will be appropriate to dial back the level of restriction so that we don’t drive the economy into recession."

Also, keep an eye on broader risk sentiment over the coming days as the Dollar now appears to be responding to ongoing improvements in sentiment.

"The last few weeks have seen a firm shift back towards risk sentiment being the biggest driver of USD behaviour and therefore catalysing USD weakness. With global equity markets continuing to rally, low levels of volatility across a range of asset markets, and modest signs of recovery in various global PMIs for example, there is justification for this shift," says Dominic Bunning, Head of European FX Research at HSBC.

Should markets continue to rise, anticipate the Pound-Dollar to follow suit.