Dollar 2024 Outlook

- Written by: Gary Howes

Image: Doug Turetsky. Sourced: Flikr, licensing: CC 2.0.

The consensus sees 2024 as a year when the Dollar will gradually ease as a slowing economy and falling inflation allow the Federal Reserve to reverse some of the recent interest rate hikes it delivered.

Yet, there is high uncertainty about the timing of these rate hikes as the U.S. economy has shown an ability to outperform expectations, allowing for a divergent set of views amongst the good and great at the world's major investment banks.

Dollar weakness is a conviction call for 2024 at Amundi, Europe's largest asset manager, whose rationale reflects the broader consensus.

In a year-ahead outlook note, Amundi says the mild U.S. recession - a base case expectation for H1 2024 - may not be as positive for the USD as in the past.

Analysts say that barring a hard-landing scenario, worsening U.S. data should hurt the USD via two main channels:

i) reversal of U.S. exceptionalism (which becomes even more likely if Chinese growth stabilises)

ii) the Fed shifts focus to growth and enters a cutting cycle

"Entering 2024, should the USD continue to trade at a higher premium relative to fundamentals (that have dropped compared to last year), it will be vulnerable to pullbacks when moving from policy tightening to policy easing," says Amundi.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Recent events have overtaken Goldman Sachs's base-case assumptions for 2024, and economists at the Wall Street bank have lowered their dollar forecasts before the new year begins.

Following recent downside surprises in U.S. inflation readings and December’s Federal Reserve Open Market Committee meeting, economists at Goldman Sachs have made a "significant" change to their Fed call.

Goldman now expects five interest rate cuts from the Federal Reserve next year, compared to just one made in its initial 2024 Outlook publication. "Our new forecasts incorporate more Dollar weakness than before," says Kamakshya Trivedi, an analyst at Goldman Sachs.

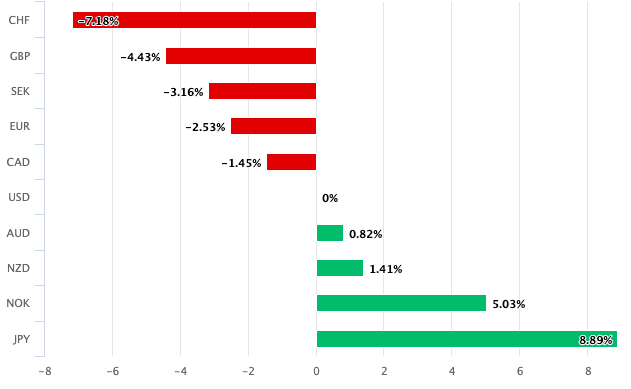

Above: USD performance in 2023.

Goldman Sachs now forecasts the Pound to Dollar exchange rate at 1.28 in three months, an upgrade from the previous forecast of 1.25. In six months, the pair is seen at 1.30, unchanged from the previous forecast and in 12 months, the target is raised to 1.35 from 1.30.

The Euro to Dollar exchange rate is forecasted at 1.08 in three months (1.04 previously), 1.10 in six (1.06), and 1.12 in twelve months (1.10). The Dollar to Yen exchange rate is forecasted at 145 (155), 142 (155), and 140 (150) at the aforementioned time points.

Track USD with your custom rate alerts. Set Up Here.

The Federal Reserve appeared to signal a pivot in policy stance at its December policy update when it maintained interest rates at current settings but effectively condoned market bets for a series of rate cuts in 2024.

This resulted in falling U.S. Treasury yields and a weakening in the Dollar and endorsing the consensus expectation that a gradual easing in value will characterise 2024.

ANZ Bank sees a weaker Dollar and holds some of the more bearish USD predictions.

"Fading fiscal support in the US combined with the impact of interest rate hikes will impact growth in the US," says Mahjabeen Zaman, an analyst at ANZ. "This adds to our bearish view of the USD."

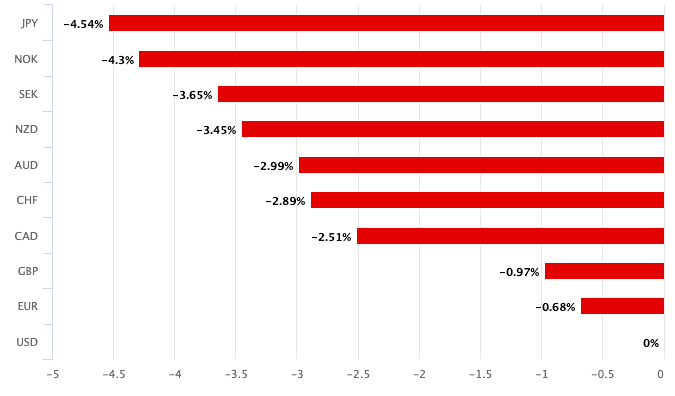

Above: USD is the worst performer in G10 over the past months as investors see the Fed pivoting to rate cuts. This performance can be reversed if that pivot is delayed.

ANZ sees the Pound-Dollar exchange rate trading at 1.32 by mid-year and 1.34 by year-end. For Euro-Dollar, 1.13 is expected mid-year ahead of 1.15 at year-end.

Bank of America's 2024 forecasts confirm it is more bearish on the U.S. Dollar than the consensus, with analysts saying Federal Reserve interest rate cuts "matter more for the market" than cuts at other central banks.

Bank of America expects the EUR/USD to clear the 1.10 level over the coming months and rise towards its fair value.

Thanos Vamvakidis, Head of G10 FX Strategy at Bank of America, told a media briefing that in 2023, he and his colleagues were more bullish than the consensus on the Dollar, but the opposite is true for 2024.

The coming USD weakness will be premised on expectations that U.S. economic growth will "land" and create a smaller outperformance gap for the U.S. versus others in a "U.S. recoupling".

BofA sees Pound-Dollar at 1.26 by mid-2024 and 1.31 by the end of the year.

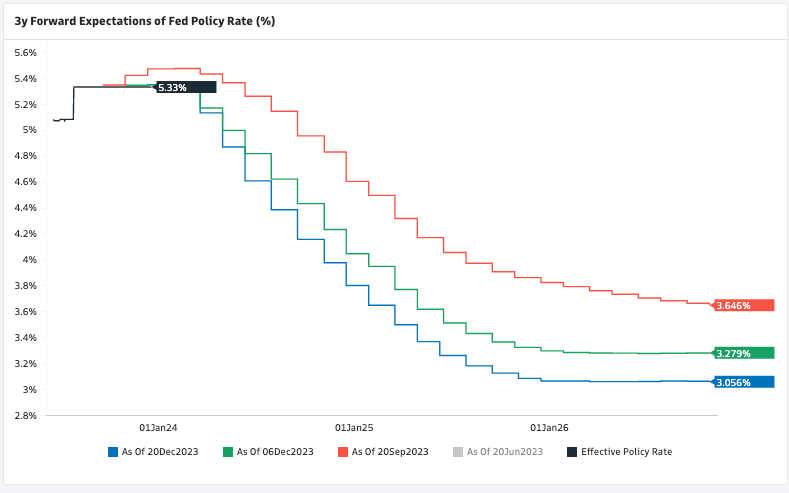

Above: Market-implied expectations for the outlook of Fed rates. Note the sizeable drop since September, consistent with a weaker USD of late. But, should this curve lift over the coming weeks, USD can strengthen.

The risk to USD bears is that the Fed holds rates higher for longer than markets are currently expecting and/or if global markets capitulate in the face of a deeper-than-expected economic downturn.

"2024 should see USD remaining strong as rate differentials continue to favour USD, as does the currency's safe-haven nature," says a note from Morgan Stanley.

Strategists at the Wall Street bank make selling Euro-Dollar a top thematic trade of 2024. In fact, the extent of Dollar strength expected by Morgan Stanley will raise eyebrows.

"Our strategists forecast lower EUR/USD by year-end. Data in Europe continue to soften, with the risk of a technical recession rising further," says Morgan Stanley. The bank expects EUR/USD will return to parity by the first quarter of 2024 and stay around the 1.00 level for most of the year.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Analysts at Danske Bank also hold a constructive view on the Dollar in 2024, although the recent weakness in the currency must be given room to extend into early 2024.

Danske Bank expects Euro-Dollar to trade at lower levels on a 6-12M horizon based on relative terms of trade, real rates (growth prospects), and relative unit labour costs.

Danske Bank is strategically bearish EUR/USD and looks for the pair to fall to 1.10 in three months, 1.07 in six months and 1.05 in twelve months.

It's also a counter-consensus call from HSBC, which is holding out for U.S. dollar strength in 2024.

HSBC's projections show Euro-Dollar will trend lower as the Federal Reserve and other central banks may not be able to loosen monetary policy as much as markets are thinking.

As a result, HSBC warns there has been a lot of optimism expressed by markets already, and the hurdles for this to be upheld are even higher now.

"We retain our expectation for a stronger USD during 2024, in contrast to the consensus," says Daragh Maher, Head of Research for the Americas at HSBC.

Above: "US growth surprises still holding up strong while the RoW has not improved" - HSBC.

HSBC forecasts Euro-Dollar at 1.06 by the end of the first quarter of 2024, below the current level of spot at 1.0950, 1.04 by mid-2024, 1.02 by the end of the third quarter and 1.02 by year-end.

For the Pound to Dollar exchange rate, HSBC expects 1.18 to be the anchor from mid-year through to year-end.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks