GBP/USD Rate Seen Back Below 1.20 in 2024: Morgan Stanley

- Written by: Gary Howes

Image © lj16, Reproduced Under CC Licensing.

Foreign exchange strategists at investment bank Morgan Stanley say they are "most negative" on Pound Sterling in the G10 space for 2024.

This negativity crystalises in a sobering year-ahead forecast profile that sees the Pound set to fall to crisis-era levels against the Dollar.

Yet, there are no eye-catching worries in Morgan Stanley's year-ahead forecasts for the British Pound that would suggest drama lies ahead. Previous episodes of significant idiosyncratic Pound underperformance came amidst 'no deal' Brexit fears, global financial crises and Truss's bond market meltdown.

Instead, steady Dollar strength combined with a Bank of England-inspired move lower in Pound Sterling will deliver levels last seen in September and October of 2022 when former Prime Minister Liz Truss's mini-budget spooked global markets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Morgan Stanley's strategists say 2024 is about the normalisation of UK monetary policy in the form of interest rate cuts at the Bank of England, as disinflation is sustained and economic growth remains weak.

UK yields are expected to fall across the term structure in anticipation of more cuts.

The Pound to Dollar and Pound to Euro exchange rates have closely followed the movement in UK bond yields relative to those of the U.S. and Germany, and there is little to suggest this relationship will break down soon. Lower yields will make for a weaker Pound.

"We are cautious on EUR and EMFX, and most negative on GBP," says Matthew Hornbach, a strategist at Morgan Stanley.

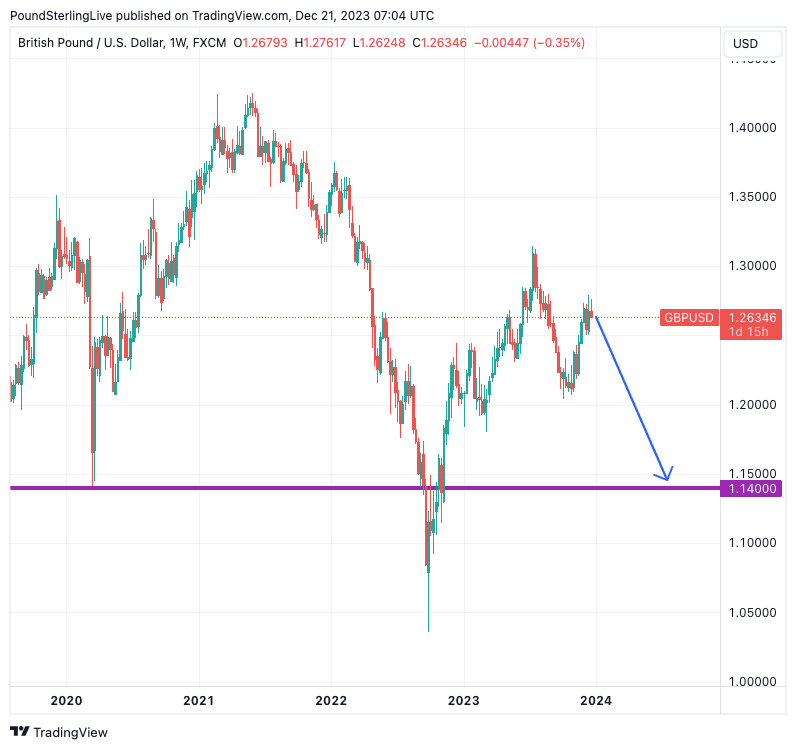

Above: GBPUSD at weekly intervals showing the direction of travel and low point anticipated by Morgan Stanley in 2024. Track GBP with your custom rate alerts. Set Up Here.

According to Hornbach, Pound Sterling chiefly benefited from its "high carry" in 2023 thanks to elevated UK bond yields as investors anticipated significantly higher Bank of England interest rates.

But he expects the Bank to cut far faster and more aggressively than what’s priced.

Heading into year-end, markets have boosted UK rate cut bets following a sharp fall in UK inflation, suggesting these dynamics are underway; over 125 basis points of rate cuts are now being 'priced in' for the coming year, with the first now timed for March.

The Pound fell across the board in the wake of these inflation data, but already it appears that weakness will have its limits with Sterling's rate cut profile now so bloated: in short, how many more cuts can be realistically expected, and what are the practicalities of expecting a cut before March?

Above: Markets are now discounting a significant rate cutting path from the Bank of England. Chart updated 09:14 GMT, 20/12/23. Source: Refinitiv. Courtesy of @Capital Edge

By contrast, Morgan Stanley analysis finds it difficult to chart a path that results in U.S. Dollar weakness, anticipating further gains over the first half of the year.

"We think that the trend of USD strength is likely to continue, at least for the next few months, with the DXY forecast to rise to 111 by the spring, a roughly 5% gain from current levels. The ‘stronger for longer’ USD path incorporates US outperformance across a variety of metrics," says Hornbach.

Morgan Stanley forecasts the Pound-Dollar exchange rate will fall to 1.14 by mid-2024, ahead of 1.15 by year-end.

These levels were last tested during the Truss crisis and before this during the Covid crisis.

So, crisis-era levels, but none of the drama.

Euro-Pound is tipped to rise to 0.90 by end-2024, which gives a Pound-Euro conversion of 1.11.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks