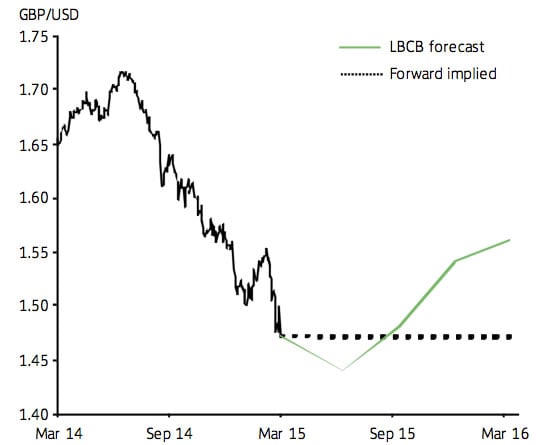

Pound / Dollar Forecast to Recover in Late 2015

- Written by: Gary Howes

New research from Lloyds Bank confirms the weakness in the pound sterling is set to reverse in the second half of 2015.

Those watching the currency markets in the hope of a stronger British pound against the dollar will be feeling deflated - the exchange rate has fallen from 1.7180 in June 2014 to below 1.50 at the current time.

Analysis just released by Lloyds Bank does however bring good news as the situation will eventually turn in favour of the GBP.

However, those with US dollar purchase requirements will have to wait until year-end 2015 for markets to swing back into their favour.

Forecasting an Eventual Recovery

In their latest International Financial Outlook publication released at the end of the first quarter of 2015 analysts at Lloyds say they are downgrading their forecasts for the pound to dollar exchange rate (GBP-USD) in the nearer-term.

It is therefore a case of more pain to come for those looking to transfer money into USD.

“We have revised lower our near-term forecast for GBP/USD at end -June to 1.44 from 1.47, but maintain our expectation of sterling recovery in the second half of the year, with the end-2015 target little changed at 1.54,” confirm Lloyds.

NB. All currency quotes mentioned here refer to the wholesale market. Your bank will affix a discretionary spread when transferring money internationally. However, an independent provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Please learn more.

Beware the General Elections

The Scottish Referendum provided a good example of how political uncertainty can undermine the UK currency.

Expect more of the same around May.

“A build-up of political uncertainty in the run-up to, and possibly in the aftermath of, the General Election in May leaves us wary of a strong bounce in GBP/USD over the coming months - especially as the first rise in US interest rates approaches,” say Lloyds Bank.

Pound to Dollar Forecast

Having reached a peak above 1.55 in late February 2015, GBP/USD has since retraced below 1.50, touching a 5-yr low of 1.4635 in mid-March.

The main catalyst for the move has been a resurgent US dollar argue analysts at Lloyds.

There have also been signs of a slight softening in the economic data, a further drop in headline inflation and an associated scaling back in UK rate hike expectations have also weighed.

“Given recent trends, we have lowered our near-term Cable forecast,” say forecasters.

Furthermore, “we expect GBP/USD to drop to 1.44 by midyear, although it should recover thereafter, as focus returns to the strength of the UK economy, inflation starts to move higher, and expectations of a UK rate rise by end year build. GBP/USD is forecast to be back at 1.54 by end 2015.”

Bank of England to Prompt GBP Recovery

At the present time currency markets have read the recent 0% inflation figures as being a sign that the Bank of England will not raise interest rates in 2015.

Remember - expectations on interest rates are the key driver of global exchange rate levels at the current time - click here to understand why.

The thinking goes - if there is no threat of inflation there is no reason to jeopardise strong economic growth by raising interest rates.

The mistake potentially being made by currency markets is the assumption that the Bank of England looks at once set of figures and uses them to form long term policy.

Indeed, the Bank has priced in the current levels and expect inflation to pick up again. As such, Lloyds reckon an interest rate hike is coming in late 2015.

Markets are currently pricing in 2016. Therefore, if Lloyds is correct catch-up will have to take place.

And catch-up will involve the buying of sterling.