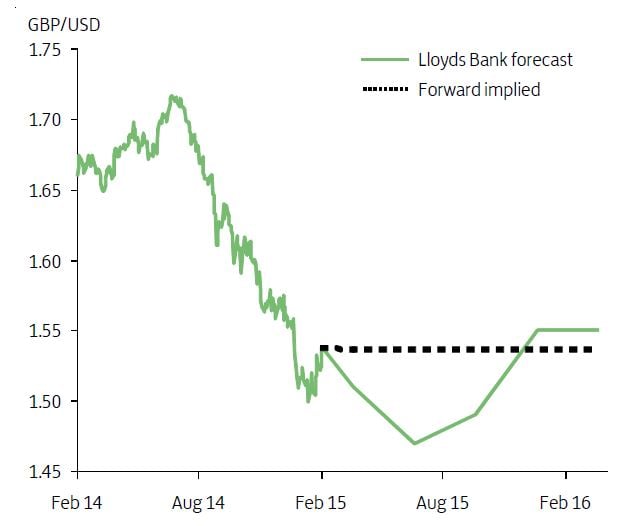

GBP Forecast Lower v USD as Lloyds Eye Break below 1.50

- Written by: Gary Howes

-

The pound sterling (GBP) is predicted to fall from current levels through the first half of 2015 before the onset of a recovery should see the pair end the year on a sound footing.

According to Lloyds Bank, who have just released the latest edition of their International Financial Outlook, the uncertain outcome of the General Election in May remains a potential negative factor in the first half of the year.

Political uncertainty will leave GBP exposed to the UK’s high current account deficit and a reliance on external capital inflows.

International capital does not like uncertainty, and the prospect of a hung parliament is just the ticket to capital outflows.

If Lloyds is correct, traders should be prepared for downside in coming months with current highs offering attractive entry points for those looking to profit on such a move.

Those buying the USD with their GBP should also be aware that current levels are competitive in the context of this report.

At the time of writing the British pound to dollar exchange rate (GBP/USD) is converting at 1.5372.

We are seeing UK high street banks charging a conversion rate of 1.4769 on international payments while we are seeing independent providers quote tighter at 1.5264.

The Outlook for GBP/USD

“The near-term outlook for GBP/USD has been revised lower to 1.47 at end-June, as we have pushed out our expectation of the first rate hike until Q4 2015,” says Robin Wilkin, Head of FX Strategy at Lloyds Bank.

The end-2015 target, however, remains unchanged at 1.55.

A 2015 Recovery

GBP/USD has recovered since the start of February after dipping briefly below 1.50.

“The move has been supported by a combination of a recovery in oil prices and the re-pricing of UK rate hike expectations - market expectations for the first UK rate hike have been brought forward from the summer of 2016 to around the turn of the year,” says Wilkin.

In the near term Lloyds believe rising political uncertainty, a record high current account deficit and an expected rise in US interest rates in June should push GBP/USD lower.

The possibility of continued political uncertainty over the summer if there is a hung parliament is a clear downside risk.

As such analysts target a move in the exchange rate back below 1.50.

This chimes with a number of technical forecasts that see a low of 1.48 GBP/USD being possible.

“Nevertheless, with the UK economy expected to maintain above-trend growth and the Bank of England predicted to start raising interest rates before the end of the year, the strength of the UK economy should see GBP/USD finding renewed support - up towards 1.55 by year-end,” says Wilkin.

When will the Bank of England Raise Rates?

At the current time central bank policy remains the single most important driver of exchange rate levels.

We have seen the Australian and Canadian dollars fall sharply in 2015 on the back of interest rate cuts while actions at the Swiss National Bank and the ECB's quantitative easing programme have kept respective currencies under pressure.

The USD and GBP are meanwhile subject to central banks that are leaning to interest rate raising regimes.

Lloyds have pushed back their forecast on the first interest rate rise by the Bank of England by a quarter to Q4 2015.

Although UK average earnings growth continues to improve gradually, the lower oil price means that the near-term profile of inflation is weak.

“Nevertheless, our forecast for the timing of the first interest rate rise still precedes that implied by forward market interest rates, although these have moved closer to our view over the past month,” says Wilkin.