Pound Recoups Losses against Euro, But Dollar Shines on Fresh Banking-centred Sell-off

- Written by: Gary Howes

Image © Adobe Stock

Pound Sterling and the Euro fell against the Dollar as a sell-off in a U.S. bank and disappointing corporate earnings prompted demand for traditional safe-haven currencies.

Shares in First Republic Bank plunged after investors took fright at the scale of the deposit flight disclosed by the bank's management during the recent bout of banking sector stresses.

"Unease is spreading across the banking sector again, sparked by the sinking realisation of the scale of deposit flight suffered this year and the worry that the problem is not yet at an end. Shares in First Republic Bank plunged at the open on Wall Street after the extent of the run on the bank became clear, with customers pulling more than $100 billion from their accounts in the first quarter," says Susanah Streeter, head of money and markets at Hargreaves Lansdown.

Globally-listed banking stocks were lower in sympathy, confirming investors remain nervous as to the destabilising effects of the recent rapid rise in global interest rates.

The Dollar, Franc and Yen were higher in traditional risk-off trade.

The Euro meanwhile retreated against the Pound and other major currencies as investors bet there was more fat to cut from rate hike expectations at the European Central Bank than is on offer at the Bank of England.

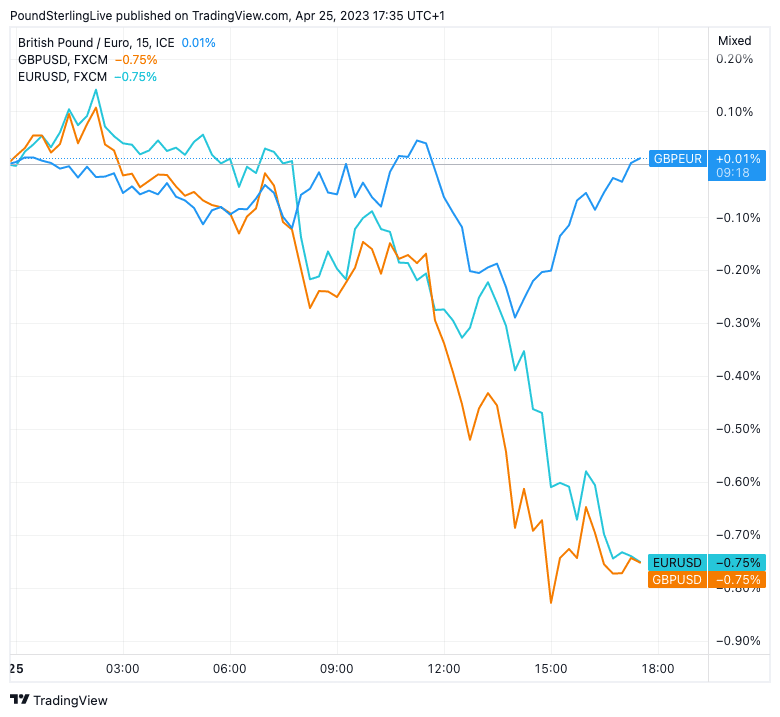

Above: GBP/EUR rose while GBP/USD and EUR/USD fell following the start of U.S. stock trade.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

First Republic spooked markets with its first earnings report since the mid-March chaos that engulfed U.S. regional lenders. The bank revealed the scale of the deposit flight at $100BN.

But Bloomberg reports First Republic Bank’s decision not to take questions during its earnings call might have cost it, with shares dropping to an all-time low as analysts digested a challenging quarter without additional details from management.

During times of banking sector stresses investors lower their expectations for central bank rate hikes 1) because central banks won't want to add fuel to the fire and 2) commercial banks inevitably tighten lending practices during times of nervousness, which in effect doing the bidding of central banks keen to stamp out inflation.

With the ECB expected to raise rates more than its G10 peers over the coming months, it stands that it has more rate hike expectations to give back.

The Federal Reserve is meanwhile seen hiking only once more in 2023 with the Bank of England priced for one more hike in May and a potential final hike thereafter.

The Pound to Dollar exchange rate was as high as 1.25 ahead of the First Republic share price decline but subsequently fell to a low at 1.2387.

The Euro to Dollar exchange rate was lower by a similar margin to trade at 1.0974, ensuring the Pound to Euro exchange rate was flat at 1.13.

However, the pair had been as low as 1.1267, confirming the market stress offered Sterling the chance to recoup some lost value.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |