Pound Dollar Exchange Rate Outlook Sees Losses Until 1.48 Support

Despite strength against the majority of major currencies the GBP is still predicted to remain exposed to an ever-strengthening U.S. Dollar.

However the pace of decline is decidely less dramatic than that facing the EUR/USD.

Nevertheless, "risk remains for further declines over coming days and weeks," warns Lucy Lillicrap, FX risk management solutions at AFEX in her latest weekly sterling / dollar forecast note.

Concerning the technical outlook for the British pound to dollar exchange rate (GBP/USD), Lillicrap tells us:

"The psychological 1.5000 level is not likely to provide much more than a temporary respite, a better indicator of the medium term outlook will be what happens when this tests the prior cycle lows from mid-2013 around 1.4800.

"A break through this latter point would mean an extension toward 1.4000 appears inevitable looking further ahead prior to more substantial demand being uncovered. Rebounds in the meantime are thus considered corrective/unsustainable with resistance visible at 1.5100 and then 1.5250 initially. A push back through this latter level might, if seen, signal an interim low but long term bear trends are probably unaffected."

Sterling Extremely Oversold

Is relief in the air for GBP/USD?

Bill McNamara at Charles Stanley has looked at the charts and thinks this could indeed be the case:

"The pound might be strong against most leading currencies at the moment but it continues to lose ground relative to the dollar and last week’s 0.79% decline takes it to within striking distance of its 2013 low, at 1.489 or so. Sterling looks extremely oversold in this scenario – its 14-week RSI has dropped to 16% - and it does feel like

support might not be too far off now."

Fundamentals: Bank of America Revise GBP Forecast

A number of analysts have pointed to the May general elections in the UK as being a key risk for GBP in the near-term.

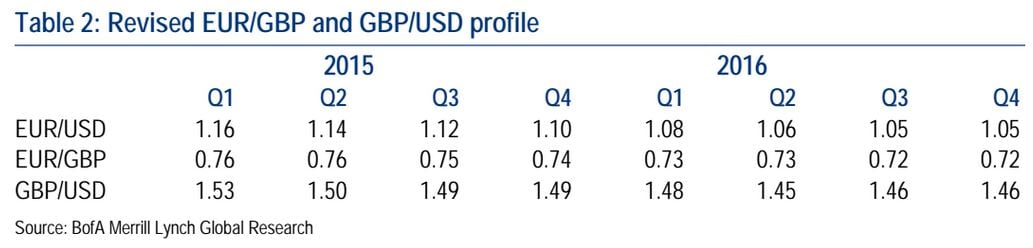

While the pound sterling could be at risk of near-term weakness, the currency analysis team at Bank of America Merrill Lynch Global Research tell us they see the second half of 2015 being supportive for GBP/USD's prospects.

"The second half of 2015 should prove supportive for GBP as the uncertainty of the General Election lifts, though GBP/USD will likely remain under pressure on the divergence in central bank policy. Nonetheless, the relative shift in data surprises offers some relief to GBP/USD in the coming weeks before giving way to pre-election weakness," say BofA.

Federal Reserve to Keep USD Strong

The theme of a strengthening US dollar should continue to dominate the currency landscape say analysts at Barclays.

In a weekly currency forecast note, Barclays point to the driving force behind USD being Federal Reserve Bank policy:

"Next week’s FOMC meeting is unlikely to alter our view that the USD stays strong. The Fed is likely to maintain its view that economic activity will expand at a moderate pace, as well as acknowledge the continued improvements in labor market conditions characterized by solid job gains and steady declines in the unemployment rate.

"Activity data (durable goods, Chicago PMI, consumer confidence) and preliminary estimates of Q4 GDP (Friday) will likely confirm this view, with our tracking estimates suggesting a 3.3% q/q GDP expansion for the quarter (versus 2.8% in mid-December).

"That said, recent inflation outcomes have been weaker than expected, similar to the trends in most countries. As such, we think that the FOMC will likely maintain that it can be patient in beginning the hiking cycle, but is also equally unlikely to make material changes to the statement which would alter our base case of a mid-2015 hike."

Dollar Strength to Continue say Bank of America

Joining Barclays with a pro-USD stance is Michael S. Hanson at Bank of America:

"A steady-state FOMC statement that maintains a “patient” stance of policy and does not add any dovish language should be supportive for the bullish USD trend seen since the last FOMC meeting.

"The relative strength of the US economy and the policy divergence it fosters is a key reason we have a bullish USD stance in 2015. Inflation remains weak, and market-based measures of inflation expectations have continued to decline (alongside developed market peers). But, importantly, our expectation for healthy

"3.5% growth for 2015, the unemployment rate dropping to the low 5% range, and some pickup in wages, all point to rate hikes sometime in 2015, and potentially by June if activity surprises to the upside and core inflation does not fall further.

"There are clearly risks around this call, but for FX, a shift in the first hike by a meeting or two will not change the trajectory of policy divergence we expect to be a key USD support."

Summary

The GBP/USD could find relief in the immediate-term as oversold conditions could see the pace of decline slow and eventually stall.

Further out downward pressures could be exerted by political uncertainty.

Longer-term the GBP/USD outlook sees ultimate support at 1.40, at which stage a recovery is likely to be staged as it could co-incide with the start of an interest rate raising cycle at the Bank of England.