British Pound and Bank of England: Analyst, Economist and Investor Outlooks

- Written by: James Skinner

-

Image © Adobe Stock

Pound Sterling was nursing losses for the period in the final session of the week after the latest Bank of England (BoE) interest rate decision prompted widespread selling while further emboldening already-bearish forecasters.

Thursday's decision to raise Bank Rate from 3.5% to 4% made for a 390-point increase since December 2021 and the strongest monetary tightening for decades having surpassed that which precipitated the 2008 financial crisis.

But the decision also came alongside new economic forecasts and a change in the BoE's language about the outlook for interest rates, which may have been what made the market leery of the Pound.

Forecasts for the economy were lifted but remained pessimistic with a recession still envisaged for much of this year or more.

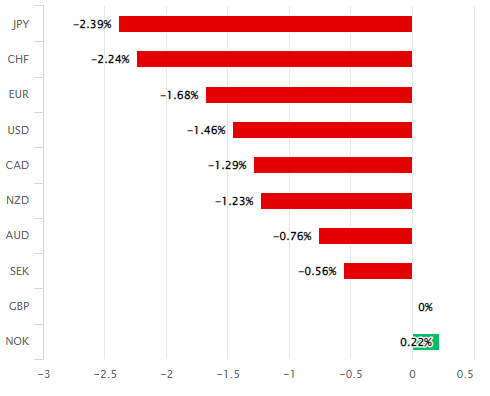

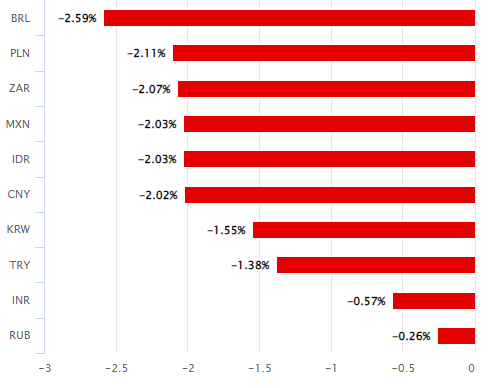

Above: Pound Sterling relative to G10 and G20 currencies this week. Source: Pound Sterling Live.

Meanwhile, the BoE dropped its commitment to "act forcefully" if it appears likely at any stage that inflation will remain higher for longer than anticipated.

It did warn that further increases in Bank Rate cannot be ruled out, however, and that "sizeable impacts from past rate increases were still to come."

This did nothing to improve appetite for Sterling and has in some cases encouraged the bearish sentiments of analysts, economists and investors when it comes to the outlook for the currency and economy.

Some of those sentiments are encapsulated below in no particular order.

Ed Hutchings, head of rates, Aviva Investors

"With the Minutes stating the BoE expects a shorter and shallower recession, and that inflation risks are ‘skewed significantly to the upside’, gilt yields should head higher but not to a large degree given the inflation forecast."

"After its recent bullish run of late, Sterling may well begin to struggle in the near term, and with the sizeable amount of gilt issuance to come, plus on-going quantitative tightening, 2023 could also be somewhat more challenging for the UK gilt market."

Hussain Mehdi, macro & investment strategist, HSBC Global Asset Management

“With policy in restrictive territory and activity indicators deteriorating, we think Bank Rate is now near its peak. The big question is now the speed in which the MPC can reverse course on rates. A downside risk for markets and the economy is a long period of restrictive policy to deal with persistent underlying inflation."

"We retain a cautious view on UK and European stocks in the face of downside risks to GDP and corporate earnings growth relative to consensus expectations and believe the recent rally to be unsustainable.”

Vivek Paul, UK chief investment strategist, BlackRock Investment Institute

"The damage to the UK’s real economy is only starting to be seen – the effects of the rate hikes are lagged, so the recent near-term growth resilience should not be extrapolated. Despite the Bank upgrading its own forecasts, they still forecast a contraction – and we believe the UK will feel more pain than its peers."

“Equity investors should consider opportunities elsewhere, for now. Emerging markets have a comparatively better backdrop in the near-run as EM rates peak and China reopens. We remain cautious on UK gilts, preferring short-term U.S. government bonds and investment-grade credit."

Paul Dales, chief UK economist, Capital Economics

"The Bank of England implied that rates are very close to their peak. We still think that rates may rise to 4.50%, but perhaps via two 25bps increases rather than one 50bps rise. Either way, we think that lingering domestic inflation pressures will force the Bank to keep interest rates at their peak for all of this year."

Andrew Goodwin, chief UK economist, Oxford Economics

"The forecasts imply that risks to the inflation outlook are heavily skewed to the upside. And the minutes suggested the majority placed more weight on near-term labour market and inflation data and less import to the medium-term forecasts. This emphasis on the wage and inflation data means we expect one further 25bps hike in March."

Stephen Gallo, European head of FX strategy, BMO Capital Markets

"We view the BoE's MPC as having delivered a dovish hike, so we continue to see GBPUSD as a better buy on a 1.2200 handle (preferably 1.2200 the figure)."

"The partial hawkish offsets were that the hike was bigger than we were expecting (+25bps), and the profile for growth was much shallower in terms of the downturn (2023 real GDP growth was revised to -0.5% from -1.5%)."

"On the whole, we continue to think GBPUSD strength will be constrained north of 1.2300."

Derek Halpenny, head of research EMEA, MUFG

"From a yield play perspective, EUR/GBP looks a more attractive way to trade today’s outcome than GBP/USD given the Fed is approaching a pause but guidance from the ECB today is that “rates still have to rise significantly.”

"EUR/GBP broke higher yesterday in part in anticipation of a divergent policy path becoming more obvious from here and that trading view looks accurate based on the outcome of both the BoE and ECB meetings."

"Our current estimates for the terminal rate both in the UK and the euro-zone was 4.00% and 3.00% respectively. Following today’s MPC announcement that is still feasible although the risk remains that the BoE hikes one more time by 25bps to 4.25%."