Dollar + Pound Strength Predicted in 2015 as Growth Divergence Drives Exchange Rates

- Written by: Sam Coventry

-

The British pound and US dollar are likely to retain a dominant tone in global FX as their economies outperform major rivals.

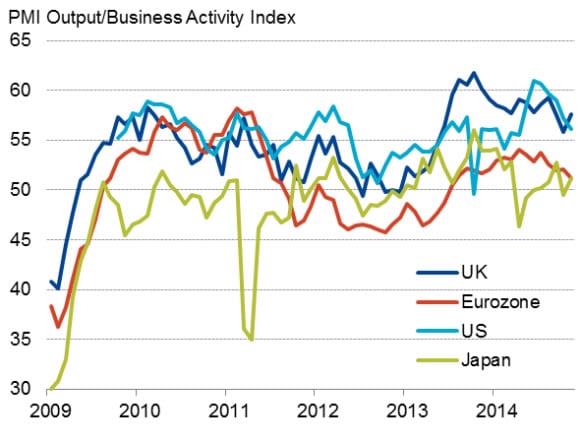

The November PMI data series, released in early December, shows the US and UK markedly outperforming all other major economies.

With the rest of the world it will be growth divergences between various economies that "look set to drive exchange rate and interest rate differentials in coming months," says Chris Williamson, Chief Economist at Markit who complies the data.

Latest Rates (markets closed):

The pound to euro exchange rate: GBP/EUR @ 1.2687.

The pound to dollar exchange rate: GBP/USD @ 1.5593.

Pound to Australian dollar rate: GBP/AUD @ 1.8718.

Pound to Canadian dollar rate: GBP/CAD @ 1.7852.

Be Aware: The above quotes are taken from the wholesale market and your bank will affix a spread at their discretion. However, an independent FX provider will guarantee to undercut your bank’s offer, thereby delivering up to 5% more currency.

To gaurd against currency fluctuations we recommend discussing a trading strategy whereby optimal levels are automatically executed.

Divergence - Negative-EUR, Negative-JPY

The JPMorgan Global PMI, compiled by Markit, fell for a fourth month running in November, down from 53.5 in October to 53.2, its lowest since April.

So far, the fourth quarter of 2014 has seen the slowest average global economic growth since the final quarter of 2013, with the PMI data roughly consistent with the global economy growing at an annual rate of just over 2%.

"Growth slowed closer to stagnation in China and the eurozone, business confidence in the latter being again dented by concerns over the strained relations with Russia, whose downturn deepened in November," says Williamson.

But US and UK remain brightest lights: Pro-USD, Pro-GBP

Growth meanwhile continues to be led by the US and the UK, with both seeing strong expansion persisting into the fourth quarter of 2014.

"However, in both cases growth has slowed compared to earlier in the year as the adverse global economic environment has weighed on business conditions," warns Williamson.

After enjoying especially strong economic growth over the second and third quarters, the PMI data suggest the US economy has slowed towards the end of the year.

Markit’s weighted manufacturing and services PMI fell to 56.1, its lowest since April, suggesting annualised economic growth is likely to have slowed from 3.9% in the third quarter to around 2.5% in the fourth quarter.

The theory that the US, with its vast domestic market and self-sufficiency on energy, has ‘decoupled’ from weak demand in the rest of the world is being challenged by the surveys.

In the UK, the ‘all-sector’ PMI rose to 57.8 after it had slumped to a 16-month low of 56.4 in October.

So far, the PMI data are pointing to UK quarterly GDP growth of 0.6% in the fourth quarter (similar to the US’s 2.5% annualised pace), down from 0.7% in the third quarter.

Central Bank Policy Key for the Pound and Dollar Exchange Rates

Despite data slowing in the US and UK the relative outperformance will continue to drive the British pound and US dollar forward.

"Growth in the US and UK remains robust by historical standards, meaning speculation will continue to intensify about the timing of interest rate hikes in both countries," notes Williamson.

That said, the slowdowns and recent falls in oil prices point to any initial tightening being delayed until the second half of 2015.

In contrast, the ongoing travails in the eurozone, Japan, China and other emerging markets suggest policymakers there will need to continue to seek ways to revive growth in these economies.

"Such policy divergences will no doubt continue to drive exchange rate differentials, the US dollar having already strengthened sharply against the euro and yen in particular (the dollar index has risen 11% since July, climbing to its highest since March 2009). That is unless, off course, growth continues to wane in the US and UK, as these two bright lights succumb to the headwinds of weakened demand elsewhere in the world and geopolitical risks," says a note from Markit on the matter.

Eurozone Worries Could Keep Sterling Under Pressure

For the UK downside risks to the economic outlook have also intensified.

The eurozone is edging closer towards another downturn, with the Eurozone PMI sinking to a 16-month low in November, and worries about the crisis with Russia and the impact of sanctions have hit business confidence.

"Closer to home, the forthcoming General Election next year has the potential to destabilise the economy," warns Williamson.

With these risks abounding, it can be argued that now is not the time to be starting to normalise interest rate policy at the Bank of England, even gradually, as this will introduce one more worry to households and businesses.

"Higher rates would also of course push up the exchange rate, hitting already-lacklustre export performance. It’s likely, therefore, that the doves will continue to outnumber the hawks for some time to come, meaning it is likely that any hike in interest rates will be delayed until the second half of next year," warns Markit.

It is the expectation for interest rate rises at the Bank of England that will continue to keep the pound sterling underpinned.

However, should weakness start feeding through into the data releases we will certainly see sterling fall back as exchange rate markets push back their expectations for the rate rise.