Pound in Relief Rally against Dollar Following U.S. PMI Surprise

- Written by: Gary Howes

Image © Adobe Images

The Dollar slipped back against the Euro and British Pound following data out Tuesday that showed a slowdown in the U.S. economy might have accelerated in August.

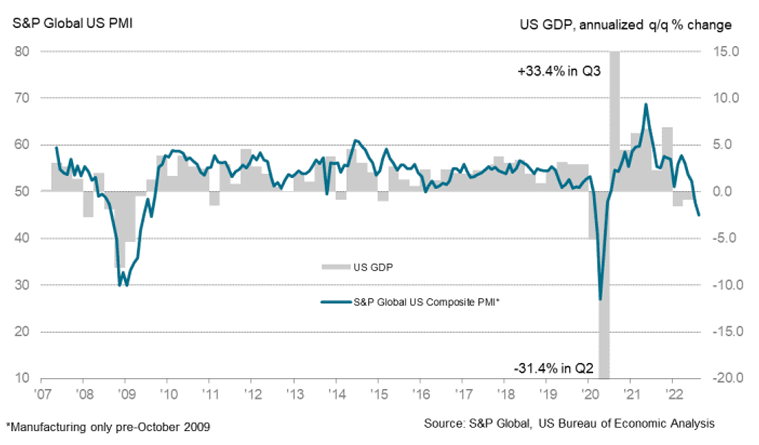

S&P Global's PMI survey for the U.S. economy showed a sharp retrenchment in service sector activity, with the service PMI reading at 44.1, well below the 49.2 markets were anticipating and July's 47.3.

A reading below 50 indicates contraction.

By contrast, the UK's service PMI read at 52.5 in August, which was ahead of expectations.

The U.S. manufacturing PMI read at 51.3, but was below the 52.0 expected by markets. The composite PMI - which adjusts the readings to better reflect the wider economy - read at 45.0, well below the expected 49.0 and July's 47.7.

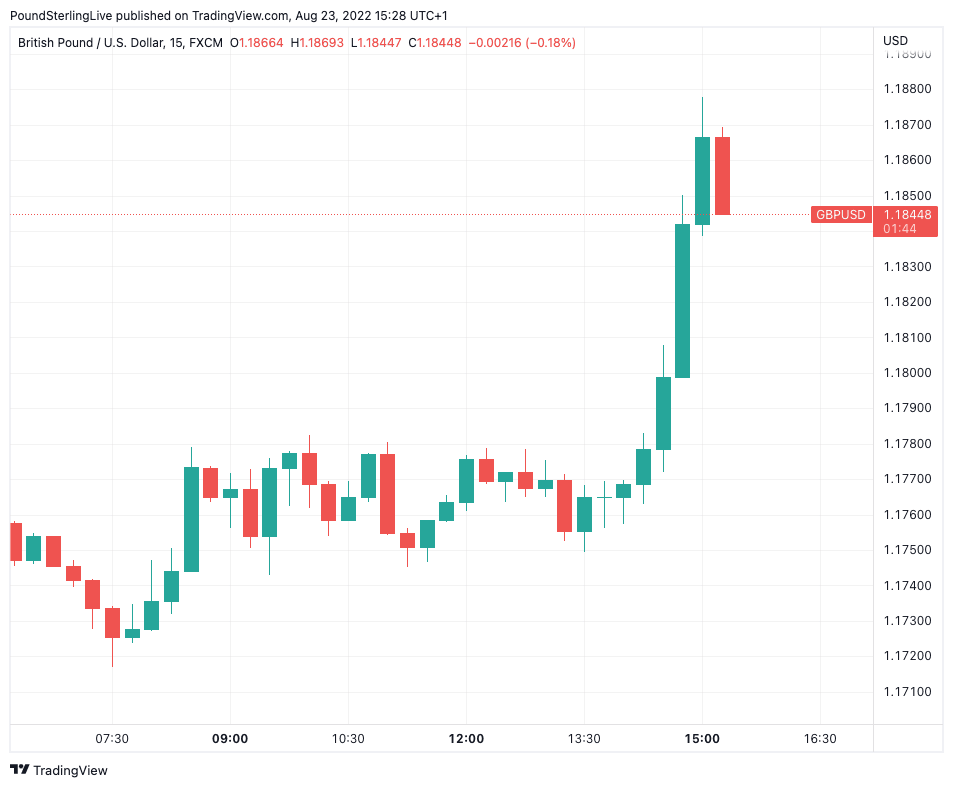

The decline registered noticeably in the Pound to Dollar exchange rate (GBP/USD):

Above: GBP/USD at 15-minute intervals showing the uptick following the U.S. PMI release.

At the time of writing the GBP/USD pair is at 1.1840, with bank accounts offering in the region of 1.1603 for dollar payments and independent specialist FX providers at 1.18.

S&P Global said the decrease in output was the fastest seen since May 2020 and outpaced anything recorded outside of the initial pandemic outbreak since the series began nearly 13 years ago.

The data suggests the U.S. economy is slowing amidst heightened inflation and rising interest rates at the Federal Reserve.

From a currency market perspective another sign of slowdown will cool investor expectations for the number of interest rate hikes the Fed is willing to deliver over coming months.

Cooling rate hike expectations in turn pose a headwind for the U.S. Dollar as they bring bond yields down.

Material shortages, delivery delays, hikes in interest rates and strong inflationary pressures all served to dampen customer demand, said S&P Global.

The Fed might be inclined to slow down its pace of hikes given it was reported firms increased their selling prices at the softest pace in 18 months.

These data suggest a significant slowdown is underway in the U.S., provided it accurately tracks GDP.

"I'm a big fan of the PMIs, but even I would take this slump with a pinch of salt," says independent economist Julian Jessop.

"The weakness has been led by a sharp fall in the #services index, which only has a brief track record, whereas the alternative ISM index has been holding up well," says Jessop.

The Fed will therefore read the PMI report with interest but will almost certainly not be swayed from its policy of raising interest rates.

Therefore, although the Dollar has retreated the overall thesis for further strength remains intact.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks