GBP/USD Week Ahead Forecast: Taking Run at 1.20 if USD Slips Further

- Written by: James Skinner

- GBP/USD may look to extend recovery short-term

- Easing Fed risks & better U.S. data weigh on USD

- After Fed pricing revised lower, U.S. data surprises

- But UK data gauntlet also important for GBP/USD

Image © Adobe Images

The Pound to Dollar exchange rate corrected higher from near coronavirus crisis lows ahead of the weekend but could attempt to recover further lost ground with a run toward 1.20 in the days ahead if softer market pricing of the Federal Reserve (Fed) interest rate outlook continues to weigh on the greenback.

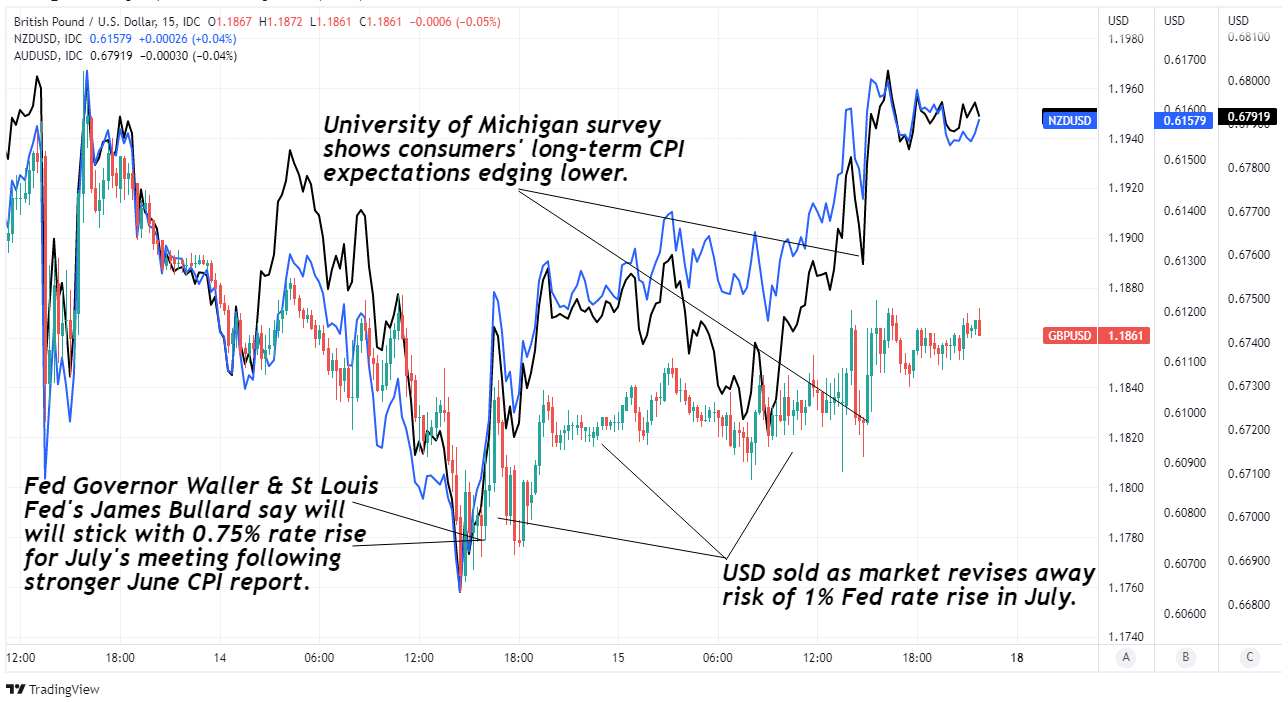

Dollars were sold widely as other currencies were bought on Friday and notably so after a University of Michigan (UoM) survey suggested consumers’ expectations of long-term inflation rates eased lower in July, reinforcing a downward correction of expectations for the Fed’s interest rate.

“Federal Reserve officials have signaled they are likely to raise interest rates by 0.75 percentage point later this month, for the second straight meeting, as part of an aggressive effort to combat high inflation,” was the verdict of The Wall Street Journal’s Nick Timiraos in a Sunday op-ed.

All of this came after Federal Reserve Bank of Atlanta President Raphael Bostic reportedly followed in the footsteps of Board Governor Christopher Waller and St Louis Fed President James Bullard on Friday by signalling a reluctance to raise U.S. interest rates by a full percentage point in July.

Above: Pound to Dollar rate at 15-minute intervals alongside AUD/USD and NZD/USD. Click image for closer inspection.

Above: Pound to Dollar rate at 15-minute intervals alongside AUD/USD and NZD/USD. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Financial market pricing had suggested on Wednesday and Thursday that investors were giving credence to the prospect of a one percent increase after inflation figures for June suggested the journey back to the Fed’s 2% target could be a longer or more arduous one than many had given credit for.

But on Thursday both Christopher Waller and James Bullard appeared to pour cold water on that idea, leading future interest rates implied by overnight-index-swap contracts to fall and resulting in a situation on Friday where a 0.75% increase in U.S. rates was priced-in almost to perfection.

“While a significant boost from energy prices was widely expected, moves in the core gauges within the two reports were a bigger surprise and suggest inflation will remain the primary concern for the Fed,” says Kevin Cummins, chief U.S. economist at Natwest Markets.

“The US economic calendar is very light in the upcoming week, with only secondary indicators, such as housing permits/starts, existing home sales, homebuilders’ confidence and a couple regional factory surveys on tap,” Cummins and colleagues said on Friday.

Above: Pound to Dollar rate shown at hourly intervals with Fibonacci retracements of early July declines indicating possible areas of minor and short-term technical resistance for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at hourly intervals with Fibonacci retracements of early July declines indicating possible areas of minor and short-term technical resistance for Sterling. Click image for closer inspection.

The week ahead is devoid of notable events in the U.S. calendar and is unlikely to bring any commentary from Fed officials now the July meeting’s blackout period is in effect, which leaves the GBP/USD outlook to be determined by a busy UK data calendar and market appetite for the Dollar.

“We are now left scratching our heads a little. The last 48 hours, whilst generally has seen a higher dollar, has been extremely whippy making it difficult to hold a sizeable position,” says Anitek Naik, a spot FX trader at J.P. Morgan.

“We do remain bearish sterling, and still ultimately like to sell rallies, however look to today’s US retail sales for further guidance,” Naik wrote in J.P. Morgan’s London FX Desk Daily on Friday morning.

The Dollar had benefited greatly from investors’ concerns about the outlook for the U.S. and global economies as well as aggressive expectations for the Fed’s interest rate in recent months but last week’s U.S. economic data and the latest remarks from Fed officials have now wrongfooted the market.

Above: U.S. Dollar Index shown at monthly intervals with Fibonacci retracements of 2002 downtrend indicating possible areas of short and medium-term technical resistance. Click image for closer inspection.

Above: U.S. Dollar Index shown at monthly intervals with Fibonacci retracements of 2002 downtrend indicating possible areas of short and medium-term technical resistance. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

June’s retail sales figures suggested on Friday that the U.S. economy is a long way away from the recession that many commentators have recently suggested is likely underway, while the University of Michigan’s measure of consumer confidence also underwent a surprise rebound for July last week.

To the extent that sentiment toward the global economy improves and expectations of the Fed’s interest rate remain under wraps in the weeks ahead, the greenback could be at risk of further profit-taking by investors and GBP/USD might be likely to recover more lost ground over the coming days.

However, much also likely depends on the details of multiple important economic announcements due out from the UK, which could each impact the Bank of England (BoE) interest rate outlook, and on whether GBP/USD can overcome multiple technical resistance littering the road back to 1.20.

“UK data remains choppy, and the MPC remains data-driven. But with growth and inflation out-performing, we think the BoE will opt for a more aggressive rate hike at its August meeting,” says James Rossiter, head of global macro strategy at TD Securities, in a Friday note.

Above: Pound to Dollar rate shown at 4-hour intervals with Fibonacci retracements of mid-June decline indicating other possible areas of technical resistance for Sterling. Click image for closer inspection.

Above: Pound to Dollar rate shown at 4-hour intervals with Fibonacci retracements of mid-June decline indicating other possible areas of technical resistance for Sterling. Click image for closer inspection.