GBP/USD Week Ahead Forecast: Extending Recovery if U.S. CPI Ebbs Further

- Written by: James Skinner

- GBP/USD under pressure near key supports above 1.24

- Faces resistance on recovery above 1.2629, near 1.2660

- Dollar trend key for GBP/USD before May’s U.S. CPI data

- Further signs of inflation top could aid GBP/USD rebound

- But lingering Fed risks limiting GBP/USD upside potential

Image © Adobe Images

The Pound to Dollar rate enters the new week with its back against the ropes near the 1.25 handle and could struggle to hold off a buoyant greenback ahead of Friday’s all-important U.S. inflation figures for May, which could be key to whether Sterling is able to avoid a retest of last month’s lows.

Pound Sterling had attempted a recovery from an earlier slide beneath the 1.25 level during thin holiday trade late last week but was curbed by a rebounding Dollar after U.S. payrolls and PMI figures underlined the lingering upside risks to the Federal Reserve (Fed) policy outlook.

While the jobs data and industry surveys clearly indicated that momentum in the labour market and other key U.S. economic sectors is slowing, they also made apparent that risks to the U.S. inflation outlook are still on the upside.

This in turn suggests continuing scope for the Fed to drive expectations for U.S. interest rates higher still in the months ahead, which would be an additional headwind for the Pound to Dollar rate, if not an outright burden for Sterling.

“A failure to reclaim the 1.26 handle may give the GBP a more bearish feel to close out the week after it broke through its bullish trend from the mid-May lows on Tue,” says Juan Manuel Herrera, a strategist at Scotiabank.

Above: Pound to Dollar rate at daily intervals with Fibonacci retracements of mid-May rebound indicating possible short-term areas of technical support for Sterling and the spread or gap between 02-year GB and U.S. government bond yields. Click image for more detailed inspection.

Above: Pound to Dollar rate at daily intervals with Fibonacci retracements of mid-May rebound indicating possible short-term areas of technical support for Sterling and the spread or gap between 02-year GB and U.S. government bond yields. Click image for more detailed inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“Support is the mid-1.25s area followed by 1.2525 and the big figure zone; Wed’s low of 1.2459 follows. Resistance after the 1.26 figure area is 1.2630 and the mid-1.26s,” Herrera and colleagues said in a Friday note.

Pay growth detailed in Friday’s U.S. payrolls report eased slightly but both of the PMI surveys suggested that demand for workers is still rising alongside their demands for wages and some other prices, which came as a headwind for the Pound-Dollar rate.

This may have been because those are all things that could stoke inflation further along the line and so potentially lead the Fed to be more minded toward continuing to lift its interest rates in larger-than-usual increments through the rest of the year.

“Although we expect the US economy to weaken, the stronger-than-expected US employment report for May will likely reduce concerns about a consumer spending slowdown over the near-term,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

Source: Institute for Supply Manufacturing (ISM). Click image for closer inspection.

Source: Institute for Supply Manufacturing (ISM). Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“The jobs data and rebound in Treasury yields may continue to support the broad Dollar over the near-term,” Pandl and colleagues said on Friday.

This is why Friday’s inflation data for May is likely to be a key determinant of the Pound to Dollar rate outlook in the short-term and especially in the context of whether it continues to reflect an easing of the monthly pace of inflation.

“We look for a gain of 0.8% in the headline index versus 0.3% at the start of Q2. We expect the core CPI to be almost as strong in May as it was in April (forecast 0.5% after 0.6%). The year-over-year growth rates for headline CPI would climb again (to 8.4% from 8.3%), while the core index would slip 0.3pts to 5.9%,” says Kevin Cummins, chief U.S. economist at Natwest Markets.

Consensus suggests that financial markets likely expect the monthly pace of inflation to rise from 0.3% to 0.7% for last month but for the core inflation rate to ease from 0.6% to 0.5%, and whether it does could be significant in crafting the Federal Reserve policy outlook.

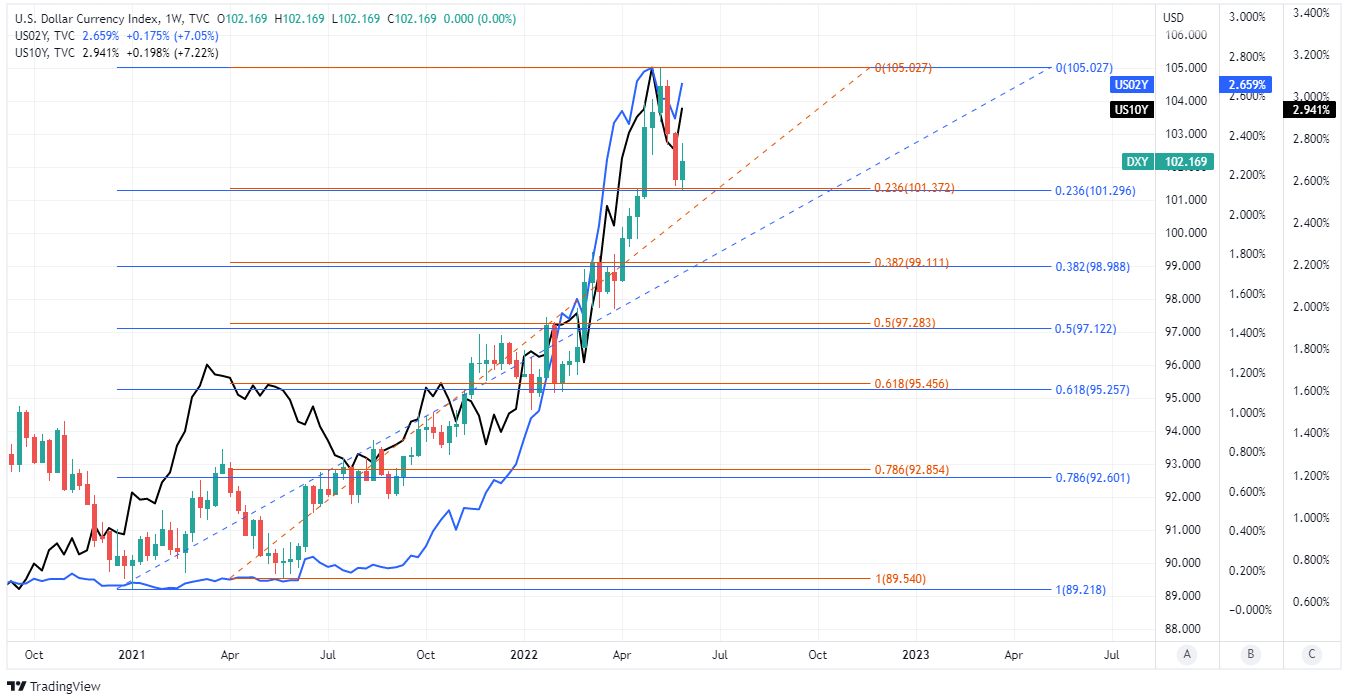

Above: U.S. Dollar Index shown at weekly intervals with Fibonacci retracements of January and June 2021 recoveries indicating possible short and medium-term areas of technical support for U.S. Dollar and selected U.S. government bond yields. Click image for more detailed inspection.

Above: U.S. Dollar Index shown at weekly intervals with Fibonacci retracements of January and June 2021 recoveries indicating possible short and medium-term areas of technical support for U.S. Dollar and selected U.S. government bond yields. Click image for more detailed inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

This is because several influential rate setters at the bank appeared to indicate last week that they are still at risk of becoming more ‘hawkish’ with their interest rate outlooks in the months ahead if U.S. inflation rates do not continue the tentative retreat seen only in recent months.

“On inflation I am going to be looking to see a consistent string of decelerating monthly prints on core inflation before I am going to feel more confident that we’re getting to the kind of inflation trajectory that is going to get us back to our two percent goal. In terms of our tools, they are very effective at cooling aggregate demand,” Vice Chair of the Fed Board Lael Brainard said Thursday.

Friday’s U.S. inflation data is the highlight in what is a quiet week in the UK economic calendar, which leaves much to be determined for the Pound to Dollar rate by developments on the Dollar side of the equation ahead of next week’s UK wage data and the June 16 Bank of England (BoE) decision.

“With consumer activity proving pressured by the surging cost-of-living, the recent fiscal ease merely limits rather than ameliorates the impact of the contraction in real household disposable incomes, we remain biased towards Sterling downside. We would look to sell GBP/USD up to 1.2590, with only a move above 1.27 negating this,” says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of various 2020 falls indicating possible short and medium-term areas of technical resistance for Sterling. Click image for more detailed inspection.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of various 2020 falls indicating possible short and medium-term areas of technical resistance for Sterling. Click image for more detailed inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks