GBP/USD Week Ahead Forecast: To QT or Not to QT, That is the Question

- Written by: James Skinner

-

- GBP/USD may see further short-term relief from USD

- If Fed defers or goes slow with balance sheet unwind

- Fed & BoE decisions eyed as U.S. data deluge looms

Image © Adobe Stock

The Pound to Dollar rate was relieved last Friday from recent heavy selling pressure but may need the Federal Reserve (Fed) to defer the anticipated start of its balance sheet reduction process known as quantitative tightening in order to avert further losses and more sustainably recover its poise.

Sterling traded as low as 1.2411 at its nadir last week when a rallying Dollar toppled most major currencies including the Pound, Euro and Japanese Yen.

“The USD’s core drivers seem easy enough to identify - a hyper-hawkish Fed and more recently, a souring of the global risk mood,” writes Richard Franulovich, head of FX strategy at Westpac, in a Monday research briefing.

"The Eurozone is battling a more acute stagflationary situation, while China is battling a Covid outbreak with strict lockdowns, knocking EM growth expectations lower. A [Dollar Index] break of 104 opens the door to a run at 20 year highs near 107," Franulovich and colleagues also said.

While other factors such as fragile global market risk appetite have also been at play, recent Pound-Dollar rate losses are as much a reflection of the emerging gap between the Fed and Bank of England (BoE) as they are anything else, while similar is also true of other currencies. (Set your FX rate alert here).

Monetary policy, its impact on U.S. bond yields and the relative advantage these confer upon the Dollar will be back in focus again this week when the Fed announces its latest policy decision on Wednesday and ahead of Thursday's equivalent from the BoE.

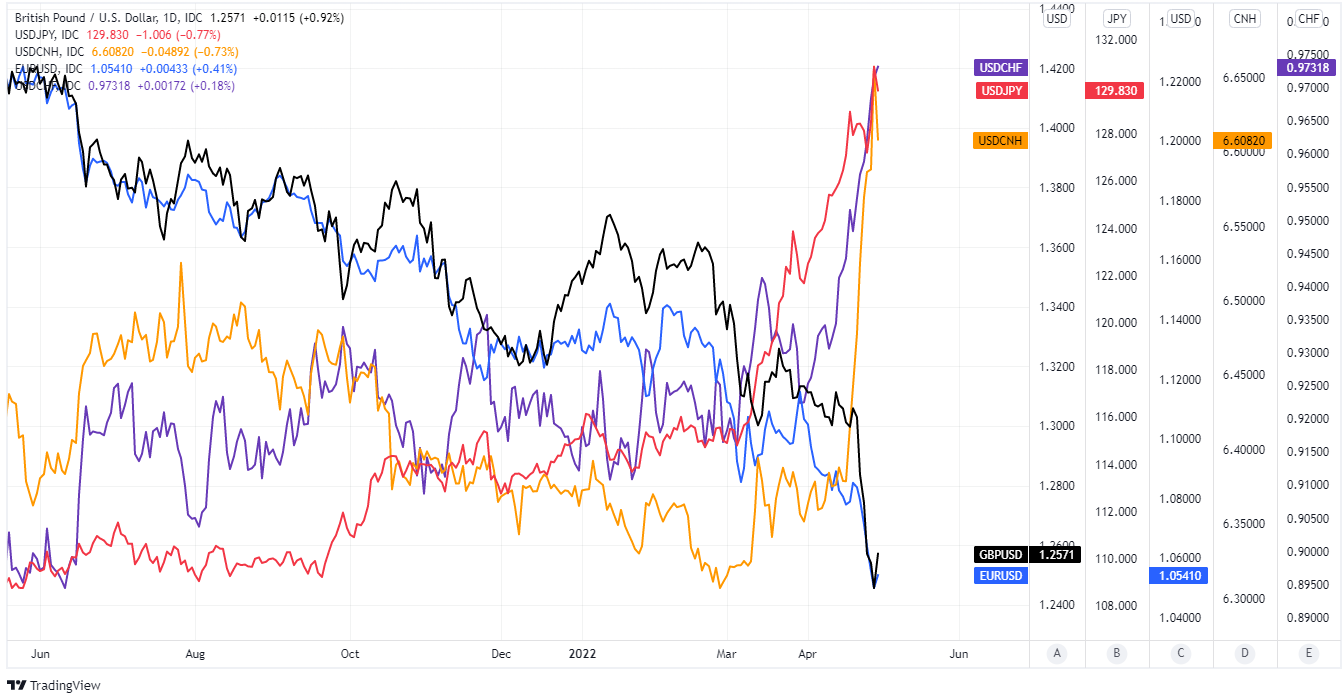

Above: Pound to Dollar exchange rate shown at daily intervals alongside EUR/USD, USD/CNH, USD/JPY and USD/CHF. Click image for closer inspection.

The Fed is widely expected to lift its interest rate by 50 basis points, taking the Fed Funds range up to between 0.75% and 1%, after Chairman Jerome Powell effectively confirmed that this would be on the table for the May meeting.

But the bank is also seen as likely to announce its plan for the balance sheet reduction process known as quantitative tightening (QT) and it’s around this part where market expectations may be at risk of an upset on Wednesday.

“We’ll be mindful of the broader financial and economic contexts when we make the decision on timing, and we will use our tools to support financial and macroeconomic stability,” Chairman Jerome Powell said of the QT announcement in last month’s press conference.

“We always want to use our tools to support macroeconomic and financial stability and we want to avoid adding uncertainty to what is a highly uncertain situation already,” he also later said when asked by Bloomberg News’ Rich Miller about the Fed’s expectations for financial conditions.

This is noteworthy in the context of the recent Dollar strength and losses for other currencies, which are an inflationary headache that risks pushing the European Central Bank (ECB) and Bank of England (BoE) to lift their interest rates sooner or faster than they otherwise might elect to.

Above: U.S. Dollar Index shown at weekly intervals with Fibonacci retracements of 2020 decline indicating various levels of technical resistance to the Dollar's recovery. Click image for closer inspection.

“Judging by the recent remarks from Philip Lane and President Lagarde, the weak EUR is a concern for the ECB,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Dollar strength and U.S. bond yields have possibly also led the People’s Bank of China (PBoC) to hesitate about providing stimulus in China where coronavirus containment measures are hastening an earlier slowdown and adding to market concerns about the global economic outlook.

“Rising US rates are leading to capital outflows and are unsynchronized with China’s divergent monetary policy and downside growth risks,” says Claudio Piron, head of FX strategy for emerging market Asia at BofA Global Research.

In addition, it's certainly the case that the Dollar’s recent advance has been the dominant driver of deepening losses for the Japanese Yen, which have drawn increasingly vocal expressions of concern from the Ministry of Finance in Tokyo.

“The BoJ reiterated that the benefits of a weaker Yen outweigh the disadvantages, but officials later highlighted that they will respond appropriately if needed,” says Peter McCallum, a rates strategist at Mizuho, on Friday.

Above: Risk analogy for other currencies, other economies and central banks. Source: Rube Goldberg Machine Science Project, markp0177, youtube.

This all comes after April heralded another escalation of ‘hawkishness’ among Federal Open Market Committee officials, which has lifted the Dollar and toppled other currencies across the globe like dominoes in the process.

“Sterling has been hit hard in recent weeks as risk appetite has soured. Moreover, momentum on rate hikes has switched from London to Washington,” says Thomas Flury, a strategist at UBS Global Wealth Management.

But all the above suggests there may now be scope for the Fed to defer this any announcement on QT this Wednesday, which would potentially act as a dampener for U.S. bond yields and perhaps also for the Dollar too.

"By now, the QT playbook has been well socialized and telegraphed. The long-end has also shifted materially to reflect the aggressive profile as well. Given this, the risks are skewed once the announcement is out," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Previously, it had taken Russia's invasion of Ukraine to dislocate the Dollar from what was otherwise a lethargic start to the 2022 year, although the greenback was also swept lower later on and in the wake of the Fed’s March decision to lift the Fed Funds rate for the first time since before the coronavirus crisis.

Above: Pound to Dollar rate at weekly intervals with Fibonacci retracements of March 2020 and June 2020 rallies indicating medium-term areas of technical support for Sterling and resistance for the Dollar. Click image for closer inspection.

“We expect the FOMC decision (a 50bp increase with more coming), ISM manufacturing (a small fall from a high level) and non-farm payrolls (low unemployment and fast wage growth) to paint a picture of US economic outperformance,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Though the Fed’s policy decision is the highlight of the week ahead for the Dollar and many other currencies, there’s also a raft of key economic figures due out from the U.S., each of which will have the potential to impact expectations for growth and, potentially, also monetary policy too.

Meanwhile, and along the way the BoE is set to announce its latest policy decision on Thursday and pricing in the overnight-indexed-swap market implied on Tuesday that it's almost certain to lift Bank Rate from 0.75% to 1%.

This would take the benchmark to its highest since before the 2008 financial crisis while marking its fourth increase since December but there is a risk of the event being marred for Sterling by economic forecasts that could again contradict market expectations for Bank Rate later this year.

“GBP is showing some stabilisation, helped by the broader risk markets bounce and a final cutting of any residual long positions. I am neutral, preferring to buy USD dips versus the EUR rather than GBP and not inclined to play EUR/GBP at current levels,” says Jonathan Pierce, a trader at Credit Suisse.