Pound Sterling Tops FX League Table as BoE Accosts Inflation at UK’s Door

- Written by: James Skinner

-

- GBP edges back into 1st place among majors for 2021

- After GBP/CAD reclaims 1.7380 on BoE, BoC tailwinds

- BoE on its feet & rolling up sleeves as inflation prowls

- ”Risk management considerations” driving policy pivot

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1740 | GBP/USD: 1.3890

- Bank transfer rates: 1.1512 | 1.3600

- Specialist transfer rates: 1.1660 | 1.3790

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The Pound has risen back into the top spot of the major currency performance table for 2021 after two rate setters indicated that “risk management considerations” could lead the Bank of England (BoE) to end its emergency quantitative easing programme as soon as its August policy decision.

Pound Sterling was the best performer in the G10 segment of the major currency basket ahead of the weekend having slipped past a recently retreating Canadian Dollar and into the top spot for the first time since April.

Thursday’s trading session saw the Pound-to-Canadian Dollar rate rise above its 1.7380 opening level for 2021 and the line which separates first from second place in the major currency rankings this year.

This was after Monetary Policy Committee (MPC) members Michael Saunders and David Ramsden - both members of the BoE’s nine-body rate and policy setting committee - warned within a short space of time that some of the BoE’s crisis-inspired and emergency monetary support for the economy could be withdrawn sooner than the currency and interest rate markets had expected.

“The result is that GBP bulls have reason to be shaken out of their inertia,” says Jane Foley, head of FX strategy at Rabobank.

“The market will have to wait until August 5 for the next BoE meeting, but unless UK economic data start to disappoint, the approach of this meeting is likely to motivate GBP bulls. We retain our EUR/GBP 0.84 [GBP/EUR: 1.19] end of year target,” Foley says.

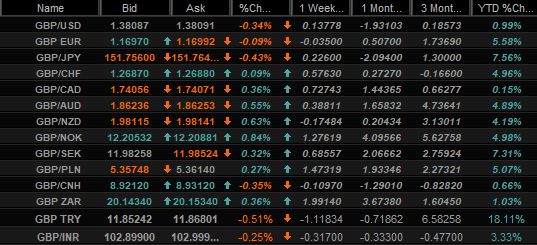

Above: Selected Pound Sterling exchange rate quotes and performances over various periods. Right hand side column shows GBP performance in 2021 year-to-date. Top nine rows reflect performance Vs other G10 currencies. Source: Netdania Markets.

It may note have been so without Canadian Dollar declines from the Wednesday session placing Sterling within arm’s reach of the landmark level but the BoE’s voice was instrumental in driving the Pound’s elevation on Thursday.

“Bank of England (BoE) rate setters Michael Saunders and Dave Ramsden suggested they support an early end to QE in speeches today and yesterday, raising risks of a change in policy at the August meeting,” says Robert Wood, a UK economist at BofA Global Research.

“Saunders confirmed that in his view the conditions to allow a rate hike - clear evidence of significant progress in eliminating spare capacity and returning inflation to target sustainably - have been met already. All meetings are live now,” Wood writes in a Thursday note.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Michael Saunders was by far the most “hawkish” of those voicing an opinion in recent days having suggested that Bank Rate should rise from 0.10% in 2022, but David Ramsden’s speech was also insightful including for its recognition of “material upside” in recent inflation numbers and a shift in the balance of inflation and growth risks.

That could mean it’s no longer appropriate for the BoE to be pumping the economy as much as it is.

The Bank has bought around £90bn of government bonds since announcing in November 2020 that it would purchase £150n before year-end 2021 for “risk management reasons,” though this was at a time when the UK had just entered its second ‘lockdown’ and the risks to economic growth and inflation were on the downside.

“Based on the rapid pace of developments since we published our May forecasts and the shift in the balance of risks I can envisage those conditions for considering tightening being met somewhat sooner than I had previously expected,” Ramsden said.

Since November the economy has substantially reopened and its recovery has been stronger than was expected by many, while the inflation that the BoE is charged with managing through its monetary policy has risen sharply and could rise further still before it eventually falls back to the 2% target.

Above: GBP/USD, GBP/CAD and GBP/EUR shown at weekly intervals.

Increases in inflation may now be tipping the balance of risks for at least some of the BoE’s policymakers, given the suppressive effect that bond purchases have on whole-of-economy borrowing costs and the uplifting impact this can have on inflation.

“While we doubt that the MPC will change its cautious medium-term inflation outlook, we recognize that the GBP’s rate advantage could remain an important support for the pound in the near-term,” says Valentin Marinov, head of FX strategy at Credit Agricole.

Just like other central banks around the world the BoE has remained confident that above-2% inflation rates are only temporary and that they’ll be likely to fade of their own accord over the coming years, although stronger-than-forecast increases risk leading to higher inflation further down the line by lifting business and household expectations.

This and a desire to avoid unnecessarily fomenting future inflation is why the earlier referenced risk management considerations could lead the bank to curtail its QE programme over the coming months, if not following its next meeting in August, which would be supportive of the Pound.

It’s inflation which central banks are attempting to manage in the context of a predefined target whenever they tinker with interest rates or change other monetary policies, although price pressures are themselves sensitive to changes in economic growth as well as many other factors.