U.S. Inflation Burns Hot, Dollar Catches a Bid

- Written by: Gary Howes

-

Image © Adobe Stock

- GBP/USD reference rates at publication:

- Spot: 1.4113

- Bank transfers (indicative guide): 1.3719-1.3818

- Money transfer specialist rates (indicative): 1.8896-1.4014

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Dollar was bid higher following the release of data showing U.S. inflation is starting to burn hot, leading investors to question just how long the Federal Reserve can afford to maintain its current ultra-low interest rate policy.

The Dollar regained some of the ground it has lost to the British Pound over recent days and held an advance against the Euro and other major currencies after headline U.S. CPI inflation read at 4.2% year-on-year for April, which is a stronger read than the 3.6% increase analysts were expecting.

This makes for a sharp increase on March's 2.6% outturn and confirms the economy is heading into a period of heightened inflation.

The Wednesday U.S. inflation released had been widely flagged by economists as the must-watch data release of the week given investors are becoming increasingly nervous about growing inflationary pressures not just in the U.S. but right across the globe.

While foreign exchange markets have proven relatively sanguine to rising inflation expectations the global sell-off in stocks, in particular technology stocks, signifies the issue is not without consequence for investors.

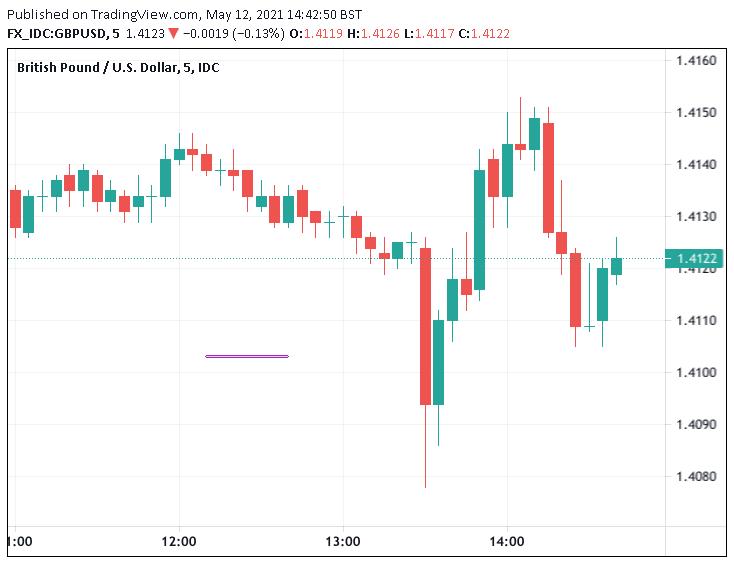

Above: GBP/USD volatility in the wake of the inflation data release.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The month-on-month inflation reading stood at 0.8% for April, which is well ahead of the consensus forecast for a reading of 0.2% and ahead of the previous month's 0.6%.

When looking at the data it must be emphasised that the current readings are being compared to the deep slump in inflation on a year-on-year basis, as the previous April saw a sharp slump owing to the global covid-induced economic slowdown.

The Federal Reserve (Fed) has indicated it is inclined to look through the 'noise' that a series of hot inflation readings of over 2.0% over coming months, eyeing them as likely to be transitory.

But, a strong core CPI reading of 3.0% for April - much stronger than the consensus expectation for a reading of 2.3% - will likely see some in the market question the sustainability of the Fed's stance. After all, core CPI strips out variables such as fuel which might be more susceptible to global dynamics.

It is arguable that the Fed has more influence on core inflations by virtue of their ability to control quantitative easing and interest rates.

"Inflation flew past consensus forecasts in April, as it was revved up from a record monthly increase in used car prices, and took off due to higher airline fares. However, even outside of these two areas, which both saw double-digit increases on the month, inflation was firmer than the consensus had predicted, suggesting that price pressures as the economy reopens may not be quite as transitory as the FOMC projects," says Andrew Grantham, Senior Economist at CIBC Capital Markets.

The market will likely support the U.S. Dollar if they believe the Fed will have to shift stance and start bringing forward the time they intend to reduce quantitative easing (taper) and bring forward the time of the first interest rate rise.

The Fed says it is employment that really matters when considering monetary policy and given last Friday's dire labour market reading investors were inclined to take the Fed's word that rate hikes were still in the distance.

But should inflation begin to look as though it could become more permanent, that position could be increasingly tested.

{wbamp-hide start}

|

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

CIBC's Grantham says one higher than expected inflation print, no matter how dramatic, won’t change the Fed's mind on current policy settings, particularly given that there were a couple of standout areas driving today’s surge.

"However, with price pressures even outside of those categories also firming, we suspect that inflation won’t be quite as quick to cool as policymakers project," he adds.

FOMC member Richard Clarida was quoted by newswires following the release, saying that inflation is likely to rise somewhat further before moderating later this year.

He did however say "I was surprised this number was well above what I had expected."

Fawad Razaqzada, Market Analyst at Think Markets says the view is an interesting one as it could amount to a subtle hint that he and some of his FOMC colleagues may be underestimating rising price pressures.