Pound-Dollar Rate Hits New 34 Month Best, but RBC Capital are Sellers

Image © Adobe Images

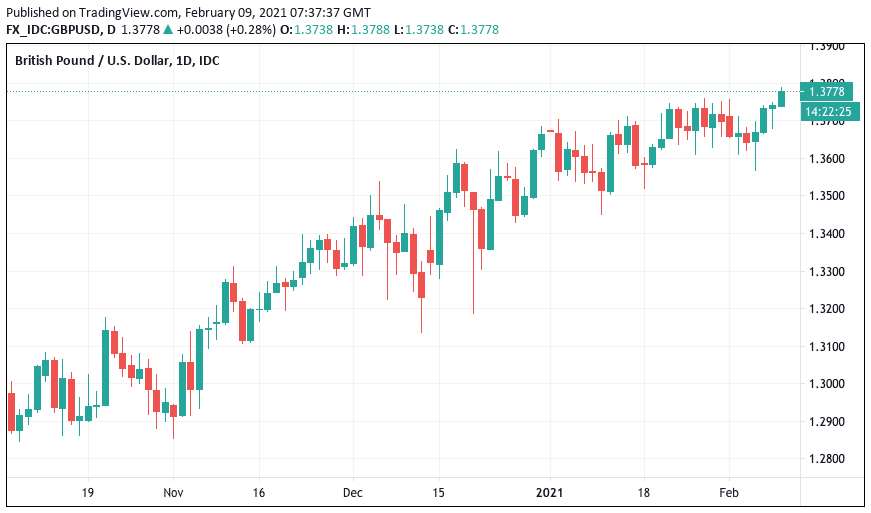

- GBP/USD spot rate at publication: 1.3781

- Bank transfer rates (indicative guide): 1.3400-1.3490

- FX transfer specialists (indicative guide): 1.3560-1.3685

- More information on securing specialist rates, here

The British Pound has reached its highest levels in nearly three years on February 09 amidst a bout of U.S. Dollar selling, however foreign exchange strategists at a prominent investment bank say they are sellers of of the exchange rate.

The Pound-to-Dollar exchange rate (GBP/USD) rallied to 1.3788, giving purchasers of dollars their best exchange rate since April 30, 2018.

The move higher for GBP/USD appears to be a function of a broader turn lower in the U.S. Dollar as opposed to any jump in Sterling.

The Dollar is softer after global equity markets turn cooler with European and Asian markets trading in the red, and U.S. futures also indicating a softer session ahead. Back in 2020 such market conditions would have been met by a stronger Dollar, but 2021 has seen the currency's relationship with markets flip.

The Dollar now appears to be positively aligned with equity market moves, particularly U.S. markets which continue to outperform their global rivals on an expectation that the U.S. economy will continue to outgrow the rest of the world over coming months.

U.S. markets had hit new record highs just hours earlier, therefore it would be incorrect to say investors sentiment has turned sour and likewise it is too soon to call an end to the Dollar's short-term 2021 bull run.

However the Pound is the one currency that has shown an ability to resist U.S. Dollar strength this year and GBP/USD is actually up 0.85% in 2021.

Adam Cole, Chief Currency Strategist at RBC Capital Markets notes this solid performance but says he is looking for Sterling's strength to unwind over coming days.

"Data calendars in most of G10 are quiet this week and we look for a tactical reversal in the year’s outperformer," says Cole, who has made selling GBP/USD his "Trade of the Week".

The UK is due to release economic growth data for December and the fourth quarter of 2020 on Friday, February 12, but Cole says the data will offer the Pound little support given its irrelevance.

Instead, Cole says market attention should return focus to Brexit and the clogging up of trade between Great Britain and Northern Ireland, which could in turn trigger animosity between the EU and UK.

"Anecdotal evidence so far is poor (yesterday’s reports of a collapse in EU export volumes, for example). As officials scramble to solve trade frictions between NI and GB this week, there is a risk of acrimonious flare ups between the UK and EC," says Cole.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Political tensions concerning Northern Ireland have increased of late.

Northern Ireland's DUP and other unionist parties have been calling to scrap the Northern Ireland Protocol, following evidence of some disruption to trade arriving at Irish Sea ports from the rest of the UK.

EU and UK officials have been locked in talks to try and resolve the issues and Cabinet Office minister Michael Gove said trading arrangements in Northern Ireland are "not working" yet but "can be made to work".

But Gove said the EU should extend a grace period on customs checks for goods arriving in Northern Ireland from the rest of the UK, something the EU is refusing.

Gove criticised the EU Commission's decision to trigger Article 16 of the Northern Ireland protocol in January over vaccine supplies.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

He called it a moment "when trust was eroded, when damage was done", and when Ireland and other EU member states were "ridden roughshod over".

"Pandora's Box has been opened and that is concerning... who knows what Trojan horses will come out," he told MPs on Monday, adding:

"If people put a particular type of integrationist theology ahead of the interests of the people of Northern Ireland they are not serving the cause of peace and progress in Northern Ireland, and that is my principal and overriding concern.

"Even though the EU said they would not be invoking Article 16 on this occasion, they haven't given us a binding undertaking never to do so."

RBC Capital's tactical trade on the GBP/USD exchange rate looks to target a fall back to 1.3450.