Dollar is Best Performer, Powell Bats away Market Volatility Concerns and Maintains a Steady Course

Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

- GBP/USD spot at publication: 1.3643

- Bank transfer rates (indicative guide): 1.3265-1.3361

- FX transfer specialist provider rates (indicative): 1.3504-1.3547

- More information on accessing specialist rates, here

The Dollar has strengthened over the course of the past 24 hours in the wake of the Federal Reserve policy meeting, although the prime driver of the move appears to be a sharp decline in markets.

The world's leading stock markets indices shed nearly all their 2021 gains in a matter of hours as investors sought to pare back on exposure to an increasingly frothy market, with intense retail investor involvement in obscure and struggling companies stoking fears of market instability.

The Dollar rallied against the Euro, Pound and other major currencies as investors sought the relative safety of the Greenback, although gains by the currency could have been significantly greater were it not for the solid messaging from the U.S. Federal Reserve.

Federal Reserve Chairman Jerome Powell delivered the Fed's January Federal Open Markets Committee statement and answered questions from the press about the current market volatility.

Interest rates and asset purchases (quantitative easing) measures were unchanged, as expected, leaving markets to focus squarely on messaging about future policy changes.

"The dollar has rallied by the most in a month overnight courtesy of a Federal Reserve that was dovish bit not dovish enough for most. Ongoing pressures in equity markets and the fears that a bubble may be popping or at least deflating in some places undermined risk appetite overnight, sending stocks lower, bonds higher and the USD higher too," says Jeremy Thomson-Cook, Chief Economist at Equals Money.

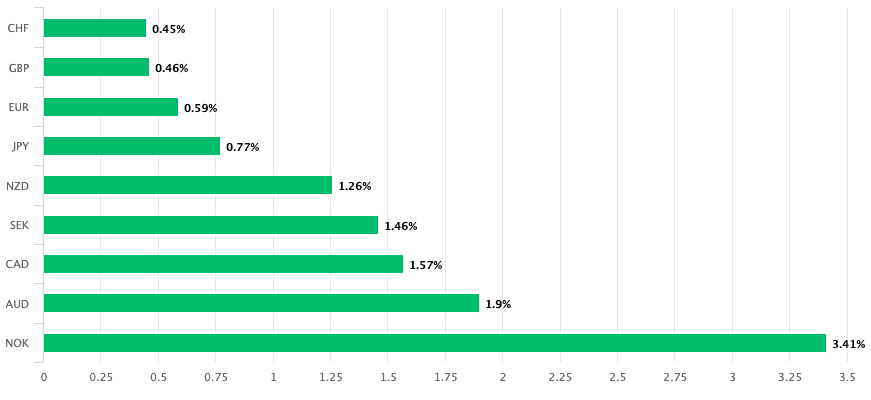

Above: The USD is now the best performing G10 currency of the past week

Powell was clear that the volatility triggered by retail trader participation was not a matter for the Fed, indeed he maintained a view the Fed had no hand in creating a market bubble as some journalists implied and that he was relaxed with broader valuations.

The assessment amongst analysts on Thursdasy is that the market volatility of the past 24 hours appears to be a short-term correction in positioning following the heady gains of late 2020 and the first part of January.

In particular, the ability of social media forums to create significant interest in stocks that are being heavily 'shorted' by institutional investors and hedge funds appears to be central to the current clearing out of market positioning.

Smaller retail traders are piling into companies such as GameStop - which are being shorted by hedge funds - and creating massive short squeezes that in turn delivers them profits. As funds exit their bets against companies like GameStop, they only accentuate the rally as they are forced to buy stock to cover their positions. But the overall contribution of these movements is one of uncertainty as investors question old paradigms.

"Funds have not only been covering their short positions - the bets they placed against individual shares - but also selling shares in companies to cut their leverage and reduce their gross exposure to the market," explains Ortenca Aliaj at the FT.

But Powell was not to be swayed by the market excitement and emphasised that from a fundamental perspective nothing had changed for markets and that the Fed would provide the necessary supportive backstop many investors have come to rely on.

In a statement, the Fed said "the pace of the recovery in economic activity and employment has moderated in recent months," and further supportive policy measures could be required if the situation deteriorates.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

But, the Fed remains convinced that the economic hardships wrought by the covid-19 pandemic will still likely remain front-loaded into 2021 and that a more durable recovery should ensue in the second half of the year.

"Powell explained that risks are mostly concentrated in the near term, whereas prospects for 2H 2021 have improved, despite lingering downside risks. Therefore, monetary policy must remain accommodative to support the recovery. Powell reasserted that it is early days yet to start considering a tapering of purchases," says analyst Asmara Jamaleh at Intesa Sanpaolo.

Concerning the all-important matter of exiting the current quantitative easing programme - known as tapering - Powell was clear that this is not on the agenda.

"The whole focus on exit is premature," said Powell.

January has seen the yield paid on U.S. government bonds rise as markets anticipate that the tapering of asset purchases is drawing closer, particularly as expectations for inflation are rising.

"The likely first move would be a ‘tapering’ (i.e. lowering) of the pace of additional asset purchases. Some Fed policymakers have suggested that this may start later this year, which helped fuel a rise in ten-year Treasury yields from 0.91% at the end of December to a near-term peak of close to 1.20% by 12th January," says Rhys Herbert, Economist at Lloyds Bank.

These bouts of rising yields have tended to in turn to support the Dollar. But Powell is eager to avoid a repeat of the 2013 'taper tantrum' where markets fell and the Dollar rose sharply as investors panicked at the loss of Fed support.