Dollar Decline Seen Fueled by Federal Reserve Twist on Wednesday as Longer Yields Come Under Fire

- Written by: James Skinner

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3435

- Bank transfer rate (indicative guide): 1.3065-1.3159

- FX specialist providers (indicative guide): 1.3233-1.3341

- More information on FX specialist rates here

The Dollar was down for the count against all major currencies on Tuesday but within recent ranges, although declines could be fueled over the coming sessions by the Federal Reserve, which could be about to target longer U.S. government bond yields with its quantitative easing programme.

Dollars were sold widely, although the greenback's greatest decline came against a resurgent Pound Sterling which was tempted into a further recovery of last week's losses by speculation suggesting that a Brexit trade agreement could be agreed before the week is out.

Outside of Europe U.S. Dollar declines and commodity currency gains were bolstered by an early stage rollout in the U.S. of the Pfizer and BioNTech coronavirus vaccine following its approval by the Food & Drug Administration last Friday for emergency use.

"Not without the occasional wobble but the bottom line is still that the vaccines, when combined with this FOMC (which will leave the current pace of asset purchases in place on Wednesday) are bad for the dollar and good for the world. We like expressing positive views with longs in NOK, AUD and CAD," says Kit Juckes, chief FX strategist at Societe Generale.

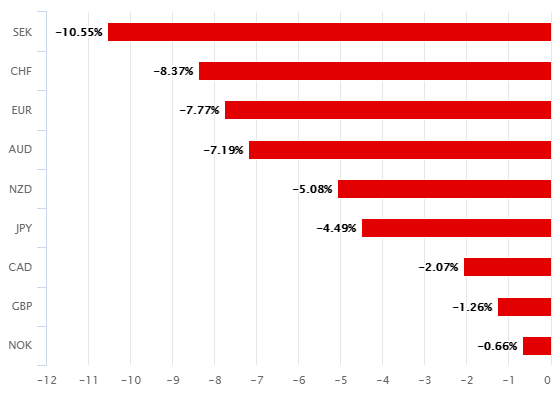

Above: U.S. Dollar performance against major currencies in 2020. Source: Pound Sterling Live.

Vaccine progress has stoked hope in the market of a more durable global economic recovery next year after the current one was marred by renewed restrictions in Europe and North America, where containment measures have continued to be strengthened. New York City Mayor Bill de Blasio has been quoted frequently in recent days calling for a fresh 'lockdown' of his city, home to one of the world's largest financial centres.

Other U.S. cities and states have also imposed new curbs on activity at a quickening pace ever since November's election. This, and an ongoing inability or unwillingness of lawmakers in Washington to put aside partisan political views has elevated the importance of Wednesday's Federal Reserve decision even though the economic outlook for next year is now much brighter in the wake of the FDA's vaccine approval.

"Our key take-away is that an Operation Twist is likely in December and that asset purchases will be kept at the same minimum tempo (in contrast to the tapering announced by BoC) – in particular since Mnuchins decision to veto against the prolongation of crisis measures has been taken after the FOMC meeting in November," says Andreas Steno Larsen, chief FX strategist at Nordea Markets. "We also think that the Fed intends to launch a set of guiding principles on how long the asset purchases will run for."

Above: Pound-to-Dollar rate shown at daily intervals alongside Euro-to-Dollar rate (black line, left axis).

Minutes of the Fed's November meeting, released near the end of last month, hinted that it could in December or subsequent months look to reorient its quantitative easing programme toward longer-term bonds by lengthening the "weighted average maturity of the Federal Reserve’s purchases."

Bonds with longer terms of seven years and above still offered investors on Tuesday something that might pass, under bad lighting, for some semblance of 'yield' that could be squeezed out by targeting exactly those parts of the 'yield curve' with the Fed's purchases. The objective behind any decision to target them would be the reduction of financing costs for the government as well as real economy which, along with direct loans to the banking sector, is about all the Fed can do for its crisis-fighting contribution.

"This event will of course be important to the outlook for the US dollar," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "Whatever the specifics of the outcome tomorrow we expect the conclusion to be that the Fed will ensure accommodation is maintained, thus providing the basis for the US dollar to weaken further in 2021. Over the short-term, we may have reached a level that draws better two-way flows that result in the key USD pairs consolidating at these weaker levels. Overall combined speculative positioning does imply a large short USD position which suggests some caution over assuming continued USD depreciation

into year-end. However, any USD rebound is likely to be short-lived."

Above: 02-year U.S. bond yield, the primary target of the Fed, alongside 07-year (black), 10-year (orange) & 30-year (yellow).

Targeting longer yields could potentially be a fresh headwind for the U.S. Dollar given that yields are the only cash flow and the primary return earned by investors in government debt.

The bank has been buying $120bn per month of U.S. government bonds since not long after the beginning of the pandemic in a bid to force down the financing costs of the government as well as American companies and households.

This was after cutting its interest rate to 0.25% and implementing a range of other initiatives to improve access to debt financing for all actors in the economy, as well as enhancing global markets' access to U.S. Dollars. The decision is due out at 19:00 London time on Wednesday and is set to be followed half an hour later by a press conference and fresh round of economic forecasts.

"The meeting carries with it the risk of a market temper tantrum if investors fail to get what they want, namely, even more accommodation from a Fed that has been providing everything expected and more since 2019. The US dollar risks are distinctly two-way over this meeting," warns John Hardy, head of FX strategy at Saxo Bank. "A shoulder shrug from the Fed and wait and see stance could see the USD backing up, while a clear commitment to ensure that longer yields won’t be allowed to rise much could encourage a fresh wave of USD selling."