Pound-Dollar Rate Forecast: "Now or Never" say the Charts

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3347

- Bank transfer rate (indicative guide): 1.2941-1.3050

- FX specialist providers (indicative guide): 1.3101-1.3181

- More information on FX specialist rates here

The next one to two weeks will prove critical in determining whether the Pound-Dollar exchange rate is able to break into the next phase of its uptrend, according to a new analysis of the market's technical setup.

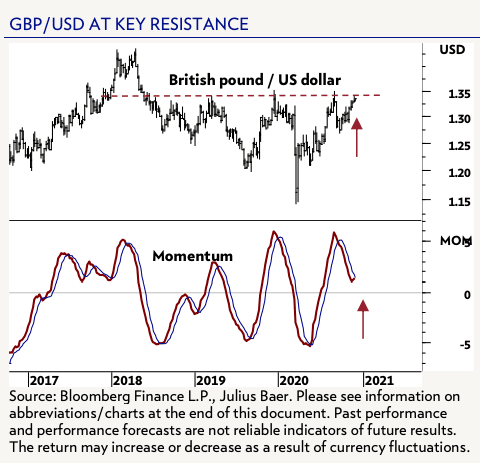

"The GBP/USD has been forming a classical head & shoulder reversal pattern. Looking at the chart, we see that 1.35 is a major resistance level. With a new medium-term momentum indicator bottom, a new attempt has started to resolve the reversal pattern and enter a sustainable recovery," says Mensur Pocinci, Head of Technical Analysis at Julius Baer.

Pocinci describes the current setup for the Pound-to-Dollar exchange rate as being a "now or never" moment:

Image courtesy of Julius Baer.

"Thus, over the coming one to two weeks, it will be critical to see if 1.35 can be broken," says Pocinci. "A sustainable rise above 1.35 should lift the mood and open the way to at least 1.40 or even 1.45. Thus, we recommend investor to stay long GBP/USD."

The Pound has been in an uptrend against the U.S. Dollar since September, going from 1.2680 to current levels above 1.33.

Price action over the past week has seen the exchange rate constantly knocking its head on the ceiling at 1.34, with all attempts being rebuffed by sell orders, betraying a market that is not yet convinced Sterling has the legs to sustainably break higher.

"GBP/USD is approaching major long term resistance, and we suspect the market will struggle to clear this. Major resistance is offered by the 1.3422 2007-2020 downtrend and the 1.3515 pivot which now needs to be monitored," says Karen Jones, Team Head, FICC Technical Analysis Research at Commerzbank.

The fundamental input into a wavering amongst market participants is of course the status of post-Brexit trade negotiations, where a final breakthrough is yet to materialise. Indeed, concerns that the final stumbling blocks will prove insurmountable have kept rallies in Sterling in check.

"The waiting game for GBP continues, but we can expect more days of contradicting headlines driving intraday oscillations in GBP. As time goes on, we should see the size of such swings increase as markets attribute a bigger weight to any remarks by both parties’ officials," says Chris Turner, analyst at ING Bank N.V.

{wbamp-hide start}

|

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

However, the clock cannot be beaten and a resolution is nigh, with a number of analysts we following pointing at the December 10-11 European Council meeting as offering the chance for a last ditch push by leaders to seal a deal.

Progress here could see 1.34-1.35 resistance in GBP/USD give way, while failure would almost certainly confirm this level as being a formidable ceiling.

The near-term failure of GBP/USD to break 1.34 coincides with the failure of EUR/USD to break above 1.20: the market is broadly contained by significant technical resistance levels, which if broken would yield to notable declines in the broader value of the dollar.

"EUR/USD was repelled at the 1.2000 resistance yesterday, but a break above that level appears more a question of when rather than if as the bearish-USD story appears to be consolidating," says Turner.

A break above 1.20 in EUR/USD would likely open the door to a break in GBP/USD at 1.34, provided all else stays equal, i.e. a break in 1.20 in EUR/USD even as Sterling treads water in anticipation of a Brexit deal could still deliver the technical breakthrough the market is waiting for.

But foreign exchange analysts at JP Morgan are not yet willing to be enticed into a bet on GBP/USD upside.

"Our view remains pretty entrenched and we still cannot see the value in being long GBP for what is becoming an increasingly expected (and not particularly good) outcome as positioning remains quite long the pound, in terms of 2021 we are getting more bearish on the greenback going into the end of the year but there are better USDs to be short of out there," says a note from JP Morgan's London spot trading desk.

Thanks to FXWatcher.com for some of the above research quotations.