Pound-to-Dollar Rate Risks Trend Reversal amid Virus Fears; Needs to Hold Current Levels

- Written by: James Skinner

- GBP threatens breakout to downside, bearish trend reversal.

- Commerzbank eyes uptrend support near 1.29 in GBP/USD.

- But a daily close below 1.2980 also portends trend reversal.

- Would mark downward resolution of consolidation pattern.

- Risk appetite key to short-term outlook, virus fears the driver.

- UK Gov 5G decision may also rankle with White House, GBP.

Image © Adobe Images

- GBP/USD Spot rate: 1.3013, down 0.35% today

- Indicative bank rates for transfers: 1.2658-1.2749

- Transfer specialist indicative rates: 1.2818-1.2896 >> Get your quote now

The Pound underperformed on Tuesday in a market that was still blighted by unease over the spread of China's new coronavirus, although losses have now got the Pound-to-Dollar rate threatening a break below key support levels on the charts, which would risk further downside over subsequent days.

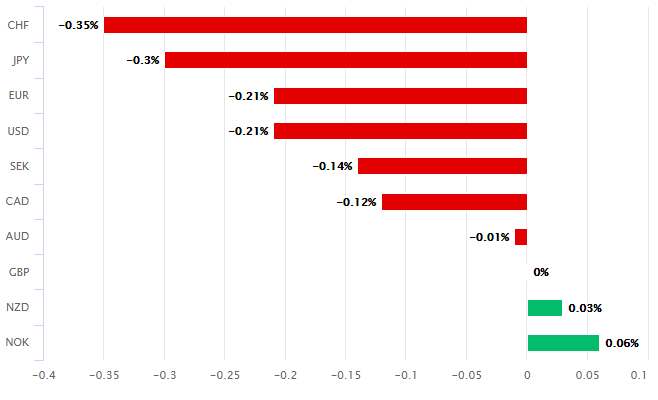

Sterling was the third worst performing major currency Tuesday as investors flocked toward the Dollar and other safe-havens amid fears over the continued spread of China's new coronavirus, which is now threatening to bring meaningful parts of the world's second largest economy to a standstill. However, stock markets rebounded from Monday's losses in the morning session Tuesday, which could indicate salvation for riskier prospects in other asset classes.

"More than 50 million people in China are now in a lockdown. It is also worth considering the following: what if we are on the brink of an exponential increase in the number of people affected by the deadly virus?," says Piotr Matys, a strategist at Rabobank. "While travel restrictions have been put in place, it could be too late. The worst may yet to come despite the best efforts by the Chinese authorities to contain the virus."

Above: Pound Sterling performance against major rivals Tuesday. Source: Pound Sterling Live.

"Concerns about severe impact on China and the global economy are reflected in rising demand for safe haven assets. The yield on the 10-year US Treasury plunged below the trendline support from the September low," adds Rabobank's Matys. "The US dollar is the beneficiary of growing demand for Treasuries..A bullish breakout in the USD Index would provide USD/EM crosses...Commodity currencies have been the most impacted so far."

The Pound may also have been impacted Tuesday by the anticipated outcome of a National Security Council decision expected from Downing Street. That will see the government decide whether to allow China's Huawei to participate in the construction and maintenance of the UK's '5G network,' and expectations are for a China-friendly decision that would irk the U.S. and which could compromise the budding relationship between Boris Johnson and President Donald Trump.

Weakness also comes as Thursday's interest rate decision from the Bank of England (BoE) looms on the horizon. Markets pared back their expectations of a rate cut last week, which may have been foolish in light of the mounting threat posed to the global economic backdrop by the virus in China.

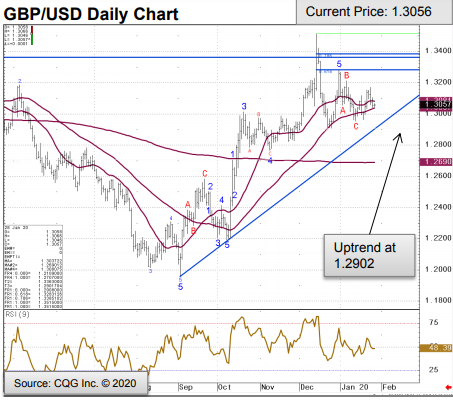

Recent falls have now got the Pound testing an upward sloping trendline and threatening a breakout to the downside from a symmetric triangle consolidation pattern that's become ever clearer on the 4-hour and daily charts of late. And a daily close beneath either of the relevant levels would be a technical harbinger of further downside fAbove: Pound-to-Dollar rate shown at hourly intervals.

"GBP/USD charted an outside day to the downside on Friday and it is possible that it will react back to its 1.2902 uptrend near term," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "The market is currently underpinned by the 1.2902 uptrend and the December low at 1.2908. Failure here would put the 200 day moving average at 1.2690 back on the plate. We have no strong bias."

Jones says Sterling needs to hold above 1.2902 to avert a deeper decline to 1.2690 because the former represents an upward sloping trendline that dates back to September, around the time markets had largely priced-in a 'no deal' Brexit that was subsequently taken off the table by an October agreement between Prime Minister Boris Johnson and the European Commission.

Analysis from elsewhere suggests that even a daily close beneath 1.2980 might be enough to augur more losses over the coming days. In other words, Sterling needs to hold near to its Tuesday level of 1.3020 in order to retain the technical initiative over the Dollar in the days and weeks ahead.

Above: Pound-to-Dollar rate graph highlighting post-September 2019 uptrend line. Source: Commerzbank.

"Another close below 1.30-1.2961 confirms a technical top and signals a decline to 1.2685. Otherwise spot is attempting to form a bigger picture double bottom. The 4Q19 rally looks like a successful repeat of the April-Sept 2017 rally, so far, with more to achieve," says Paul Ciana CMT, chief technical analyst at BofA Global Research, in a research note last week.

Sterling was suffering Tuesday mostly because FX investors and traders were still eschewing so-called risk assets amid mounting uncertainty over whether Chinese authorities really do have a grip on the coronavirus that has now spread to many other countries including Germany, the U.S. and Australia. German media reported Tuesday that the country has a confirmed case of coronavirus that looks to be the result of human-to-human transmission.

"The US Dollar Index – Dollar strength remains evident and looks to extend further towards the next band of resistance at 98.37/54 (May high, November high and 61.8% retracement)," Commerzbank's Jones also said on Tuesday.

Above: Pound-to-Dollar rate shown at daily intervals.

And the below at least purports to be from Birmingham, England.

what have i just witnessed outside my flat???????? in harborne ???? #coronavirus pic.twitter.com/P0tnLsqHLQ

— moll???? (@MollieLuneBCFC) January 27, 2020

China's National Health Commission said Tuesday that at 24:00 on January 27, it was aware of 4,515 confirmed cases of the new coronavirus, up from 291 less than a week ago on January 21.

That's according to a Yandex translation of a notice on the Commission's Chinese language website.

The Commission declared 977 "severe cases," up from zero on January 21 and 102 on January 22. There were 106 deaths declared as of midnight Monday, up from zero on January 21 and from 9 on January 22. And the Commission said that it was tracking 6,973 suspected cases, up from 922 on January 21.

Little is known about the virus or its destructive capacity although one thing that's clear is that it can spread rapidly. It's also believed the stricken may be contagious even before they begin to show symptoms, which is enough to make it a significant economic threat even if the mortality rate appears low.

Assuming that China's figures are accurate, the mortality rate is less than 3% - although that doesn't mean the virus can't bring economies to a standstill. China's Hubei province, not to mention other municipalities, are now in quarantine and cut off from the rest of the country. Meanwhile, and likely fearing infection, citizens have taken to shutting themselves indoors.