Pound-Dollar Rate Weakness Is a Buying Opportunity, Strategist Says

- Written by: James Skinner

Image © Adobe Images

- GBP unravels after BoE Governor spooks market.

- BoE says rate cuts and QE still on the MPC's table.

- Marring the market's view of Brexit's 'sunlit uplands'.

- But BMO eyes opportunity ahead of March budget.

- Says market could be surprised by scale of stimulus.

- Deutsche Bank estimates gov has £60 bn to splash.

The Pound underperformed most major rivals in the noon session Thursday after Bank of England (BoE) Mark Carney shocked markets by telling a conference in London the BoE is still contemplating cutting interest rates, although BMO Capital Markets says the resulting falls are a buying opportunity.

Monetary Policy Committee members are still contemplating interest rate cuts, according to Carney, who also told markets there's still plenty of scope for more quantitative easing in the UK. He said during a speech that further economic weakness in the months ahead would be met with a rate cut and claimed the bank has scope to provide stimulus to the economy that is equivalent to 250 basis points of rate cuts despite Bank Rate being at only 0.75%.

The 'dovishness' of Carney's comments took the Pound by surprise given that investors had generally perceived the outcome of the December election as something that not only reduced downside risks to the economy but also a development that might actually lead to a pickup in growth. However, the governor will leave the bank on March 16 and is set to be replaced by BoE veteran Andrew Bailey who could yet have an impact on the thinking of the Monetary Policy Committee - if he hasn't already.

"We would prefer to buy the pair here (1.30 or so) with a stop at around 1.2850 and a target in the mid-1.30s. There is an apparent lack of liquidity in the pair, so levels need to be considered carefully, but we think there is a case for a "bigger-than-anticipated" fiscal policy shock over the coming weeks and months as the March Budget draws nearer," says Stephen Gallo, European head of FX strategy at BMO, referring to the Pound-Dollar rate.

Above: Pound-to-Dollar rate shown at hourly intervals.

The UK economy had a tough few quarters in 2019 and by most accounts will have slowed for the year overall. Consensus has envisaged from moment one GDP growth of 1.3% for the year, down from 1.4% in 2018, although even that now looks to be an ambitious target. The economy grew 0.4% in the third quarter and by 0.6% in the first quarter of last year, but it contracted 0.1% between those two periods and needs an unlikely expansion of 0.4% for the final quarter just to meet the downbeat consensus.

"Even after accounting for the 2019 Spending Round and manifesto commitments, the Chancellor will have somewhere around GBP 60bn in additional fiscal space over the next four years. The majority of this will be skewed towards investment (~ GBP 40bn) with a smaller share left for additional day to day spending. Altogether, this amounts to a sizeable 3% of GDP in potential government spending," says Deutsche Bank economist Sanjay Raja.

Even after December 's election result and Sterling's subsequent bounce, often billed as a 'Boris bounce', investors were still pricing some probability of a rate cut in the coming months. The market-implied Bank Rate for April moved from 0.58% in early December to 0.64% before Carney spoke Thursday, suggesting investors still saw around a 50% probability of a cut but also implied plenty of scope for an actual move to be fully priced in.

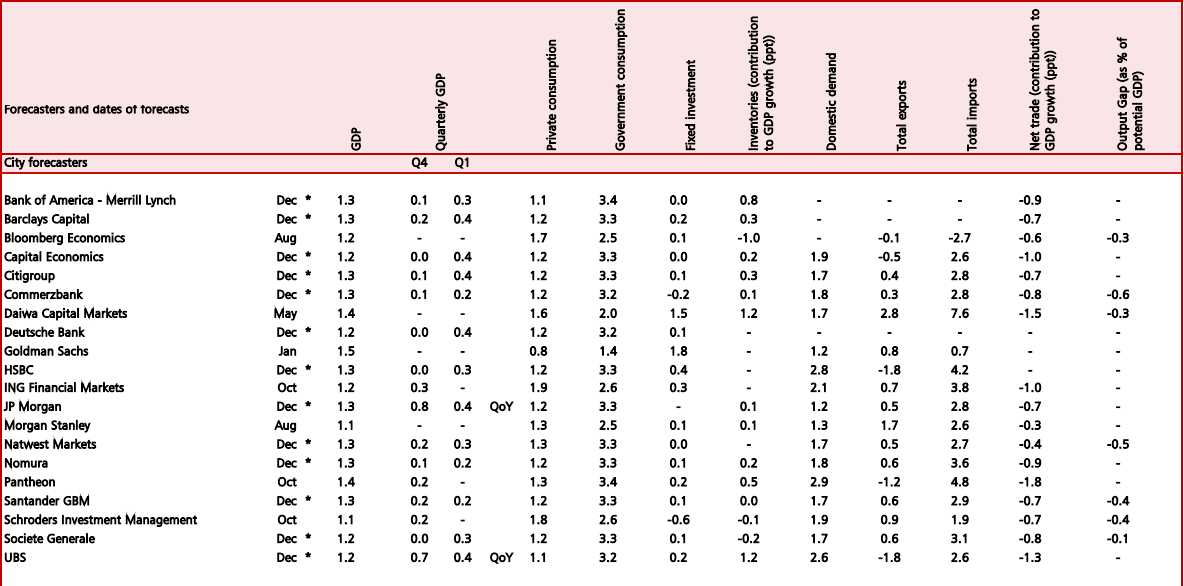

Above: Private sector forecasts for UK GDP and its components in 2019. Collected by HM Treasury in December 2019.

Forecasts collected by HM Treasury in December suggest the market is even more downbeat on the economy's prospects for the year ahead, with consensus last month anticipating a 1.1% increase in GDP growth for 2020. However, the newly-elected government of Prime Minister Boris Johnson will present its maiden budget in March and markets have long been briefed to expect at least some form of fiscal stimulus to be unveiled, although Gallo says investors could still be surprised by the scale of stimulus.

"We''ll have more on this stance in an upcoming weekly Insight piece," Gallo writes in a note to clients. "The broad value of the USD is trading moderately higher as measured by the BBDXY, but most of the strength in the Index has been fed by weakness in other G10 currencies. The rebound in risk appetiite, meanwhile, has tended to provide support to various EM currencies."

There is broad support in the wider market for Gallo's view or something like it, with many firms looking to see the Pound win back more previously-lost ground from the Dollar over the course of 2020, although some forecasts are motivated more by anticipation of weakness in the greenback than they are strength in Sterling. However, the UK has entered what will be a formative year for the economy and political constitution so the path ahead could be a bumpy one.

Above: Pound-to-Dollar rate shown at daily intervals.

The House of Commons voted in favour of the Withdrawal Agreement Bill by 330 to 231 at its third reading Thursday. The government has 365 MPs.

Boris Johnson's bill will now go to the House of Lords where it faces further votes. Ratification will lead to a technical EU exit on January 31, at which point the UK will enter a 'transition period' where the current relationship is preserved until the end of 2020 or the point when a future relationship is agreed.

European Commission chief Ursula Von der Leyen said Wednesday that it's "basically impossible" for the UK and EU to agree their future trade relationship before the end of 2020 despite a uniform starting position in terms of regulations and current external trade settings. The EU boss may well be playing for time, not to mention budget contributions that will continue to be billed throughout the looming transition period, but if the EU didn't hold all of the cards before then it certainly will once Johnson's withdrawal agreement is ratified.

The withdrawal agreement will leave Johnson with a choice between a 'no deal' Brexit for Great Britain that radically weakens the constitutional bond between it and Northern Ireland, or extending the transition period in defiance of a manifesto pledge in the event that UK negotiators cannot satisfty the EU with its concerns about the integrity of its single market in a post-Brexit world where there is an open border on the island of Ireland.

In other words, there's still plenty of scope for Sterling to occasionally be blighted by Brexit headlines and renewed political uncertainty in 2020.

"The twenty-first Joint Ministerial Committee (EU Negotiations) met today at 70 Whitehall in London. The meeting was chaired by the Chancellor of the Duchy of Lancaster," the UK government said Thursday. "The Committee discussed the UK’s exit from the EU, including preparations for the UK-EU future relationship negotiations and a forward look to post-January engagement structures."

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. Global Reach can offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement