U.S. Dollar Index is Vulnerable, Technical Analyst Says, as Other Currencies Turn Higher

- Written by: James Skinner

Image © Adobe Images

- USD index softens, tests major trendline support level.

- Is now vulnerable to the downside says Commerzbank.

- As EUR, GBP and CAD turn higher against the USD.

- Westpac says model is buying USD, but eyes the Fed.

- Says forthcoming Fed decisions key to the USD outlook.

The Dollar index softened on Tuesday but technical analysts at Commerzbank say an ongoing test of a major trendline of support on the charts has left the U.S. currency vulnerable to further losses in the days and weeks ahead.

The Dollar index, a broad measure of the greenback relative to a number of its most frequently traded rivals, had drawn support earlier Tuesday from fresh doubts about the viability of the trade accord that was said to have been struck by the U.S. and China on Friday. But the greenback was beaten into a modest retreat late in the European session as the Pound rallied in response to fresh speculation suggesting a Brexit deal could be reached this week.

Sterling's upward climb enabled the Euro, which accounts for one half of the Dollar index, to move back into the black for the Tuesday session. Canada's Dollar, another constituent of the index, also enjoyed a strong gain as it followed the S&P 500 higher during the noon session.

The rub for the greenback is that Tuesday's retreat has led it to test for a second time, an important level of support on the charts.

Above: Dollar Index at hourly intervals alongside GBP/USD (yellow) and EUR/USD (orange).

"The US Dollar Index has sold off to the 4 month uptrend at 98.31. This is now exposed and failure here will target the more important 2018-2019 uptrend 97.55. [It] is increasingly viewed as vulnerable to the downside," says Karen Jones, Commerzbank's head of technical analysis for currencies, commodities and bonds. "EUR/USD has eroded its 4 month downtrend and is expected to head of the top of its one year channel at 1.1296."

The Dollar saw a promising start to the week as European investors got their first chance to vote with their wallets on the deal announced by President Donald Trump late Friday, which is yet to even be written let alone signed, but the Tuesday's noon losses have left the earlier 48 hours of trading looking like a mere blip in a broader pattern of losses. The greenback declined through the latter half of last week as expectations of a U.S.-China breakthrough built.

Whether the Dollar sustains a daily close below 98.31 will be key to if it extends the nascent run of losses for much longer, as far as technical analysts studying trends and momentum on the charts are concerned. That means the Euro, with its significant weight in the index, will play an outsized role in determining the path trodden ahead and the bad news for the greenback is that Jones tips Europe's single currency as well as Sterling to rise further in the coming days.

Above: Commerzbank chart showing Dollar Index with technical indicators overlayed.

"{GBP} is consolidating below the 1.2712 200 day ma and above here we find the 55 week ma sat 1.2753 and the 1.2784 June high. We suspect that these may hold the initial test, but while dips lower hold over 1.2400/1.2365 and the short term up channel at 1.2231 it will remain capable of further upside," Jones says. "USD/JPY has started to erode the 50% retracement at 108.43 (of the move down from April) and the mid September high at 108.48...above here lies the 200 day ma at 109.07 and we would allow for this to hold the initial test."

Jones is looking for the Euro to rise over the coming days which, absent a substantial retracement lower by the Pound, might be enough to ensure the Dollar slips below the trendline and succumbs to further move downward. However, fundamental analysts at Westpac are looking for the Dollar index to rise this week and for a range of other currencies to fall. The bank's financial model has given off a buy signal for the Dollar index this week.

"The model has a notably bullish USD tilt for the week ahead, +22% of the portfolio. A lowering of trade tensions and a fall in various metrics of market volatility have nudged the model into CHF and JPY shorts," says Richard Franulovich, head of FX strategy at Westpac. "Canada’s ongoing run of healthy data leaves the model comfortably long CAD for yet another week. AUD and NZD remain out of favour - still - thanks to negative readings from an array of signals including growth, yield and long term trend."

Above: Dollar Index shown at daily intervals and annotated for recent events.

Last Friday's trade accord between the U.S. and China may yet fall apart in the weeks ahead but it's already achieved one thing for markets by averting an American tariff increase that had been scheduled to go into effect this Tuesday. The resulting ebbing of concerns about an immediate and damaging escalation of the trade war is tipped to carry the Dollar through this week but the Federal Reserve's next steps in its interest rate policy will be key to determining the longer-term outlook.

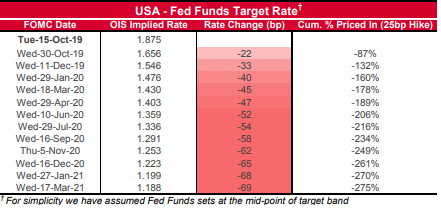

The Fed will announce its next interest rate decision at 19:00 October 30 and investors are growing increasingly confident that it will cut U.S. rates for a third time, taking the top end of the Fed Funds rate range down to 1.75%. But just a few short weeks ago, when the Fed cut rates in September, market pricing had implied that it would be December at the earliest before there was a genuine chance of another cut being delivered.

"In the first few months of either an insurance easing cycle or a more notable easing cycle – the DXY tends to be resilient regardless. But, if the Fed goes beyond a “mid-cycle” adjustment and embarks on a genuine easing cycle the USD eventually capitulates, notching up an average 6%+ decline 9-12 months into the cycle," Franulovich says. "On the other hand if this proves to be a short series of insurance cuts such as 1995 and 1998 the DXY could find itself substantially higher in a few months."

Pricing in the overnight-index-swap market implied on Tuesday, that by October 30 the top end of the Fed funds rate range would sit at 1.78%. That's just three basis points above the level that would prevail if the bank announced a typical 25 basis point cut at the end of this month. Failure to indulge the market with that rate cut over the coming weeks could lift the Dollar, while delivering it might tempt the market into betting that an all out 'easing cycle' is afoot.

Above: Westpac graph showing Overnight Index Swap pricing for the Fed Funds rate.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement