GBP/USD Recovery is Open Invitation for Sellers to Return

- Written by: James Skinner

© IRStone, Adobe Stock

- GBPUSD slips despite broad USD retreat from G10 rivals.

- As Brexit Party poll position puts 'no deal' risk front & centre.

- May 23 EU elections billed as watershed moment for GBP.

- USD conflicted as geopolitics support, slowing growth weighs.

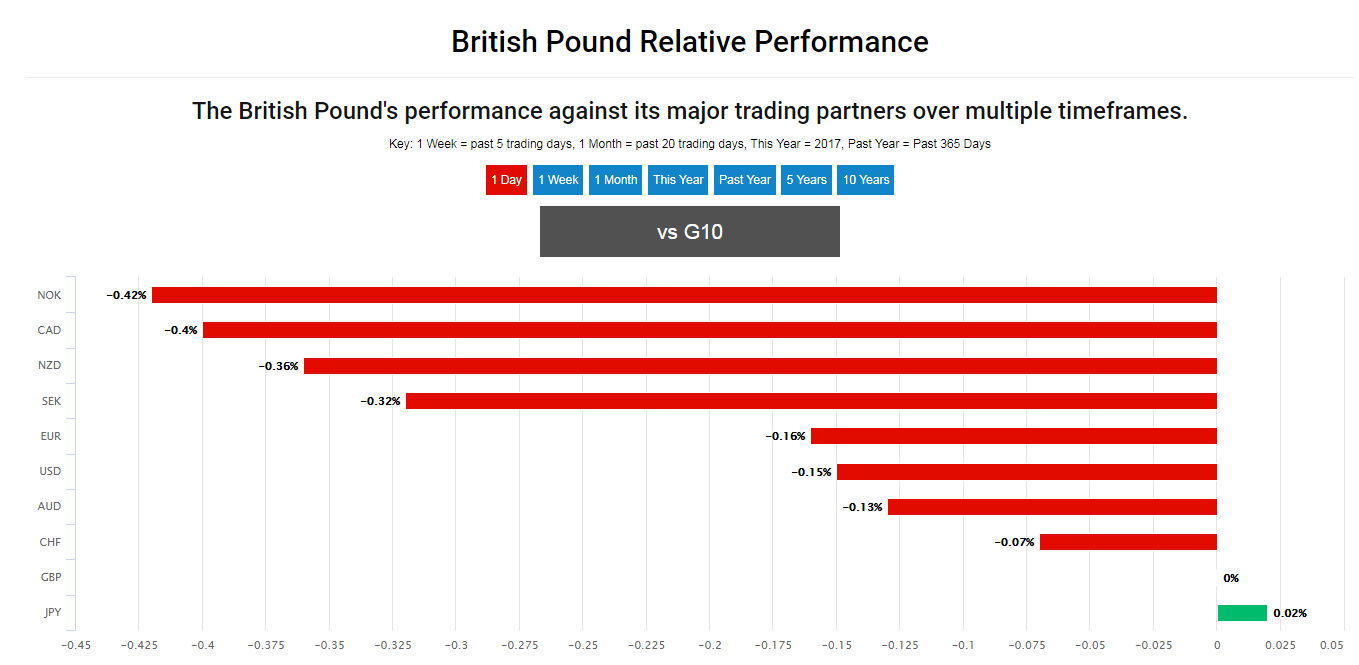

The Pound was languishing close to the bottom of the G10 league table on Thursday after failing to capitalise on a weakening Dollar, given escalating concerns about the likely path the UK will take out of the European Union.

Pound Sterling could well find itself edging higher over the coming days, given the market is increasingly falling out of love with the U.S. Dollar. However, such an intermittent recovery might prove to be little more than an open invitation for short-sellers at a later date.

"President Trump postponed a decision on increasing import tariffs on European cars by up to six months, and equities rallied. US retail sales, industrial production and capacity utilization data all came out soft and bond yields fell as the market shifted to price in a near 80% chance of a 2019 Fed rate cut. The FX market isn't sure what to do with all this," says Kit Juckes, chief FX strategist at Societe Generale.

Sterling was trading at 1.2832 against the Dollar on Thursday morning, which amounts to a - 0.11% loss for the session and makes it one of only two G10 currencies to post a loss against an underperforming U.S. Dollar.

The only G10 currency to perform worse than Pound Sterling on Thursday morning was the safe-haven Japanese Yen, which has been deflated by President Donald Trump's decision to delay the implementation of tarifs on imports of cars from Japan and Europe.

This dire performance comes as concerns over the outlook for the Brexit process have risen back to the fore once again, with Prime Minister Theresa May close to running out of road with her exit plans and under increasing pressure to stand down and make way for a Brexit-supporting replacement.

Above: Sterling's intraday performance against G10 rivals Thursday. Source: Pound Sterling Live.

"When all the dust settles, the UK economy will move from Brexit and in the absence of inflation, sterling will bounce too. But there are still months of uncertainty ahead and the market is worried about the possibility both of a Labour Government and a no-deal Brexit," Juckes says.

Conservative Party Prime Minister May is openly consorting with the Labour Party in the hope of moving her EU withdrawal agreement through parliament on the back of opposition votes, although some analysts say she risks losing more MPs from her own party than she stands to gain from the opposition.

The talks are said to be close to collapse, as the opposition is demanding PM May openly commit to placing the UK in a permanent customs union with the EU, to the ire of Brexit-supporting lawmakers and voters.

PM May's withdrawal agreement and the accompanying political declaration establish a basis for a customs union-like relationship in the future anyhow, but acknowledging that and backing the proposals could hardly be cast by the opposition as a victory.

"If the European elections in the UK produce the result some predict – with a disastrous defeat of the established parties and a spectacular victory for EU hater Nigel Farage – things are going to get interesting for Prime Minister Theresa May. It will be more than questionable whether the Tories would still be willing to enter a compromise with Labour at that stage. “No deal” will become a possibility," warns Ulrich Leuchtmann, head of FX strategy at Commerzbank.

Above: Pound-to-Dollar rate shown at daily intervals.

Leuchtmann says the Pound's underperformance Thursday is likely the result of a meteoric rise through the opinion polls of The Brexit Party, which has sprung out the political ether in the last six weeks with a coalition of European parliament candidates drawn from across the traditional spectrum.

With the May 23 EU elections approaching, The Brexit Party is now offering voters of all stripes with a channel through which they will be able to express their discontent with the government and opposition before the month is out.

This risks casting the cross-party talks in Westminster in an illegitimate light and could yet force the governing Conservative Party into a leadership change and a pivot toward a so-called no deal Brexit.

However, it might take until after the May 23 EU poll for the market to seriously begin contemplating such an outcome, which could leave the Pound trapped in a kind of no man's land up until then.

"GBP/USD is continuing to fall towards the February low at 1.2772, a drop below which would put the October low at 1.2696 on the cards. Immediate downside pressure will be maintained while no rise above the 200 day moving average at 1.2957 is seen. Next up is the May 10 high at 1.3048," says Axel Rudolph, a technical analyst colleague of Leuchtmann's at Commerzbank.

The ongoing Pound-to-Dollar rate decline comes despite an increasingly negative outlook for the greenback, with the U.S. currency currently being propped up by elevated investor concerns about the outlook for global growth in the face of President Donald Trump's second major offensive in the so-called trade war with China.

Above: Pound-to-Dollar rate shown at weekly intervals.

The White House has lifted from 10% to 25% the tariff levied on around $200 bn of annual imports from China and set the ball rolling on a process that could see a 25% tariff imposed on China's remaining $300 bn of exports to the U.S.

China has since retaliated by lifting to 25% the tariff levied from around $60 bn of annual imports from the U.S., and rhetoric from both the U.S. and Chinese governments toward one another is turning increasingly hostile, stoking fears of a protracted trade conflict.

This escalation in the trade conflict comes amid speculation that Iranian military forces could be preparing to attack their U.S. counterparts in Iraq. There are now mounting concerns within the analyst community about a possible conflict that destabilises global markets.

"Something is going on in the Middle East that is not at all well-defined," says Barbara Rockefeller at RTS Forex. "In Saudi Arabia, two oil tankers were sabotaged and the next day, a drone attacked two pump stations. No one has claimed credit but the US ordered all nonemergency staff to leave Iraq immediately. In response to a meeting at which the Dept of Defense presented a plan that includes the US was sending 120,000 troops to the areas, Trump said if he wanted to start a war, he would send a lot more than 120,000. What? Then Iran’s foreign minister said “radical individuals” (presumably Walrus Mustache Bolton) are trying to start a war."

Above: Societe General graph showing U.S. industrial capacity utilisation trend-correlation with GDP.

"Even though it seems clear Trump doesn’t want war with Iran, such an outcome can still occur by accident," says Michael Every, a strategist at Rabobank. "The fat tail risk is of an Iranian/proxy attack triggering a US response and escalating tit-for-tat until we stumble into something far, far worse."

Exactly where the safe-haven U.S. currency would be trading without all of this geopolitical risk to prop it up is still an open question, because many analysts say the fundamental outlook is deteriorating rapidly.

Retail sales and industrial production figures for April surprised on the downside on Tuesday, leading financial markets to bet more heavily that the Federal Reserve might feel compelled to cut its interest rate before the year is out.

"Softish US April retail sales yesterday seemed to support the narrative that the US is talking itself into recession with 10 year US Treasury yields now back on the lows for the year at 2.35%. Important for the dollar here will be the Fed reaction. Does the Fed start to acknowledge market calls for a rate cut, where the Dec Fed 19 Fund futures now prices 32bp of easing?," says Chris Turner, head of FX strategy at ING Group.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement