The Pound-Dollar Rate is Threatened by U.S. GDP this Week but Brexit and Global Growth Key to Outlook

- Written by: James Skinner

© Robert Cicchetti, Adobe Stock

© Robert Cicchetti, Adobe Stock

- GBP still vying with CAD for No.1 spot in G10 as USD GDP data looms.

- Upgrades to market consensus for GDP help USD onto its front foot.

- But Brexit and global growth matter most for medium-term outlook.

Sterling slipped into and out of the top spot in the G10 league table Tuesday as the UK parliament having returned from its Easter recess stoked fresh hope of a breakthrough in the Brexit process, but first-quarter GDP data due from the U.S. on Friday could pose a threat to the Pound-to-Dollar rate.

Sterling could easily find itself on the back foot before the week is out, particularly if the U.S. figures reveal that growth in the world's largest economy was faster than the market had anticipated, but ultimately it will be the evolution of the global growth picture and the Brexit process that dictate the outlook thereafter.

U.S. GDP data will be released at 13:30 on Friday and will come after a week that sees Westminster come back to life following an Easter recess that brought about a dearth of Brexit-related developments and steady, risk-off grind lower by the Pound.

The Pound fell 70 points against the Dollar over the Easter period and although still up by 1.6% for 2019, is down more than -1.8% in April. At one stage in the middle of March the British currency was carrying a 5% 2019 gain over the greenback.

"There have been some late upward revisions to US Q1 economic growth estimates following the stronger than expected March trade data. However, we don't expect the result to be enough to drive the USD outside of its recent trading range. In particular, a stronger Q1 GDP result will not offset ongoing expectations for additional easing in economic growth over the remainder of 2019," says Kim Mundy, a strategist at Commonwealth Bank of Australia.

Above: Atlanta Federal Reserve now-cast of U.S. Q1 GDP growth. Source: ING Group, Atlanta Fed.

"Just a few weeks ago, markets were worried that the US economy might have stagnated in the first quarter. However, a recent raft of positive surprises means that we should be expecting 2.5% annualised growth from Friday's 1Q GDP report," says James Knightley, chief international economist at ING Group.

Knightley is forecasting annualised GDP growth of 2.5% to come from the U.S. announcement on Friday while the market itself is looking for growth of 2.2%, although the consensus for the first-quarter was only 1.5% just a few weeks ago and some analysts had previously suggested the economy might even stall during the opening quarter.

Financial markets currently have laser-like focus on differences in the trajectories of major economies because economic growth differentials are often a reasonable predictor of the gap between yields on short-term bonds of two countries. Yields have significant influence over exchange rates because international capital tends to flow in the direction where the outlook for relative returns is most favourable.

Bond yield differentials move in response to changes in relative growth because of what the various economic numbers might mean for central bank interest rate policies across the world. Consensus still suggests the U.S. economy will slow sharply in 2019, ending the Federal Reserve rate hiking cycle in the process, and that a pick-up in growth across other parts of the world will put interest rate rises back on the table in Europe and elsewhere.

Such an outcome would be a death knell for the 2018-2019 Dollar rally that has helped keep the Pound-to-Dollar pair and many other exchange rates under the thumb during recent months, only the 2019 story thus far has not panned out in the way the market had imagined it would.

So far though, U.S. growth has slowed, although not by much according to the latest analyst commentary, and despite the Chinese economy having stabilised the slowdown in Europe deepened in the New Year. This leaves U.S. growth still looking rather superior to that seen in Europe.

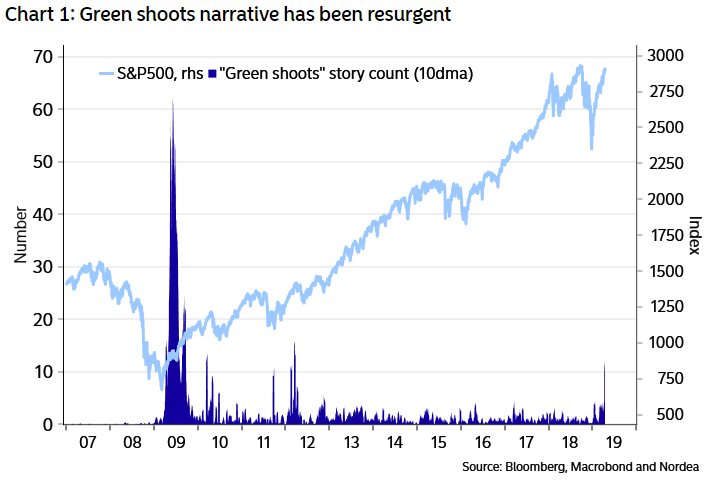

"For sure, the green shoots narrative is still in a highly budding phase, and recent performance of cyclicals and copper may eventually prove to be growing signs of complacency rather than a rational response to reduced recession risks. A look at surprise indices around the also shows that the green shoots are present primarily in China while e.g. EA and US data prints have continued to look gloomy," says Andreas Steno Larsen, a strategist at Nordea Markets.

Above: U.S. stock market alongside Bloomberg count of 'green shoots' stories in the press.

As it relates to the Pound-to-Dollar rate, economists are growing increasingly bullish in their forecasts for first-quarter growth in the UK after a solid performance from the economy in January and a back-to-back set of blockbuster retail sales figures described by one economist as "astonishing".

UK economic output rose by a total of 0.7% in the first two months of the year, which is even faster than the 0.6% pace of growth seen through the whole of the third quarter of 2018 and puts the economy on course for its best quarter since the period spanning April to July 2015.

This outlook would be a particular source of strength for the exchange rate in a scenario where Friday's U.S. number disappoints the market but won't necessarily prevent Sterling from ceding ground to the Dollar if the GDP number surprises on the upside.

However, and regardless of what happens with the U.S. GDP data, the medium-term outlook for the Pound-to-Dollar rate will be determined mainly by the developments in the UK and Eurozone economies as well as the Brexit process.

"GBP/USD lifted off recent lows to 1.2990 and may take some fresh guidance from Brexit-related developments this week as the UK parliament returns from is Easter recess today," says CBA's Mundy. "UK travel agents report a large pick-up in U.K. to EU passenger bookings since the announcement Brexit would be delayed."

Above: Pound-to-Dollar rate shown at four-hour intervals.

The Pound-to-Dollar rate was quoted -0.22% lower at 1.2953 on Tuesday although this was after having made a solid start to the session that previously saw Sterling knock the Canadian Dollar off its perch as G10's best performer for 2019.

Sterling began the Tuesday session well but the noon trading hours and opening of North American trading subsequently prompted a bid for the Dollar and Canadian currencies, driving the Pound and GBP/CAD rates to intraday losses.

Both Sterling and the Loonie are vying with each other for first place in the G10 league table and what will matter most for the outcome of this competition is the performance of the GBP/USD rate relative to CAD/USD.

If Sterling rises faster against the U.S. Dollar than its Canadian rival, or falls by a lesser extent, the Pound-to-Canadian-Dollar rate will cling to its 2019 gain and the British currency likely retain the number one spot for the G10 universe.

The Pound recently broke below a key technical support level, located at 1.30, that was guarding the path down toward lows not seen by the market since early February. There is still a risk of further losses ahead and the outlook from a technical perspective, at least, is beginning to sound clouded.

"GBP/USD is on the defensive while capped by the 20 day ma at 1.3086 and has eased back to the 200 day ma at 1.2966. This is also the location of the 1.2966 20 week ma and the double Fibo retracement at 1.2900/1.2895, this is pretty solid support that is expected to hold the initial test. This guards the recent low at 1.2772," says Karen Jones, head of technical analysis at Commerzbank.

Jones says the market should survive the initial test of the 1.2966 level but still recommended Tuesday that clients bet on a further fall in the exchange rate if and when it recovers to 1.3025 and 1.3060. She's advocated stop-losses at 1.3135, suggesting a move above there would nullify the bearish bias.

Above: Pound-to-Dollar rate shown at daily intervals.

"Today PM May will again ramp up Brexit negotiations this week as the House of Commons sits again and pound volatility is set to increase. In particular, cross-party talks between the Conservatives and Labour will continue this week as PM May attempts to settle a compromise Brexit deal," sats Lee Hardman, an analyst at MUFG.

UK politicians are fighting among themselves, and against a clock, each advocating their own particular or preferred 'model of Brexit', and until they can agree on a proposal for the future relationship with the EU the Article 50 negotiating window could remain open.

Currently MPs have until May 22 to come up with an agreed plan if they want to avoid UK participation in elections to the European parliament and until October 31 before they will need to request from the European Union a further extension of the Article 50 period. There's no guarantee another extension will be granted.

"There seems to be little impetus for Labour to rush to the support of the ailing government. In this case it becomes increasingly likely that initiative on Brexit will shift again to the House of Commons in a series of alternative votes, and that the probability of a Tory leadership election or even a general election will rise. This would likely be viewed negatively initially for the pound as it would increase uncertainty without necessarily offering a clear solution to the Brexit impasse," warns MUFG's Hardman.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement